As an employer, you are required to file Form 941, also known as the Employer's Quarterly Federal Tax Return, to report your quarterly federal income tax withholding and Federal Insurance Contributions Act (FICA) taxes. However, if you need to make corrections to a previously filed Form 941, you will need to file Form 941-X, also known as the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. In this article, we will guide you through the 5 steps to file Form 941-X correctly.

Why File Form 941-X?

Before we dive into the steps to file Form 941-X, let's discuss why you might need to file this form. You may need to file Form 941-X if you:

- Made an error on a previously filed Form 941

- Need to report a change in your tax liability

- Want to claim a refund for overpaid taxes

- Need to report a change in your employer identification number (EIN)

Step 1: Determine Which Type of Adjustment You Need to Make

Before you start filling out Form 941-X, you need to determine which type of adjustment you need to make. There are two types of adjustments:

- Corrected return: If you need to correct an error on a previously filed Form 941, you will file a corrected return.

- Claim for refund: If you need to claim a refund for overpaid taxes, you will file a claim for refund.

Understanding the Different Types of Adjustments

It's essential to understand the difference between a corrected return and a claim for refund. A corrected return is used to correct errors on a previously filed Form 941, while a claim for refund is used to claim a refund for overpaid taxes.

Step 2: Gather Required Documents and Information

To file Form 941-X, you will need to gather certain documents and information, including:

- A copy of the original Form 941

- A copy of any supporting documentation, such as payroll records or W-2 forms

- The corrected information or the amount of the refund you are claiming

Required Documents and Information

Make sure you have all the required documents and information before you start filling out Form 941-X. This will help ensure that your form is accurate and complete.

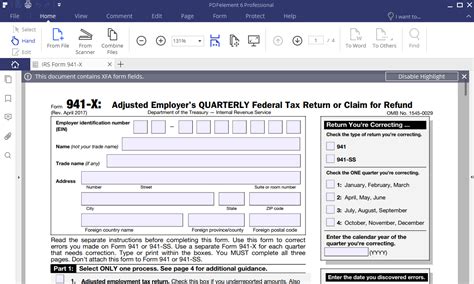

Step 3: Fill Out Form 941-X

Once you have gathered all the required documents and information, you can start filling out Form 941-X. The form is divided into several sections, including:

- Section 1: Identification: This section requires you to provide your employer identification number (EIN) and the quarter and year for which you are filing the adjustment.

- Section 2: Adjustments: This section requires you to provide the corrected information or the amount of the refund you are claiming.

- Section 3: Certification: This section requires you to certify that the information on the form is accurate and complete.

Filling Out Form 941-X

Make sure you fill out Form 941-X accurately and completely. If you have any questions or concerns, you can contact the IRS or a tax professional for assistance.

Step 4: Submit Form 941-X

Once you have completed Form 941-X, you can submit it to the IRS. You can submit the form electronically or by mail.

- Electronic filing: You can file Form 941-X electronically through the IRS's Electronic Federal Tax Payment System (EFTPS).

- Mail filing: You can mail Form 941-X to the IRS address listed in the instructions for the form.

Submitting Form 941-X

Make sure you submit Form 941-X on time and to the correct address. If you have any questions or concerns, you can contact the IRS or a tax professional for assistance.

Step 5: Follow Up on Your Adjustment

After you submit Form 941-X, you should follow up on your adjustment to ensure that it is processed correctly. You can check the status of your adjustment online or by contacting the IRS.

Following Up on Your Adjustment

Make sure you follow up on your adjustment to ensure that it is processed correctly. If you have any questions or concerns, you can contact the IRS or a tax professional for assistance.

By following these 5 steps, you can ensure that you file Form 941-X correctly and avoid any potential penalties or delays. Remember to gather all required documents and information, fill out the form accurately and completely, submit the form on time, and follow up on your adjustment.

We hope this article has been helpful in guiding you through the process of filing Form 941-X. If you have any questions or concerns, please don't hesitate to reach out to us.

What is Form 941-X?

+Form 941-X is the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund. It is used to correct errors on a previously filed Form 941 or to claim a refund for overpaid taxes.

Why do I need to file Form 941-X?

+You may need to file Form 941-X if you made an error on a previously filed Form 941, need to report a change in your tax liability, want to claim a refund for overpaid taxes, or need to report a change in your employer identification number (EIN).

How do I file Form 941-X?

+You can file Form 941-X electronically through the IRS's Electronic Federal Tax Payment System (EFTPS) or by mail to the IRS address listed in the instructions for the form.