Filing taxes can be a daunting task, especially for those who are new to the process or are not familiar with the specific tax laws of their state. North Carolina, like many other states, has its own set of tax forms and regulations that residents must navigate when filing their taxes. One of the most important forms for North Carolina taxpayers is the D-400, also known as the Individual Income Tax Return. In this article, we will explore five ways to master the North Carolina tax form D-400 and ensure a smooth and accurate tax filing experience.

Understanding the D-400 Form

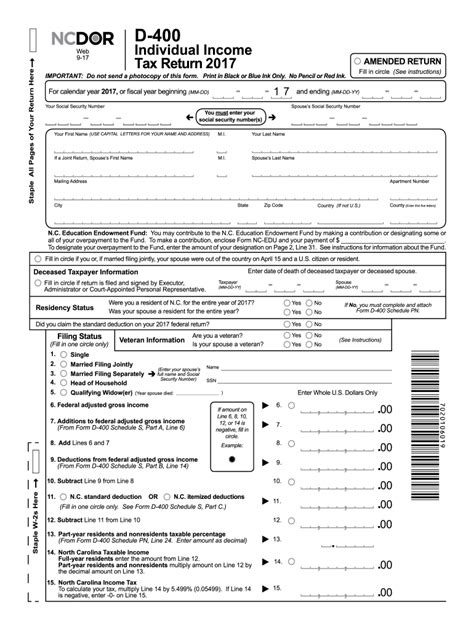

Before diving into the five ways to master the D-400 form, it's essential to understand what the form is used for and who needs to file it. The D-400 form is used by individuals to report their income, claim deductions and credits, and calculate their tax liability. If you are a North Carolina resident and have income that is subject to state taxation, you will need to file the D-400 form.

Who Needs to File the D-400 Form?

- Residents of North Carolina who have income that is subject to state taxation

- Part-year residents who earned income in North Carolina during the tax year

- Non-residents who earned income in North Carolina during the tax year

1. Gather All Necessary Documents

To master the D-400 form, you'll need to gather all necessary documents before starting the filing process. This includes:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Having all necessary documents will ensure that you report all your income accurately and take advantage of all eligible deductions and credits.

2. Choose the Correct Filing Status

Your filing status will determine the tax rates and deductions you're eligible for. North Carolina recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you're taking advantage of the most beneficial tax rates and deductions.

3. Take Advantage of Eligible Deductions and Credits

North Carolina offers several deductions and credits that can reduce your tax liability. Some of the most common include:

- Standard deduction

- Itemized deductions (e.g., medical expenses, charitable donations)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Take the time to review the available deductions and credits to ensure you're taking advantage of all eligible opportunities.

4. Report All Income Accurately

Accurately reporting all income is crucial to avoid any potential errors or penalties. Make sure to report all income from:

- W-2 forms

- 1099 forms

- Interest statements

- Dividend statements

- Freelance or contract work

Use the correct tax forms and schedules to report all income accurately.

5. Seek Professional Help if Needed

If you're unsure about any aspect of the D-400 form or need help with the filing process, consider seeking professional help from a tax professional or accountant. They can guide you through the process, ensure accuracy, and help you take advantage of all eligible deductions and credits.

By following these five steps, you'll be well on your way to mastering the North Carolina tax form D-400 and ensuring a smooth and accurate tax filing experience.

Now that you've read this article, we encourage you to take the next step and start preparing your D-400 form. If you have any questions or need further clarification on any of the topics discussed, please don't hesitate to comment below.

What is the deadline for filing the D-400 form?

+The deadline for filing the D-400 form is typically April 15th of each year.

Can I file the D-400 form electronically?

+Yes, you can file the D-400 form electronically through the North Carolina Department of Revenue's website.

What is the penalty for late filing of the D-400 form?

+The penalty for late filing of the D-400 form is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.