As a property owner in Michigan, it's essential to stay on top of your tax obligations to avoid any potential penalties or fines. One crucial aspect of this is filing the correct forms on time, including the Michigan Extension Form 4. In this article, we'll delve into the world of Form 4, exploring its purpose, benefits, and most importantly, the filing deadlines you need to be aware of.

Michigan Extension Form 4, also known as the "Application for Extension of Time to File Michigan Estate Tax Return," is a critical document for those who need more time to file their estate tax return. This form is typically used by executors or administrators of an estate who require an extension to gather the necessary information and documentation to complete the return accurately.

Benefits of Filing Michigan Extension Form 4

Filing Form 4 can provide several benefits, including:

- Avoiding penalties and fines associated with late filing

- Giving you more time to gather necessary documentation and information

- Reducing stress and pressure to meet the original filing deadline

- Allowing you to focus on other aspects of the estate administration process

Eligibility and Requirements

To be eligible to file Form 4, you must meet the following requirements:

- You are the executor or administrator of an estate

- You need more time to file the estate tax return

- You have a valid reason for requesting an extension

- You have not already filed the estate tax return

Filing Deadlines for Michigan Extension Form 4

The filing deadline for Form 4 is typically the same as the original due date for the estate tax return. However, it's essential to note that the Michigan Department of Treasury may grant an automatic six-month extension if you file Form 4 by the original due date.

Here are some key filing deadlines to keep in mind:

- April 15th: This is the original due date for filing the estate tax return and Form 4.

- October 15th: If you file Form 4 by April 15th, you will receive an automatic six-month extension, making the new due date October 15th.

- Six months from the original due date: If you file Form 4 after April 15th, you will still receive an extension, but the new due date will be six months from the original due date.

Penalties for Late Filing

If you fail to file Form 4 or the estate tax return by the required deadline, you may be subject to penalties and fines. These can include:

- A late-filing penalty of 5% of the unpaid tax per month, up to a maximum of 25%

- A late-payment penalty of 0.5% of the unpaid tax per month, up to a maximum of 25%

- Interest on the unpaid tax, calculated from the original due date

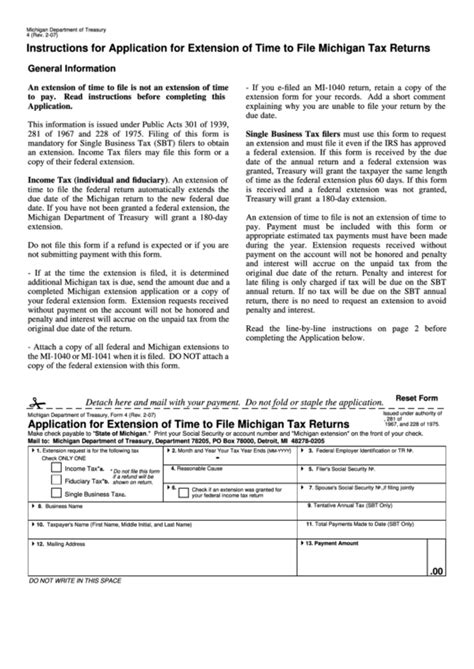

How to File Michigan Extension Form 4

Filing Form 4 is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Gather required documentation: Make sure you have all the necessary information and documentation, including the estate's tax identification number, the decedent's name and date of death, and a detailed explanation of the reason for requesting an extension.

- Complete Form 4: Fill out Form 4 accurately and completely, making sure to sign and date it.

- Submit Form 4: File Form 4 with the Michigan Department of Treasury by the required deadline.

- Pay any required fees: You may need to pay a fee for filing Form 4, which can be paid by check or money order.

Conclusion

In conclusion, Michigan Extension Form 4 is a vital document for those who need more time to file their estate tax return. By understanding the benefits, eligibility requirements, and filing deadlines, you can ensure a smooth and stress-free process. Remember to file Form 4 by the required deadline to avoid any potential penalties or fines.

We encourage you to share your thoughts and experiences with filing Michigan Extension Form 4 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of Michigan Extension Form 4?

+The purpose of Michigan Extension Form 4 is to request an extension of time to file the Michigan estate tax return.

Who is eligible to file Michigan Extension Form 4?

+Executors or administrators of an estate who need more time to file the estate tax return are eligible to file Form 4.

What is the filing deadline for Michigan Extension Form 4?

+The filing deadline for Form 4 is typically the same as the original due date for the estate tax return, which is April 15th.