As a business owner, you're no stranger to the importance of meeting deadlines, especially when it comes to tax filing. The Internal Revenue Service (IRS) requires businesses to file various forms to report their income, pay taxes, and request extensions when needed. One such form is the Form 7004, which is used to request an automatic six-month extension of time to file certain business income tax, information, and other returns. In this article, we'll guide you through the easy steps to e-file Form 7004.

What is Form 7004?

Before we dive into the steps to e-file Form 7004, let's quickly understand what this form is and who needs to file it. Form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns. This form is used by businesses that need more time to file their tax returns, beyond the original deadline. The IRS allows an automatic six-month extension, which can be requested by filing Form 7004.

Who Needs to File Form 7004?

Businesses that need to file Form 7004 include:

- Corporations (Form 1120)

- S corporations (Form 1120S)

- Partnerships (Form 1065)

- Trusts (Form 1041)

- Estates (Form 1041)

- Certain exempt organizations (Form 990)

5 Easy Steps to E-File Form 7004

Now that we've covered the basics, let's move on to the easy steps to e-file Form 7004.

Step 1: Gather Required Information

Before you start the e-filing process, make sure you have the following information readily available:

- Business name and address

- Employer Identification Number (EIN)

- Tax year and type of return (e.g., Form 1120, Form 1065, etc.)

- Original deadline for filing the tax return

- Estimated tax liability (if applicable)

Step 2: Choose an Authorized E-File Provider

The IRS requires businesses to e-file Form 7004 through an authorized provider. You can choose from a list of approved providers, such as Tax1099, ExpressExtension, or eFile360. Make sure to select a provider that meets your business needs and offers secure and reliable e-filing services.

What to Look for in an Authorized E-File Provider?

When choosing an authorized e-file provider, look for the following features:

- IRS-approved and certified

- Secure and reliable e-filing services

- Easy-to-use online platform

- Competitive pricing

- Good customer support

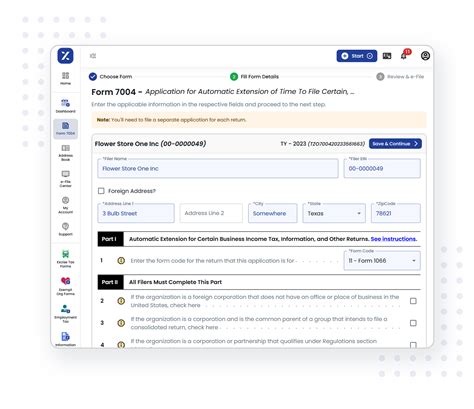

Step 3: Create an Account and Log In

Once you've chosen an authorized e-file provider, create an account and log in to their online platform. You'll need to provide some basic business information, such as your business name, address, and EIN.

What to Expect During the Account Creation Process?

During the account creation process, you can expect to provide the following information:

- Business name and address

- EIN

- Contact information (e.g., email address, phone number)

- Password and security questions (for secure login)

Step 4: Complete and Submit Form 7004

After logging in to your account, complete Form 7004 by providing the required information. Make sure to review your form carefully to ensure accuracy and completeness. Once you're satisfied with your form, submit it to the IRS through the e-file provider's platform.

What to Expect During the Form Submission Process?

During the form submission process, you can expect the following:

- Automatic calculation of estimated tax liability (if applicable)

- Electronic signature and certification

- Instant submission confirmation

- Email notification with a copy of your submitted form

Step 5: Receive Confirmation and Follow Up

After submitting Form 7004, receive confirmation from the IRS and follow up on your extension request. You can check the status of your extension request online or contact the IRS directly.

What to Expect After Submitting Form 7004?

After submitting Form 7004, you can expect the following:

- Instant confirmation of submission

- Email notification with a copy of your submitted form

- IRS processing and approval (or rejection) of your extension request

- Follow-up notification with instructions on next steps (if required)

Conclusion

E-filing Form 7004 is a straightforward process that can be completed in just a few easy steps. By following these steps and choosing an authorized e-file provider, you can ensure a smooth and secure e-filing experience. Remember to gather required information, create an account, complete and submit Form 7004, and receive confirmation and follow up on your extension request.

What is the deadline to file Form 7004?

+The deadline to file Form 7004 is the original deadline for filing the tax return. For example, if the original deadline is March 15th, the deadline to file Form 7004 is also March 15th.

Can I file Form 7004 electronically?

+Yes, you can file Form 7004 electronically through an authorized e-file provider. The IRS requires businesses to e-file Form 7004 through an approved provider.

How long does it take to process Form 7004?

+The IRS typically processes Form 7004 within 24-48 hours. However, processing times may vary depending on the complexity of the form and the workload of the IRS.