The state of Hawaii requires businesses to file various tax forms to report their income and pay taxes on time. One such form is the Hawaii Tax Form G-49, also known as the General Excise Tax Return. In this article, we will provide a step-by-step guide on how to file the Hawaii Tax Form G-49, making it easier for businesses to comply with the state's tax laws.

Understanding the Hawaii Tax Form G-49

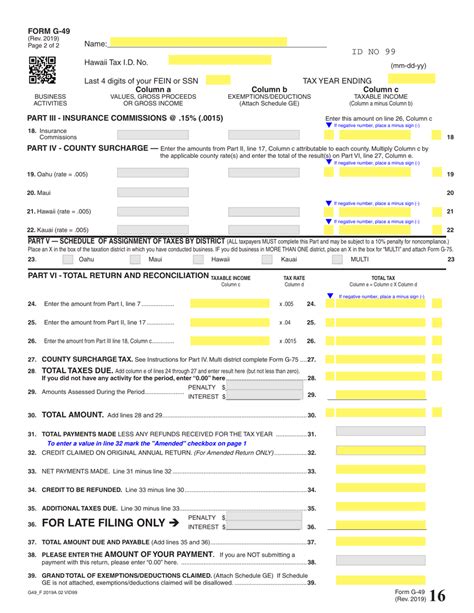

The Hawaii Tax Form G-49 is a quarterly tax return that businesses must file to report their general excise tax liability. The general excise tax is a tax on the gross income of businesses, including sales, services, and other activities. The tax rate varies depending on the type of business and the location of the business.

Who Needs to File the Hawaii Tax Form G-49?

Businesses that are required to file the Hawaii Tax Form G-49 include:

- Sole proprietorships

- Partnerships

- Corporations

- Limited liability companies (LLCs)

- Estates and trusts

Businesses that are exempt from filing the Hawaii Tax Form G-49 include:

- Non-profit organizations

- Government agencies

- Businesses with a gross income of less than $1,000 per quarter

How to File the Hawaii Tax Form G-49

Filing the Hawaii Tax Form G-49 involves several steps:

- Obtain the form: Businesses can obtain the Hawaii Tax Form G-49 from the Hawaii Department of Taxation's website or by contacting the department directly.

- Gather necessary information: Businesses will need to gather information about their gross income, deductions, and credits for the quarter.

- Calculate the tax liability: Businesses will need to calculate their tax liability based on their gross income and tax rate.

- Complete the form: Businesses will need to complete the Hawaii Tax Form G-49, including the calculation of their tax liability.

- Submit the form: Businesses can submit the Hawaii Tax Form G-49 online or by mail.

Filing Deadlines

The filing deadline for the Hawaii Tax Form G-49 is the 20th day of the month following the end of the quarter. For example, the filing deadline for the first quarter (January 1 - March 31) is April 20th.

Penalties for Late Filing

Businesses that fail to file the Hawaii Tax Form G-49 on time may be subject to penalties and interest. The penalty for late filing is 5% of the tax liability per month, up to a maximum of 25%.

Amending the Hawaii Tax Form G-49

Businesses that need to make changes to their Hawaii Tax Form G-49 can file an amended return. The amended return must be filed within three years of the original filing deadline.

Common Mistakes to Avoid

Businesses should avoid the following common mistakes when filing the Hawaii Tax Form G-49:

- Failing to file the form on time

- Underreporting or overreporting gross income

- Failing to calculate the tax liability correctly

- Failing to submit the form online or by mail

Tips for Filing the Hawaii Tax Form G-49

Businesses can follow these tips to make filing the Hawaii Tax Form G-49 easier:

- Keep accurate records of gross income and deductions

- Use tax preparation software to calculate the tax liability

- File the form online to avoid mailing delays

- Contact the Hawaii Department of Taxation if you have questions or concerns

Conclusion

Filing the Hawaii Tax Form G-49 is a crucial step for businesses to comply with the state's tax laws. By following the steps outlined in this article, businesses can ensure that they file their tax return accurately and on time. Remember to keep accurate records, use tax preparation software, and file the form online to make the process easier.

FAQ Section

Who is required to file the Hawaii Tax Form G-49?

+Businesses that are required to file the Hawaii Tax Form G-49 include sole proprietorships, partnerships, corporations, limited liability companies (LLCs), and estates and trusts.

What is the filing deadline for the Hawaii Tax Form G-49?

+The filing deadline for the Hawaii Tax Form G-49 is the 20th day of the month following the end of the quarter.

What is the penalty for late filing?

+The penalty for late filing is 5% of the tax liability per month, up to a maximum of 25%.