South Carolina is a state known for its stunning natural beauty, rich history, and vibrant culture. However, when it comes to taxes, even the most enthusiastic resident might feel a sense of dread. Filling out tax forms can be a daunting task, especially for those who are new to the state or are unsure about the process. In this article, we will explore five ways to fill out the SC state tax form, making the process less overwhelming and more manageable.

Filling out tax forms is a crucial part of being a responsible citizen, and it's essential to do it correctly to avoid any penalties or fines. The South Carolina Department of Revenue (SCDOR) provides various resources to help taxpayers navigate the process, including online tools, paper forms, and in-person assistance. In this article, we will discuss five ways to fill out the SC state tax form, including:

- E-filing using the SCDOR's online portal

- Using tax preparation software

- Hiring a tax professional

- Visiting a Volunteer Income Tax Assistance (VITA) site

- Mailing a paper return

Each of these methods has its advantages and disadvantages, and we will explore them in detail to help you decide which one is best for you.

E-filing using the SCDOR's online portal

The SCDOR's online portal is a convenient and secure way to file your state tax return. The portal is available 24/7, and you can access it from the comfort of your own home. To e-file, you will need to create an account on the SCDOR website and follow the prompts to complete your return. The online portal guides you through the process, and you can save your progress and return to it later if needed.

E-filing has several advantages, including:

- Faster refunds: E-filed returns are typically processed faster than paper returns, which means you can receive your refund sooner.

- Increased accuracy: The online portal reduces the risk of errors, as it checks your return for mistakes and missing information.

- Convenience: You can e-file from anywhere with an internet connection, at any time.

However, e-filing may not be suitable for everyone, especially those who are not comfortable with technology or have complex tax situations.

Using Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, is another popular way to fill out the SC state tax form. These programs guide you through the tax preparation process, asking you questions and filling out the forms for you. They also check for errors and ensure that you take advantage of all the deductions and credits you are eligible for.

Using tax preparation software has several benefits, including:

- Ease of use: The software is designed to be user-friendly, making it easy to navigate and understand.

- Accuracy: The software checks for errors and ensures that your return is accurate.

- Convenience: You can prepare and e-file your return from the comfort of your own home.

However, tax preparation software can be expensive, especially if you have complex tax situations or need to file multiple returns.

Hiring a Tax Professional

If you have a complex tax situation or are unsure about how to fill out the SC state tax form, hiring a tax professional may be the best option for you. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the knowledge and expertise to navigate even the most complicated tax situations.

Hiring a tax professional has several advantages, including:

- Expertise: Tax professionals have the knowledge and experience to handle complex tax situations.

- Accuracy: They ensure that your return is accurate and complete.

- Time-saving: They handle the entire tax preparation process, saving you time and stress.

However, hiring a tax professional can be expensive, and you will need to find a reputable and trustworthy professional to work with.

Visiting a Volunteer Income Tax Assistance (VITA) Site

The VITA program is a free service provided by the IRS and the SCDOR to help low-to-moderate-income individuals prepare and file their tax returns. VITA sites are located throughout the state, and you can find one near you by visiting the IRS website.

Visiting a VITA site has several advantages, including:

- Free service: VITA sites provide free tax preparation and filing services.

- Expertise: VITA volunteers are trained to handle tax preparation and can assist with complex tax situations.

- Convenience: VITA sites are located throughout the state, making it easy to find one near you.

However, VITA sites may have income and eligibility requirements, and you will need to make an appointment in advance.

Mailing a Paper Return

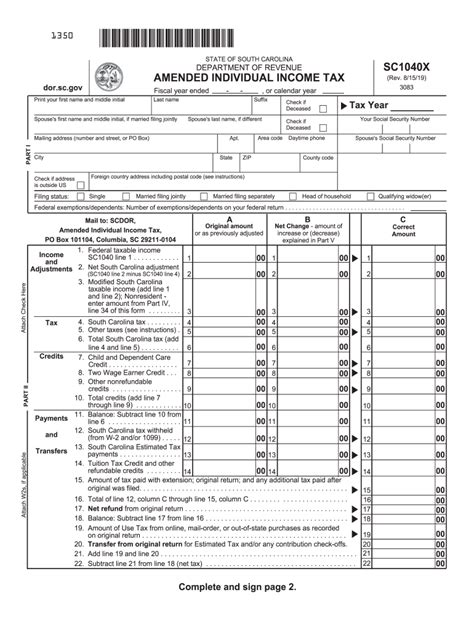

Mailing a paper return is still an option for those who prefer to prepare their tax return by hand or do not have access to a computer. You can download and print the SC state tax form from the SCDOR website or pick one up at a local library or post office.

Mailing a paper return has several advantages, including:

- No technology required: You do not need a computer or internet connection to prepare and file your return.

- Control: You have complete control over the preparation and filing of your return.

However, mailing a paper return can be time-consuming, and you will need to ensure that you follow the correct procedures to avoid any delays or penalties.

In conclusion, there are several ways to fill out the SC state tax form, each with its advantages and disadvantages. Whether you choose to e-file, use tax preparation software, hire a tax professional, visit a VITA site, or mail a paper return, it's essential to ensure that you follow the correct procedures to avoid any penalties or fines. By taking the time to understand your options and choose the method that best suits your needs, you can make the tax preparation process less overwhelming and more manageable.

We encourage you to share your thoughts and experiences with filing SC state tax forms in the comments below. Have you used any of the methods mentioned in this article? Do you have any tips or advice for making the tax preparation process easier?

What is the deadline for filing SC state tax returns?

+The deadline for filing SC state tax returns is April 15th of each year. However, if you need an extension, you can file Form SC4868 by the original deadline to receive an automatic six-month extension.

Do I need to file a SC state tax return if I only have a part-time job?

+Yes, you may need to file a SC state tax return even if you only have a part-time job. If you earned income from a SC employer, you may be required to file a return, even if it's just to report your income and claim any credits or deductions you are eligible for.

Can I e-file my SC state tax return if I owe taxes?

+Yes, you can e-file your SC state tax return even if you owe taxes. However, you will need to make a payment by the original deadline to avoid any penalties or interest.