As a Canadian taxpayer, you're likely familiar with the various tax credits available to help reduce your tax liability. One such credit is the Ontario Trillium Benefit (OTB), which is designed to help low- and moderate-income individuals and families with their living expenses. To claim this credit, you'll need to file Form 3804-Cr, also known as the "Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant" form. In this article, we'll delve into the details of Form 3804-Cr and provide you with a comprehensive guide on how to complete it.

What is Form 3804-Cr?

Form 3804-Cr is a provincial tax form used by the Canada Revenue Agency (CRA) to determine an individual's eligibility for the Ontario Trillium Benefit (OTB) and the Ontario Senior Homeowners' Property Tax Grant. The form is used to calculate the amount of benefit or grant an individual is entitled to receive, based on their income and other factors.

Who is Eligible for the Ontario Trillium Benefit?

To be eligible for the OTB, you must meet certain criteria, including:

- Being a resident of Ontario

- Having a net income below a certain threshold (varies depending on family size and composition)

- Being at least 18 years old (or turning 18 in the tax year)

- Not being in prison or a similar institution

- Not being a non-resident of Canada

Additionally, you may also be eligible for the OTB if you're a senior homeowner, in which case you'll need to complete the relevant sections of Form 3804-Cr.

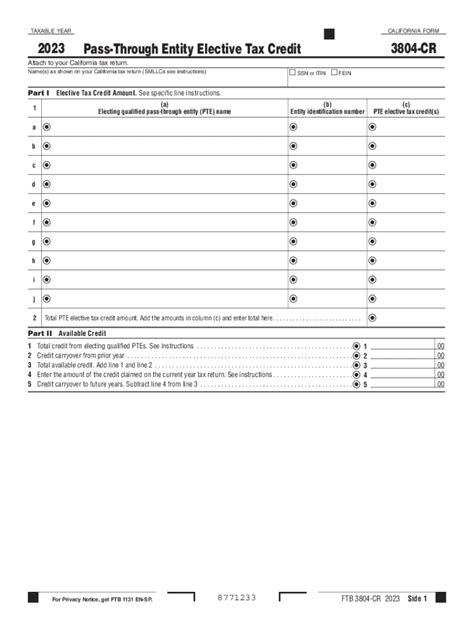

How to Complete Form 3804-Cr

Completing Form 3804-Cr requires attention to detail and an understanding of the various sections and calculations involved. Here's a step-by-step guide to help you navigate the form:

Part 1: Identification and Eligibility

In this section, you'll need to provide your personal identification information, including your name, address, and social insurance number. You'll also need to answer a series of questions to determine your eligibility for the OTB.

Part 2: Income Calculation

Here, you'll need to calculate your net income from all sources, including employment, self-employment, and investments. You'll also need to report any deductions or credits that may affect your net income.

Part 3: Benefit and Grant Calculations

In this section, you'll use your net income and other information to calculate the amount of OTB and Ontario Senior Homeowners' Property Tax Grant you're eligible for. The form provides a series of tables and formulas to help you make these calculations.

Part 4: Certification and Signature

Finally, you'll need to certify that the information you've provided is accurate and complete, and sign the form.

Tips and Reminders

When completing Form 3804-Cr, keep the following tips and reminders in mind:

- Ensure you have all necessary documentation, including your Notice of Assessment and T4 slips.

- Double-check your calculations to avoid errors.

- If you're eligible for both the OTB and the Ontario Senior Homeowners' Property Tax Grant, make sure to complete the relevant sections for each.

- Don't forget to sign and date the form.

Common Errors to Avoid

When completing Form 3804-Cr, it's essential to avoid common errors that can delay or even reject your claim. Here are some errors to watch out for:

- Incomplete or missing information

- Incorrect calculations or miscalculations

- Failure to sign or date the form

- Not reporting all income or deductions

What to Do if You're Unable to Complete the Form

If you're having trouble completing Form 3804-Cr, don't worry. You can:

- Contact the CRA for assistance

- Seek help from a tax professional or accountant

- Visit a local tax clinic or community organization for support

Conclusion

Form 3804-Cr is an essential document for Canadian taxpayers who want to claim the Ontario Trillium Benefit and the Ontario Senior Homeowners' Property Tax Grant. By following the steps outlined in this guide and avoiding common errors, you can ensure that you receive the benefits you're eligible for. Remember to double-check your calculations, report all income and deductions, and seek help if you need it.

Additional Resources

- Canada Revenue Agency: Ontario Trillium Benefit

- Ontario Government: Ontario Trillium Benefit

- Tax Professionals and Accountants: Local listings and directories

What is the deadline for filing Form 3804-Cr?

+The deadline for filing Form 3804-Cr is typically the same as the deadline for filing your tax return, which is April 30th for most Canadians.

Can I file Form 3804-Cr electronically?

+Yes, you can file Form 3804-Cr electronically using the CRA's NETFILE service or through a certified tax software.

What happens if I make a mistake on Form 3804-Cr?

+If you make a mistake on Form 3804-Cr, you may need to correct it and resubmit the form. You can contact the CRA for assistance or seek help from a tax professional.