Understanding the Importance of Filling Out OGE Form 278e Correctly

As a federal employee, filling out the OGE Form 278e is a crucial part of your annual financial disclosure process. The form requires you to report your financial interests, assets, and liabilities, which helps to prevent conflicts of interest and ensure transparency in government. However, filling out the form correctly can be a daunting task, especially for those who are new to the process. In this article, we will provide you with a comprehensive guide on how to fill out OGE Form 278e correctly, highlighting five key areas to focus on.

Why is it Important to Fill Out OGE Form 278e Correctly?

Filling out OGE Form 278e correctly is crucial for several reasons. Firstly, it helps to prevent conflicts of interest, which can arise when a federal employee's personal financial interests intersect with their official duties. By reporting your financial interests, you can avoid situations that may compromise your impartiality. Secondly, accurate reporting helps to maintain transparency in government, which is essential for building public trust. Finally, failure to fill out the form correctly can result in serious consequences, including fines, penalties, and even termination of employment.

5 Ways to Fill Out OGE Form 278e Correctly

1. Understand the Reporting Requirements

Know What to Report

Before filling out the form, it's essential to understand what needs to be reported. The OGE Form 278e requires you to report your financial interests, assets, and liabilities, including:

- Stocks and bonds

- Real estate

- Mutual funds

- Retirement accounts

- Trusts

- Liabilities, such as mortgages and credit card debt

Make sure you understand what constitutes a reportable interest and what does not.

2. Gather Required Documents and Information

Get Your Financial Records in Order

To fill out the form accurately, you'll need to gather your financial records, including:

- Tax returns

- Bank statements

- Investment accounts

- Retirement account statements

- Mortgage documents

- Credit card statements

Having all the necessary documents and information at hand will make the reporting process much easier.

3. Report Your Financial Interests Accurately

Be Detailed and Specific

When reporting your financial interests, be sure to provide detailed and specific information. This includes:

- The name and address of the issuer or entity

- The type of investment or asset

- The value of the investment or asset

- The date of acquisition

Avoid vague or general descriptions, as they may not provide enough information for accurate reporting.

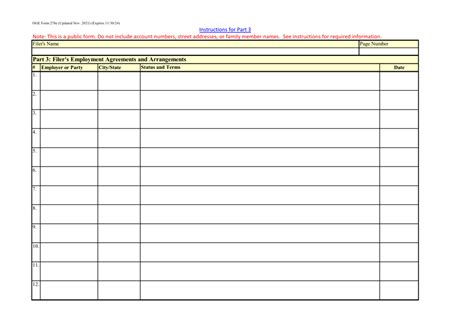

4. Report Your Spouse's and Dependents' Financial Interests

Include Your Family Members' Financial Information

If you have a spouse or dependents, you'll need to report their financial interests as well. This includes:

- Spouse's employment information

- Spouse's investments and assets

- Dependents' investments and assets

Make sure you have the necessary documentation and information to report your family members' financial interests accurately.

5. Review and Certify Your Report

Double-Check Your Work

Before submitting your report, review it carefully to ensure accuracy and completeness. Once you're satisfied with your report, certify it by signing and dating it.

By following these five steps, you'll be able to fill out OGE Form 278e correctly and ensure that you're in compliance with federal regulations.

What is the purpose of OGE Form 278e?

+OGE Form 278e is a financial disclosure form required for federal employees to report their financial interests, assets, and liabilities. The purpose of the form is to prevent conflicts of interest and ensure transparency in government.

What happens if I fail to fill out OGE Form 278e correctly?

+Failing to fill out OGE Form 278e correctly can result in serious consequences, including fines, penalties, and even termination of employment. It's essential to ensure accuracy and completeness when filling out the form.

Do I need to report my spouse's and dependents' financial interests?

+Yes, you are required to report your spouse's and dependents' financial interests, including their employment information, investments, and assets.