As a small business owner or employer, offering a retirement plan to your employees can be a great way to attract and retain top talent, as well as provide a valuable benefit to your team. One popular option is a SIMPLE IRA, or Savings Incentive Match Plan for Employees Individual Retirement Account. Edward Jones is a well-established financial services company that offers SIMPLE IRA plans to businesses. If you're considering a SIMPLE IRA through Edward Jones, here are five tips to keep in mind when making contributions:

Understanding the Contribution Limits

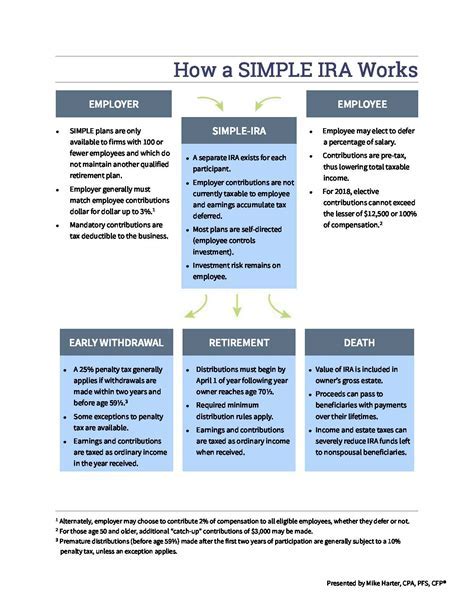

When contributing to a SIMPLE IRA through Edward Jones, it's essential to understand the contribution limits. The annual contribution limit for SIMPLE IRAs is $13,500 in 2022, and an additional $3,000 catch-up contribution is allowed for employees 50 and older. Employers are also required to make either a matching or non-elective contribution to each employee's account.

Who is Eligible to Contribute?

To be eligible to contribute to a SIMPLE IRA, employees must have earned at least $5,000 in compensation from the employer in the two preceding calendar years and be reasonably expected to earn at least $5,000 in the current calendar year. Employers can also exclude certain employees, such as those who are covered by a collective bargaining agreement or are non-resident aliens.

Timing of Contributions

Contributions to a SIMPLE IRA through Edward Jones can be made at any time, but they must be made by the employer's tax filing deadline, including extensions. Employers can also make contributions on a monthly or quarterly basis, as long as the total contributions for the year do not exceed the annual limit.

Employer Matching Contributions

Employers have two options for making contributions to a SIMPLE IRA: a matching contribution or a non-elective contribution. A matching contribution requires the employer to match the employee's contributions dollar-for-dollar up to 3% of the employee's compensation. A non-elective contribution requires the employer to contribute 2% of each employee's compensation, regardless of whether the employee makes contributions.

Investment Options

Edward Jones offers a range of investment options for SIMPLE IRA plans, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Employees can choose from a variety of investment portfolios, and employers can also offer a default investment option for employees who do not make an election.

Recordkeeping and Administration

Edward Jones provides recordkeeping and administration services for SIMPLE IRA plans, including plan documents, employee communications, and compliance support. Employers can also access online tools and resources to help manage their plan.

Automatic Enrollment

Edward Jones offers automatic enrollment for SIMPLE IRA plans, which allows employers to automatically enroll employees in the plan at a default contribution rate. Employees can opt out of the plan or change their contribution rate at any time.

Benefits of Automatic Enrollment

Automatic enrollment can help increase employee participation in the plan and reduce the administrative burden on employers. It can also help employees get started with saving for retirement earlier, which can lead to better retirement outcomes.

Education and Support

Edward Jones provides education and support to help employers and employees understand the SIMPLE IRA plan and make informed investment decisions. Employers can access online resources, including plan documents, employee communications, and investment information.

Customized Education and Support

Edward Jones offers customized education and support to help employers meet the unique needs of their business and employees. Employers can work with a dedicated financial advisor to develop a tailored education and support program.

By following these five tips, employers can make the most of their SIMPLE IRA plan through Edward Jones and help their employees achieve their retirement goals. Whether you're just starting out or looking to optimize your existing plan, these tips can help you make informed decisions and get the most out of your SIMPLE IRA.

We hope you found this article informative and helpful. If you have any questions or comments, please don't hesitate to reach out. We'd love to hear from you!

What is the annual contribution limit for SIMPLE IRAs?

+The annual contribution limit for SIMPLE IRAs is $13,500 in 2022, and an additional $3,000 catch-up contribution is allowed for employees 50 and older.

Who is eligible to contribute to a SIMPLE IRA?

+To be eligible to contribute to a SIMPLE IRA, employees must have earned at least $5,000 in compensation from the employer in the two preceding calendar years and be reasonably expected to earn at least $5,000 in the current calendar year.

What are the investment options for SIMPLE IRA plans through Edward Jones?

+Edward Jones offers a range of investment options for SIMPLE IRA plans, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).