As a business owner, navigating the complexities of international trade can be a daunting task. One crucial aspect of this process is accurately completing customs forms, such as the CBP Form 3311, also known as the Entry Summary Declaration. In this article, we will delve into the world of CBP Form 3311, exploring its importance, benefits, and providing a step-by-step guide on how to complete it correctly.

What is CBP Form 3311?

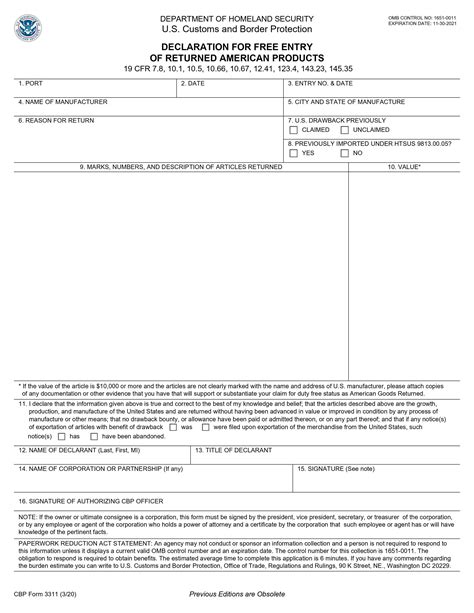

The CBP Form 3311, or Entry Summary Declaration, is a critical document required by U.S. Customs and Border Protection (CBP) for all imports entering the United States. This form serves as a summary of the shipment, providing essential information about the goods being imported, such as the type, quantity, value, and country of origin.

Why is CBP Form 3311 Important?

The CBP Form 3311 plays a vital role in the customs clearance process, enabling CBP to assess duties, taxes, and fees owed on imported goods. By accurately completing this form, importers can ensure compliance with U.S. customs regulations, avoid potential delays, and prevent costly penalties.

Benefits of Accurate CBP Form 3311 Completion

Accurate completion of the CBP Form 3311 offers several benefits, including:

- Reduced risk of delays and penalties

- Improved compliance with U.S. customs regulations

- Enhanced supply chain efficiency

- Increased transparency and visibility throughout the customs clearance process

Step-by-Step Guide to Completing CBP Form 3311

To ensure accurate completion of the CBP Form 3311, follow these steps:

- Gather necessary information: Collect all relevant documentation, including the commercial invoice, bill of lading, and any other supporting documents.

- Determine the correct HTS code: Identify the correct Harmonized Tariff Schedule (HTS) code for the imported goods.

- Complete the header section: Enter the required information, including the entry number, importer's name and address, and broker's name and address.

- Provide shipment details: Enter the shipment details, including the date of arrival, port of entry, and mode of transportation.

- List the goods: Describe the goods being imported, including the quantity, value, and country of origin.

- Calculate duties and taxes: Calculate the duties and taxes owed on the imported goods.

- Certify the declaration: Sign and certify the declaration, confirming the accuracy of the information provided.

Common Mistakes to Avoid

When completing the CBP Form 3311, it's essential to avoid common mistakes, such as:

- Inaccurate or incomplete information

- Incorrect HTS code usage

- Failure to report all goods

- Insufficient documentation

Best Practices for CBP Form 3311 Completion

To ensure accurate and efficient completion of the CBP Form 3311, follow these best practices:

- Use automation tools: Utilize automation tools, such as software or online platforms, to streamline the completion process.

- Verify information: Double-check all information to ensure accuracy and completeness.

- Maintain accurate records: Keep accurate records of all shipments and supporting documentation.

- Stay up-to-date with regulations: Regularly review and update knowledge of U.S. customs regulations and procedures.

Conclusion

In conclusion, accurate completion of the CBP Form 3311 is crucial for ensuring compliance with U.S. customs regulations and avoiding potential delays and penalties. By following the step-by-step guide and best practices outlined in this article, importers can ensure efficient and accurate completion of this critical customs form.

We encourage you to share your experiences and tips for completing the CBP Form 3311 in the comments below. Additionally, if you have any questions or concerns, please don't hesitate to reach out.

What is the purpose of the CBP Form 3311?

+The CBP Form 3311, or Entry Summary Declaration, is a critical document required by U.S. Customs and Border Protection (CBP) for all imports entering the United States.

What information is required on the CBP Form 3311?

+The CBP Form 3311 requires information such as the entry number, importer's name and address, broker's name and address, shipment details, and a list of the goods being imported.

What are the consequences of inaccurate or incomplete CBP Form 3311 completion?

+Inaccurate or incomplete CBP Form 3311 completion can result in delays, penalties, and even fines.