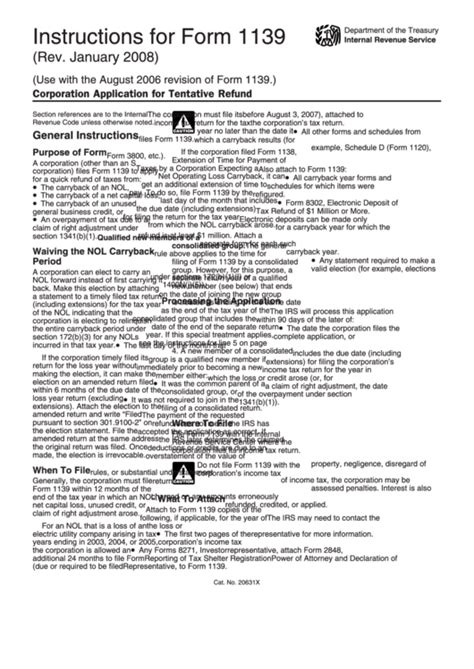

As a corporation, navigating the complex world of tax compliance can be daunting. The Form 1139, also known as the "Corporation Application for Tentative Refund," is a crucial document that can help your business reclaim overpaid taxes. In this comprehensive guide, we will walk you through the Form 1139 instructions, providing a step-by-step approach to ensure a smooth and accurate filing process.

Understanding the Form 1139: A Brief Overview

The Form 1139 is used by corporations to claim a tentative refund of taxes overpaid in a previous tax year. This form is typically filed when a corporation has overpaid its taxes due to an error in reporting income, deductions, or credits. By filing the Form 1139, corporations can expedite the refund process, allowing them to receive the overpaid amount sooner.

Step 1: Determine Eligibility for Filing Form 1139

Before diving into the Form 1139 instructions, it's essential to determine whether your corporation is eligible to file this form. To qualify, your corporation must have:

- Filed a prior tax return (Form 1120) for the tax year in question

- Overpaid its taxes for that tax year

- Not received a refund for the overpaid amount

Additional Requirements

Your corporation must also meet the following requirements:

- The overpayment must be due to an error in reporting income, deductions, or credits

- The error must be corrected on an amended return (Form 1120X)

- The corporation must have filed the amended return before the statute of limitations expires

Step 2: Gather Required Documents and Information

To complete the Form 1139, you will need to gather the following documents and information:

- A copy of the original tax return (Form 1120) for the tax year in question

- A copy of the amended return (Form 1120X) correcting the error

- The overpayment amount and the reason for the overpayment

- Your corporation's employer identification number (EIN)

- The date the original return was filed

Additional Information

You may also need to provide additional information, such as:

- A detailed explanation of the error and how it was corrected

- Supporting documentation for the corrected amounts

- A statement explaining why the corporation is entitled to a tentative refund

Step 3: Complete the Form 1139

With the required documents and information in hand, you can now complete the Form 1139. The form consists of four sections:

- Section 1: Corporation Information

- Section 2: Overpayment Information

- Section 3: Explanation and Supporting Documentation

- Section 4: Certification and Signature

Section 1: Corporation Information

Complete this section by providing your corporation's EIN, name, and address. You will also need to specify the tax year for which you are claiming the overpayment.

Section 2: Overpayment Information

In this section, you will need to provide the overpayment amount and the reason for the overpayment. You will also need to specify the date the original return was filed.

Section 3: Explanation and Supporting Documentation

Provide a detailed explanation of the error and how it was corrected. You will also need to attach supporting documentation, such as a copy of the amended return (Form 1120X).

Section 4: Certification and Signature

Certify that the information provided is accurate and complete. Sign and date the form.

Step 4: Submit the Form 1139

Once you have completed the Form 1139, you can submit it to the IRS. You can file the form electronically or by mail.

E-Filing

You can e-file the Form 1139 through the IRS's Modernized e-File (MeF) system. You will need to register for an account and follow the e-filing instructions.

Mailing

You can also mail the Form 1139 to the IRS address listed in the instructions. Make sure to use certified mail with return receipt requested.

Form 1139 Frequently Asked Questions (FAQs)

Q: What is the purpose of the Form 1139?

A: The Form 1139 is used by corporations to claim a tentative refund of taxes overpaid in a previous tax year.

Q: Who is eligible to file the Form 1139?

A: Corporations that have overpaid their taxes due to an error in reporting income, deductions, or credits are eligible to file the Form 1139.

Q: What documents do I need to file the Form 1139?

A: You will need a copy of the original tax return (Form 1120), a copy of the amended return (Form 1120X), and supporting documentation for the corrected amounts.

Q: How do I submit the Form 1139?

A: You can e-file the Form 1139 through the IRS's Modernized e-File (MeF) system or mail it to the IRS address listed in the instructions.

Q: What is the deadline for filing the Form 1139?

A: The deadline for filing the Form 1139 is typically the same as the deadline for filing the original tax return.

What happens after I file the Form 1139?

+After you file the Form 1139, the IRS will review your application and determine whether you are eligible for a tentative refund. If approved, the IRS will issue a refund check or apply the overpayment to your next tax liability.

Can I file the Form 1139 electronically?

+Yes, you can e-file the Form 1139 through the IRS's Modernized e-File (MeF) system. You will need to register for an account and follow the e-filing instructions.

What is the statute of limitations for filing the Form 1139?

+The statute of limitations for filing the Form 1139 is typically three years from the date the original return was filed. However, this period can be extended in certain circumstances.

Conclusion

Filing the Form 1139 can be a complex process, but by following these step-by-step instructions, you can ensure a smooth and accurate filing process. Remember to gather all required documents and information, complete the form carefully, and submit it to the IRS in a timely manner. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the IRS directly.

Take Action

- Review the Form 1139 instructions carefully

- Gather required documents and information

- Complete the Form 1139 accurately

- Submit the form to the IRS in a timely manner

Share Your Thoughts

Have you filed the Form 1139 before? Share your experiences and tips in the comments below.