The PA-41 form is a crucial document for individuals receiving workers' compensation benefits in Pennsylvania. Understanding the intricacies of this form is essential for both employers and employees to navigate the complexities of workers' compensation. In this article, we will delve into the world of the PA-41 form, exploring its importance, usage, and benefits.

The PA-41 form, also known as the "Notice of Workers' Compensation Benefit Termination," is a formal document used by employers or their insurance carriers to notify the Pennsylvania Bureau of Workers' Compensation of changes to an employee's benefits. This form is a critical component of the workers' compensation system, ensuring that employees receive the correct benefits and that employers comply with state regulations.

What is the Purpose of the PA-41 Form?

The primary purpose of the PA-41 form is to inform the Pennsylvania Bureau of Workers' Compensation of any changes to an employee's benefits, including:

- Termination of benefits

- Reduction of benefits

- Increase of benefits

- Change in benefit type

This form is typically used when an employee's work-related injury or illness has improved, and they are no longer eligible for benefits or require a modification of their existing benefits. By submitting the PA-41 form, employers ensure that the Bureau of Workers' Compensation is aware of these changes, which helps maintain accurate records and prevents potential disputes.

Who Needs to File the PA-41 Form?

Employers or their insurance carriers are responsible for filing the PA-41 form with the Pennsylvania Bureau of Workers' Compensation. This typically includes:

- Employers with workers' compensation insurance policies

- Insurance carriers providing workers' compensation coverage

- Third-party administrators handling workers' compensation claims

Failure to file the PA-41 form can result in penalties and fines, emphasizing the importance of timely and accurate submissions.

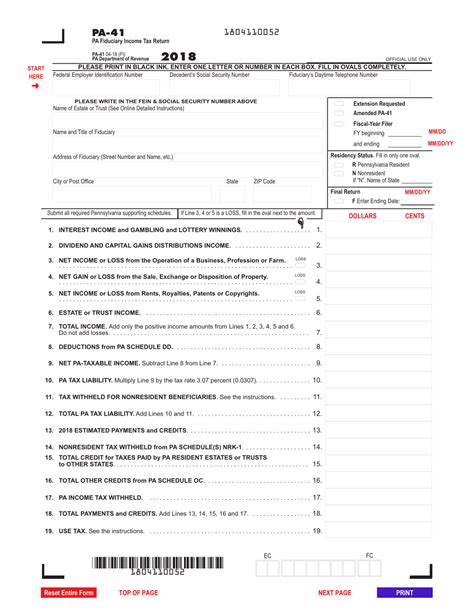

What Information is Required on the PA-41 Form?

The PA-41 form requires specific information to ensure accurate processing and update of benefits. This includes:

- Employee's name and social security number

- Employer's name and address

- Insurance carrier's name and address

- Date of injury or illness

- Type of benefits being terminated or modified

- Reason for termination or modification

Accurate and complete information is crucial to avoid delays or disputes in the processing of benefits.

Benefits of Filing the PA-41 Form

Filing the PA-41 form offers several benefits for both employers and employees, including:

- Ensures accurate records and updates to benefits

- Prevents potential disputes and penalties

- Maintains compliance with Pennsylvania workers' compensation regulations

- Facilitates timely and efficient processing of benefits

Consequences of Not Filing the PA-41 Form

Failure to file the PA-41 form can result in severe consequences, including:

- Penalties and fines for non-compliance

- Delays in processing benefits

- Disputes and potential litigation

- Negative impact on employer's reputation and insurance premiums

Employers must prioritize the timely and accurate filing of the PA-41 form to avoid these consequences.

How to File the PA-41 Form

Filing the PA-41 form involves the following steps:

- Download the form from the Pennsylvania Bureau of Workers' Compensation website or obtain a copy from your insurance carrier.

- Complete the form with accurate and required information.

- Submit the form to the Pennsylvania Bureau of Workers' Compensation.

- Retain a copy of the form for your records.

Employers must ensure that the PA-41 form is filed in a timely and accurate manner to maintain compliance with state regulations.

We invite you to share your experiences or ask questions about the PA-41 form in the comments section below. Your feedback is invaluable in helping us create a more informative and engaging article.

What is the purpose of the PA-41 form?

+The PA-41 form is used to notify the Pennsylvania Bureau of Workers' Compensation of changes to an employee's benefits, including termination, reduction, increase, or change in benefit type.

Who needs to file the PA-41 form?

+Employers or their insurance carriers are responsible for filing the PA-41 form with the Pennsylvania Bureau of Workers' Compensation.

What are the consequences of not filing the PA-41 form?

+Failure to file the PA-41 form can result in penalties and fines, delays in processing benefits, disputes, and a negative impact on employer's reputation and insurance premiums.