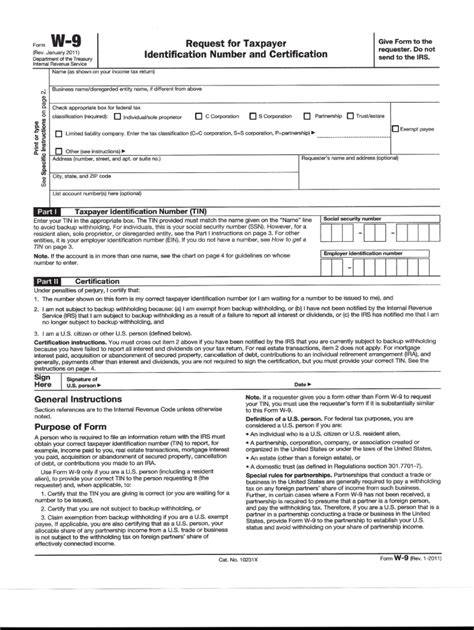

As a freelancer, independent contractor, or small business owner, you're likely familiar with the W-9 form. The W-9, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by the Internal Revenue Service (IRS) to collect taxpayer identification information from individuals and businesses. In this article, we'll delve into the world of W-9 forms, explaining their importance, how to obtain a blank W-9 2017 form, and providing guidance on filling it out correctly.

Why Do You Need a W-9 Form?

The W-9 form is a requirement for many businesses and individuals who receive income that's not subject to withholding, such as freelance work, consulting services, or rent payments. The form serves as a way for payers to verify the identity and taxpayer identification number (TIN) of recipients, ensuring compliance with IRS regulations. Without a valid W-9 on file, payers may be required to withhold taxes on payments, which can lead to unnecessary administrative burdens and potential penalties.

How to Get a W-9 2017 Blank Form

Obtaining a blank W-9 2017 form is relatively straightforward. You can:

- Download the form from the official IRS website (irs.gov).

- Contact the IRS directly via phone or mail to request a physical copy.

- Use online tax preparation software or services, such as TurboTax or H&R Block, which often provide access to W-9 forms.

Understanding the W-9 Form

Before filling out the W-9 form, it's essential to understand the different sections and what information is required.

- Section 1: Name and Business Name: Provide your name and business name (if applicable).

- Section 2: Business Entity Type: Identify your business entity type, such as sole proprietor, partnership, or corporation.

- Section 3: Address: Enter your address, including street, city, state, and ZIP code.

- Section 4: Taxpayer Identification Number (TIN): Provide your TIN, which can be a Social Security number (SSN) or Employer Identification Number (EIN).

- Section 5: Certification: Sign and date the form, certifying that the information provided is accurate.

Tips for Filling Out the W-9 Form

To ensure accuracy and avoid delays, follow these tips when filling out the W-9 form:

- Use a black pen to fill out the form.

- Print or type your information clearly and legibly.

- Double-check your TIN and address for accuracy.

- Sign and date the form in the presence of a notary public (if required).

Common Mistakes to Avoid

When filling out the W-9 form, be cautious of common mistakes that can lead to delays or even penalties:

- Inaccurate or missing TIN information.

- Incorrect or incomplete address information.

- Failure to sign and date the form.

- Using an outdated or incorrect W-9 form version.

Best Practices for Managing W-9 Forms

To ensure compliance and minimize administrative burdens, follow these best practices for managing W-9 forms:

- Maintain a secure and organized record-keeping system for W-9 forms.

- Regularly review and update W-9 forms to ensure accuracy and compliance.

- Provide clear instructions to recipients on how to complete and return the W-9 form.

W-9 Form FAQs

What is the purpose of the W-9 form?

+The W-9 form is used to collect taxpayer identification information from individuals and businesses, ensuring compliance with IRS regulations.

Who needs to complete a W-9 form?

+Freelancers, independent contractors, and small business owners who receive income that's not subject to withholding need to complete a W-9 form.

How often do I need to update my W-9 form?

+W-9 forms should be updated whenever there's a change in your taxpayer identification information or business entity type.

By understanding the importance of W-9 forms and following the guidelines outlined in this article, you'll be well on your way to ensuring compliance and minimizing administrative burdens. Remember to regularly review and update your W-9 forms to avoid potential penalties and delays. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the IRS directly.