Paying for higher education can be a daunting task, but there are ways to make it more manageable. One of these ways is through tax credits and deductions. If you're a student or the parent of a student at Kennesaw State University (KSU), you may be eligible for these benefits. One important document that can help you claim these benefits is the 1098-T form. Here are five essential facts you need to know about the Kennesaw State University 1098-T form.

What is the 1098-T Form?

The 1098-T form, also known as the Tuition Statement, is a document provided by eligible educational institutions to students who have paid qualified tuition and related expenses (QTREs) during the calendar year. The form reports the amount of QTREs paid, which can be used to claim education tax credits and deductions on your tax return.

Who is Eligible for the 1098-T Form?

To be eligible for the 1098-T form, you must be a student who has paid QTREs to KSU during the calendar year. This includes undergraduate and graduate students, as well as students who are taking courses for credit. However, not all students are eligible for the form. For example, students who are taking non-credit courses or courses that are not degree-granting are not eligible.

How to Obtain the 1098-T Form from Kennesaw State University

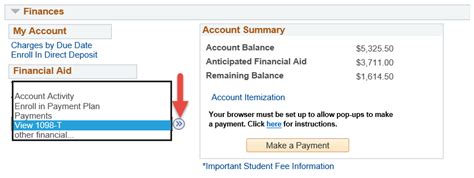

KSU typically provides the 1098-T form to eligible students by January 31st of each year. You can access your 1098-T form online through the KSU website or through your student portal. You will need to log in with your student ID and password to access the form. If you are unable to access your form online, you can contact the KSU Bursar's Office to request a paper copy.

What Information is Reported on the 1098-T Form?

The 1098-T form reports the following information:

- Your name, address, and taxpayer identification number (TIN)

- The amount of QTREs paid during the calendar year

- Whether you are a graduate student or undergraduate student

- Whether you are a degree-seeking student or non-degree seeking student

How to Use the 1098-T Form to Claim Education Tax Credits

The 1098-T form is used to claim education tax credits and deductions on your tax return. The two main education tax credits are the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). To claim these credits, you will need to report the amount of QTREs paid, as reported on the 1098-T form, on Form 8863. You can claim up to $2,500 in credits per eligible student.

Common Errors to Avoid When Claiming Education Tax Credits

When claiming education tax credits, there are several common errors to avoid. These include:

- Claiming credits for non-qualified expenses, such as room and board or transportation

- Claiming credits for non-qualified students, such as students who are not degree-seeking

- Failing to report the amount of QTREs paid on Form 8863

- Claiming credits for the same student on multiple tax returns

Additional Resources

For more information about the 1098-T form and education tax credits, you can visit the following resources:

- The IRS website (irs.gov)

- The Kennesaw State University website (kennesaw.edu)

- The KSU Bursar's Office website (kennesaw.edu/bursar)

By understanding the 1098-T form and education tax credits, you can make informed decisions about your tax return and maximize your benefits.

Take Action Today!

Don't miss out on the opportunity to claim education tax credits and deductions. Review your 1098-T form carefully and ensure that you are reporting the correct amount of QTREs paid on your tax return. If you have any questions or concerns, contact the KSU Bursar's Office or a tax professional for assistance.

What is the deadline for receiving the 1098-T form from Kennesaw State University?

+The deadline for receiving the 1098-T form from Kennesaw State University is January 31st of each year.

Can I claim education tax credits if I am a graduate student?

+Yes, graduate students are eligible for education tax credits. However, there are specific requirements and limitations that apply.

How do I report the amount of QTREs paid on my tax return?

+You will need to report the amount of QTREs paid on Form 8863, which is used to claim education tax credits.