As a real estate investor or a business owner, you may be familiar with the concept of passive activity loss limitations. The IRS imposes these limitations to prevent taxpayers from using losses from passive activities to offset income from non-passive sources. In this article, we will delve into the world of passive activity loss limitations, specifically focusing on Form 8582 and its significance in tax reporting.

Passive activity loss limitations can be a complex and nuanced topic, but understanding the basics is essential for taxpayers who engage in passive activities. The IRS defines a passive activity as a trade or business in which the taxpayer does not materially participate. This can include rental real estate, limited partnerships, and businesses in which the taxpayer is not actively involved.

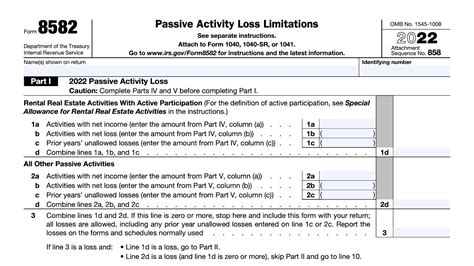

What is Form 8582?

Form 8582 is a tax form used to report passive activity losses and calculate the amount of losses that can be deducted against non-passive income. The form is used to determine the amount of passive activity losses that can be used to offset non-passive income, such as wages, interest, and dividends.

The form requires taxpayers to report their passive activity losses, including losses from rental real estate, partnerships, and S corporations. Taxpayers must also report their non-passive income and calculate the amount of passive activity losses that can be used to offset this income.

How to Complete Form 8582

Completing Form 8582 requires careful attention to detail and a thorough understanding of the tax laws surrounding passive activity losses. Here are the steps to complete the form:

- Identify passive activities: List all passive activities, including rental real estate, partnerships, and S corporations.

- Calculate passive activity losses: Calculate the losses from each passive activity, including operating losses, capital losses, and other deductions.

- Report non-passive income: Report all non-passive income, including wages, interest, and dividends.

- Calculate the passive activity loss limitation: Calculate the amount of passive activity losses that can be used to offset non-passive income.

Passive Activity Loss Limitation Rules

The passive activity loss limitation rules are designed to prevent taxpayers from using losses from passive activities to offset income from non-passive sources. Here are the key rules:

- $25,000 limit: Taxpayers can deduct up to $25,000 of passive activity losses against non-passive income.

- Phase-out: The $25,000 limit is phased out for taxpayers with modified adjusted gross income (MAGI) above $100,000.

- Excess losses: Excess losses can be carried forward to future years and used to offset non-passive income.

Exceptions to the Passive Activity Loss Limitation

There are several exceptions to the passive activity loss limitation rules, including:

- Real estate professionals: Real estate professionals can deduct losses from rental real estate without limitation.

- Active participation: Taxpayers who actively participate in a passive activity can deduct losses without limitation.

- Retirement accounts: Losses from retirement accounts, such as IRAs and 401(k)s, are not subject to the passive activity loss limitation.

Conclusion and Next Steps

Passive activity loss limitations can be a complex and nuanced topic, but understanding the basics is essential for taxpayers who engage in passive activities. By completing Form 8582 and following the passive activity loss limitation rules, taxpayers can ensure they are in compliance with tax laws and regulations.

If you are a taxpayer who engages in passive activities, it is essential to consult with a tax professional to ensure you are taking advantage of all available deductions and credits. Additionally, staying up-to-date with changes in tax laws and regulations can help you navigate the complex world of passive activity loss limitations.

We hope this article has provided you with a comprehensive understanding of passive activity loss limitations and Form 8582. If you have any questions or comments, please feel free to share them below.

What is a passive activity?

+A passive activity is a trade or business in which the taxpayer does not materially participate. This can include rental real estate, limited partnerships, and businesses in which the taxpayer is not actively involved.

What is Form 8582?

+Form 8582 is a tax form used to report passive activity losses and calculate the amount of losses that can be deducted against non-passive income.

What is the passive activity loss limitation?

+The passive activity loss limitation is a rule that limits the amount of passive activity losses that can be deducted against non-passive income. The limit is $25,000, and it is phased out for taxpayers with modified adjusted gross income (MAGI) above $100,000.