As a Spark driver, you're considered an independent contractor, not an employee. This means you're responsible for reporting your income and expenses on your tax return. The Spark Driver 1099 form is a crucial document that helps you do just that. In this article, we'll delve into the world of tax preparation for Spark drivers, exploring the ins and outs of the 1099 form and providing you with a comprehensive guide to help you navigate the tax season.

Spark Driver 1099 Form: What You Need to Know

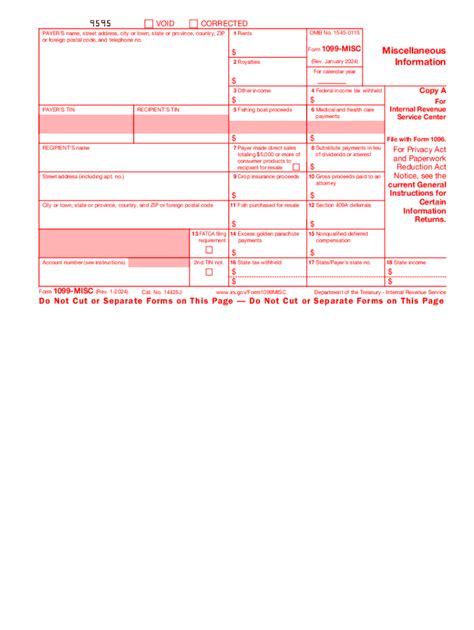

As a Spark driver, you'll receive a 1099-MISC form from Spark at the end of each tax year. This form will show the total amount of money you earned from driving for Spark during that year. But what exactly does this form mean for your taxes?

Understanding the 1099-MISC Form

The 1099-MISC form is used to report miscellaneous income, such as freelance work, independent contractor income, and other non-employee compensation. As a Spark driver, you'll receive this form because you're considered an independent contractor, not an employee.

The form will show the following information:

- Your name and address

- Spark's name and address

- The total amount of money you earned from driving for Spark during the tax year

- Any taxes withheld (if applicable)

What to Do with Your 1099-MISC Form

When you receive your 1099-MISC form, review it carefully to ensure the information is accurate. You'll use this form to report your income on your tax return. Here are the steps to follow:

- Review the form for accuracy

- Use the information on the form to complete your tax return (Form 1040)

- Report the income on Schedule C (Form 1040)

- Calculate your business expenses on Schedule C

- Calculate your net profit or loss on Schedule C

Tax Deductions for Spark Drivers

As a Spark driver, you're eligible for various tax deductions that can help reduce your taxable income. Here are some common deductions to consider:

- Business use of your car: You can deduct the business use percentage of your car expenses, including gas, maintenance, and insurance.

- Business use of your phone: You can deduct the business use percentage of your phone expenses, including your phone bill and any equipment costs.

- Tolls and parking fees: You can deduct the cost of tolls and parking fees incurred while driving for Spark.

- Meals and snacks: You can deduct the cost of meals and snacks purchased while driving for Spark.

How to Calculate Your Business Expenses

To calculate your business expenses, you'll need to keep accurate records throughout the year. Here are some tips to help you get started:

- Use a mileage log to track your business miles

- Keep receipts for all business-related expenses

- Use a spreadsheet or accounting software to track your expenses

- Calculate your business use percentage (e.g., 80% of your car expenses are for business)

Filing Your Tax Return as a Spark Driver

As a Spark driver, you'll need to file your tax return as a self-employed individual. Here's a step-by-step guide to help you get started:

- Gather all necessary documents, including your 1099-MISC form and business expense records

- Complete Form 1040, reporting your income and deductions

- Complete Schedule C, reporting your business income and expenses

- Calculate your net profit or loss on Schedule C

- Complete Schedule SE, reporting your self-employment tax

- File your tax return by the deadline (usually April 15th)

Tips for Spark Drivers to Minimize Taxes

As a Spark driver, you can minimize your taxes by following these tips:

- Keep accurate records of your business expenses

- Take advantage of tax deductions and credits

- Consider hiring a tax professional to help with your tax return

- Plan ahead for taxes by setting aside money throughout the year

Avoiding Common Tax Mistakes

As a Spark driver, you'll want to avoid common tax mistakes that can result in penalties and fines. Here are some mistakes to watch out for:

- Failing to report all income

- Not keeping accurate records of business expenses

- Not filing your tax return on time

- Not paying self-employment tax

By following these tips and avoiding common tax mistakes, you can minimize your taxes and keep more of your hard-earned money.

We hope this comprehensive guide has helped you understand the Spark Driver 1099 form and how to navigate the tax season. Remember to keep accurate records, take advantage of tax deductions, and plan ahead for taxes to minimize your tax liability.

What's your experience with taxes as a Spark driver? Share your tips and advice in the comments below!

What is the Spark Driver 1099 form?

+The Spark Driver 1099 form is a document provided by Spark to report your income as an independent contractor. It shows the total amount of money you earned from driving for Spark during the tax year.

How do I report my income on my tax return?

+You'll report your income on Schedule C (Form 1040). You'll also need to calculate your business expenses on Schedule C and report your net profit or loss.

What tax deductions can I claim as a Spark driver?

+You can claim deductions for business use of your car, phone, tolls, parking fees, meals, and snacks. Keep accurate records of your expenses to support your deductions.