As a business owner, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial form that you may need to file is the CBT-200-T, also known as the New Jersey Corporation Business Tax Return. In this article, we'll delve into the world of CBT-200-T forms, exploring what they are, who needs to file them, and the requirements for submission.

What is a CBT-200-T Form?

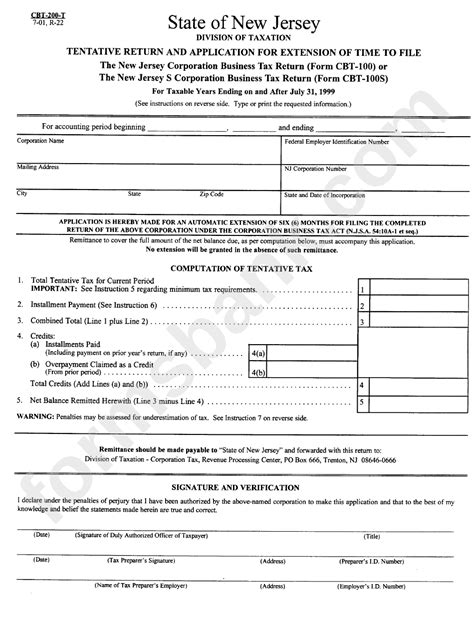

The CBT-200-T form is used by the New Jersey Division of Taxation to report the corporation business tax. This tax is imposed on corporations and other business entities that conduct business in New Jersey. The form is used to calculate the tax liability of the business and to report any payments or credits that may be applicable.

Who Needs to File a CBT-200-T Form?

Not all businesses are required to file a CBT-200-T form. The following types of businesses are typically required to file:

- Corporations, including S corporations and C corporations

- Limited liability companies (LLCs) that are taxed as corporations

- Partnerships, including limited partnerships and limited liability partnerships

- Business trusts and real estate investment trusts (REITs)

If your business is subject to the corporation business tax, you'll need to file a CBT-200-T form annually.

CBT-200-T Form Requirements

To file a CBT-200-T form, you'll need to provide the following information:

- Business identification information, including your business name, address, and federal employer identification number (FEIN)

- Financial information, including your business's gross income, deductions, and tax credits

- Information about your business's tax liability, including any payments or credits you're claiming

You'll also need to complete the following schedules and attachments:

- Schedule A: New Jersey Gross Income

- Schedule B: New Jersey Gross Income (Continuation)

- Schedule C: Dividends and Interest Income

- Schedule D: Capital Gains and Losses

- Schedule E: New Jersey Tax Credits

- Schedule F: New Jersey Tax Payments

How to File a CBT-200-T Form

You can file your CBT-200-T form electronically or by mail. The New Jersey Division of Taxation recommends electronic filing, as it's faster and more secure. You can file electronically through the New Jersey Online Corporation Business Tax Filing System.

If you prefer to file by mail, you can send your completed form to the following address:

New Jersey Division of Taxation Corporation Business Tax Section PO Box 110 Trenton, NJ 08695-0110

Penalties for Late Filing or Non-Filing

If you fail to file your CBT-200-T form on time or don't file it at all, you may be subject to penalties and interest. The penalties for late filing or non-filing include:

- A penalty of 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%

- Interest on the tax due, calculated at the rate of 3% above the prime rate

- A penalty of $100 for each month or part of a month that the return is late, up to a maximum of $500

It's essential to file your CBT-200-T form on time to avoid these penalties and interest.

Conclusion

Filing a CBT-200-T form is a critical part of your business's tax obligations. By understanding what the form is, who needs to file it, and the requirements for submission, you can ensure that your business is in compliance with New Jersey tax laws. Remember to file your form on time to avoid any penalties or interest.

We hope this article has been informative and helpful. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your colleagues or friends who may find it useful.

What is the deadline for filing a CBT-200-T form?

+The deadline for filing a CBT-200-T form is April 15th of each year.

Can I file my CBT-200-T form electronically?

+Yes, you can file your CBT-200-T form electronically through the New Jersey Online Corporation Business Tax Filing System.

What are the penalties for late filing or non-filing of a CBT-200-T form?

+The penalties for late filing or non-filing include a penalty of 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%, interest on the tax due, and a penalty of $100 for each month or part of a month that the return is late, up to a maximum of $500.