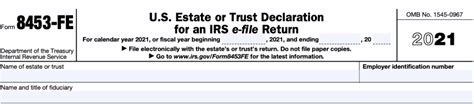

The world of tax filings can be overwhelming, especially when it comes to submitting electronic files to the Internal Revenue Service (IRS). One crucial form that requires careful attention is the Form 8453-Fe, also known as the U.S. Estate or Trust Declaration for an IRS e-file Return. This form is a critical component of the electronic filing process for estates and trusts, and its successful submission can make all the difference in avoiding delays, penalties, and even audits. In this article, we will delve into the essential tips for filing Form 8453-Fe successfully, ensuring a seamless and stress-free experience.

Understanding the Purpose and Requirements of Form 8453-Fe

Before we dive into the tips, it's essential to understand the purpose and requirements of Form 8453-Fe. This form is used by estates and trusts to declare that they have filed their tax returns electronically. It serves as a confirmation of the electronic filing and provides the IRS with the necessary information to process the return. The form requires the estate or trust to provide their name, address, and Employer Identification Number (EIN), as well as the name and PTIN (Preparer Tax Identification Number) of the preparer, if applicable.

Tip 1: Gather All Required Information and Documents

To file Form 8453-Fe successfully, it's crucial to gather all the required information and documents beforehand. This includes:

- The estate or trust's name and address

- The Employer Identification Number (EIN)

- The name and PTIN of the preparer, if applicable

- The tax year and type of return being filed (e.g., Form 1041)

- The Electronic Filing Identification Number (EFIN) of the transmitter

Having all the necessary information and documents readily available will save time and reduce the risk of errors.

Tip 2: Ensure Accuracy and Completeness

Accuracy and completeness are critical when filing Form 8453-Fe. Even a small mistake or omission can lead to delays, penalties, or even audits. Double-check all the information provided, including the estate or trust's name, address, and EIN. Ensure that the preparer's name and PTIN are correct, if applicable.

It's also essential to verify that the tax year and type of return being filed are correct.

Tip 3: Use the Correct Filing Status and Code

When filing Form 8453-Fe, it's crucial to use the correct filing status and code. The filing status determines the type of return being filed, and the code indicates the specific type of return. For example, the code "1041" indicates a fiduciary return.

Using the incorrect filing status or code can lead to delays or rejection of the return.

Tip 4: Electronic Sign the Form Correctly

To file Form 8453-Fe electronically, the estate or trust must electronic sign the form. This involves using a secure online signature platform or a handwritten signature that is scanned and attached to the form.

Ensure that the electronic signature is valid and compliant with IRS regulations.

Tip 5: Submit the Form on Time

Finally, it's essential to submit Form 8453-Fe on time. The IRS has specific deadlines for filing tax returns, and missing these deadlines can result in penalties and interest.

Ensure that the form is submitted well before the deadline to avoid any last-minute issues.

By following these 5 tips, estates and trusts can ensure a successful filing of Form 8453-Fe, avoiding delays, penalties, and even audits. Remember to gather all required information and documents, ensure accuracy and completeness, use the correct filing status and code, electronic sign the form correctly, and submit the form on time.

What is the purpose of Form 8453-Fe?

+Form 8453-Fe is used by estates and trusts to declare that they have filed their tax returns electronically.

What information is required to file Form 8453-Fe?

+The estate or trust's name and address, Employer Identification Number (EIN), and the name and PTIN of the preparer, if applicable.

What is the deadline for filing Form 8453-Fe?

+The deadline for filing Form 8453-Fe varies depending on the tax year and type of return being filed.