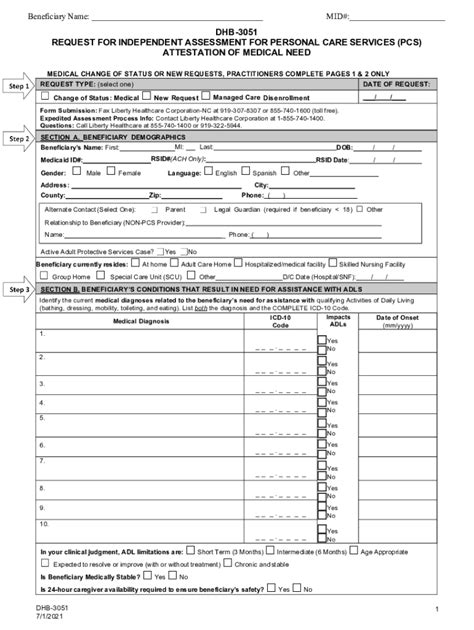

The Dhb 3051 form is an essential document required for businesses and organizations to report specific financial transactions to the government. The form can be complex and challenging to understand, especially for those who are new to financial reporting. In this article, we will provide a step-by-step guide to help you understand the Dhb 3051 form and complete it accurately.

What is the Dhb 3051 Form?

The Dhb 3051 form is a document used by businesses and organizations to report certain financial transactions to the government. The form is used to report transactions that exceed a specific threshold, and it is typically filed on a quarterly or annual basis. The form requires detailed information about the transactions, including the date, amount, and type of transaction.

Why is the Dhb 3051 Form Important?

The Dhb 3051 form is crucial for several reasons:

- It helps the government track and monitor financial transactions, which is essential for maintaining economic stability and preventing financial crimes.

- It provides businesses and organizations with a way to report their financial transactions accurately and transparently.

- It helps to ensure compliance with financial regulations and laws.

Step-by-Step Guide to Completing the Dhb 3051 Form

Completing the Dhb 3051 form can be a complex process, but it can be broken down into several steps. Here is a step-by-step guide to help you complete the form accurately:

Step 1: Gather Required Information

Before you start completing the form, gather all the required information. This includes:

- Business name and address

- Tax identification number

- Financial transaction records

- Transaction dates and amounts

- Type of transactions (e.g., sales, purchases, etc.)

Step 2: Determine the Filing Frequency

Determine how often you need to file the Dhb 3051 form. This will depend on the type of business or organization you have and the frequency of your financial transactions. You may need to file the form quarterly or annually.

Step 3: Complete the Form

Once you have gathered all the required information and determined the filing frequency, complete the form. Make sure to follow the instructions carefully and provide all the necessary information.

Common Mistakes to Avoid

When completing the Dhb 3051 form, there are several common mistakes to avoid:

- Inaccurate or incomplete information

- Failure to report all financial transactions

- Incorrect filing frequency

- Late filing

Step 4: Review and Submit the Form

Once you have completed the form, review it carefully to ensure that all the information is accurate and complete. Then, submit the form to the relevant authorities on time.

Tips for Accurate Completion of the Dhb 3051 Form

Here are some tips to help you complete the Dhb 3051 form accurately:

- Use the correct filing frequency

- Provide accurate and complete information

- Use the correct transaction codes

- Keep accurate records of financial transactions

Benefits of Accurate Completion of the Dhb 3051 Form

Accurate completion of the Dhb 3051 form has several benefits, including:

- Compliance with financial regulations and laws

- Reduced risk of errors and penalties

- Improved financial reporting and transparency

- Enhanced credibility and reputation

Common Challenges and Solutions

Here are some common challenges and solutions related to completing the Dhb 3051 form:

- Challenge: Inaccurate or incomplete information

- Solution: Use accurate and complete records of financial transactions.

- Challenge: Failure to report all financial transactions

- Solution: Use a systematic approach to track and report all financial transactions.

- Challenge: Incorrect filing frequency

- Solution: Determine the correct filing frequency based on the type of business or organization.

Best Practices for Dhb 3051 Form Completion

Here are some best practices for completing the Dhb 3051 form:

- Use accurate and complete records of financial transactions

- Use a systematic approach to track and report all financial transactions

- Determine the correct filing frequency based on the type of business or organization

- Review and verify the form carefully before submission

Conclusion

Completing the Dhb 3051 form can be a complex process, but it is essential for businesses and organizations to report their financial transactions accurately and transparently. By following the step-by-step guide and tips provided in this article, you can ensure accurate completion of the form and avoid common mistakes. Remember to review and verify the form carefully before submission and use best practices to ensure compliance with financial regulations and laws.

Call to Action

If you have any questions or concerns about completing the Dhb 3051 form, please comment below or share this article with others who may find it helpful. Remember to follow best practices and seek professional advice if needed to ensure accurate completion of the form.

What is the purpose of the Dhb 3051 form?

+The Dhb 3051 form is used by businesses and organizations to report specific financial transactions to the government.

How often do I need to file the Dhb 3051 form?

+The filing frequency depends on the type of business or organization and the frequency of financial transactions. You may need to file the form quarterly or annually.

What are the consequences of inaccurate completion of the Dhb 3051 form?

+Inaccurate completion of the Dhb 3051 form can result in errors, penalties, and reputational damage.