Missing the tax filing deadline can be stressful, but fortunately, the New York State Department of Taxation and Finance provides an easy solution. Filing a tax extension form, specifically the IT-370 form, can give you more time to prepare and submit your tax return. In this article, we'll guide you through the process of filing the NY tax extension form IT-370 easily online today.

Why File a Tax Extension Form?

Filing a tax extension form can be beneficial in various situations. Perhaps you need more time to gather necessary documents, resolve issues with your tax return, or simply require extra time to complete the filing process. Whatever the reason, filing a tax extension form can help you avoid penalties and interest associated with late filing.

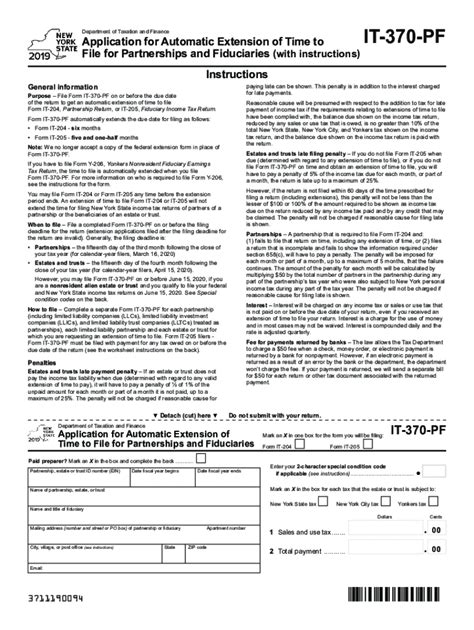

What is the IT-370 Form?

The IT-370 form is a tax extension form specifically designed for New York State taxpayers. This form allows you to request an automatic six-month extension of time to file your New York State income tax return. The form is relatively straightforward and can be completed quickly, either online or by mail.

Benefits of Filing the IT-370 Form Online

Filing the IT-370 form online offers several benefits, including:

- Convenience: You can file the form from anywhere with an internet connection, 24/7.

- Speed: The online filing process is faster than mailing the form, and you'll receive instant confirmation.

- Accuracy: The online system will guide you through the process, reducing errors and ensuring you provide all necessary information.

How to File the IT-370 Form Online

Filing the IT-370 form online is a straightforward process that can be completed in a few steps:

- Gather necessary information: Before starting the online filing process, make sure you have all necessary information, including your name, address, social security number, and tax year.

- Visit the New York State Department of Taxation and Finance website: Go to the official website of the New York State Department of Taxation and Finance and navigate to the "File a Tax Extension" section.

- Select the IT-370 form: Choose the IT-370 form and click on the "File Online" button.

- Complete the form: Fill out the form with the required information, following the on-screen instructions.

- Submit the form: Once you've completed the form, click the "Submit" button to file your tax extension request.

Additional Tips and Reminders

- File on time: Make sure to file the IT-370 form by the original tax filing deadline to avoid penalties and interest.

- Pay any estimated tax: If you owe taxes, consider making an estimated tax payment to avoid additional penalties and interest.

- Keep records: Keep a copy of your filed IT-370 form and any supporting documentation for your records.

Common Questions and Answers

What is the deadline for filing the IT-370 form?

+The deadline for filing the IT-370 form is the original tax filing deadline, typically April 15th.

Can I file the IT-370 form by mail?

+Yes, you can file the IT-370 form by mail. However, online filing is recommended for faster processing and instant confirmation.

Will I receive a confirmation of my filed IT-370 form?

+Yes, you will receive instant confirmation when filing online. If you file by mail, you will receive a confirmation by mail, which may take several weeks.

Take Action Today

Don't wait until the last minute to file your tax extension form. Take action today and file the IT-370 form online to give yourself more time to prepare and submit your tax return. Remember to gather all necessary information, follow the online filing process, and keep records of your filed form. If you have any questions or concerns, refer to the FAQ section or contact the New York State Department of Taxation and Finance for assistance.