In the state of Wisconsin, tax season can be a daunting time for many individuals and businesses. With numerous forms to file and deadlines to meet, it's easy to get overwhelmed. One crucial form for Wisconsin residents is the Form 2, also known as the Wisconsin Form 2. This form is used to report income, deductions, and credits for Wisconsin state income tax purposes. In this article, we will provide a step-by-step guide on how to file Wisconsin Form 2 with ease.

Filing your taxes can seem like a monumental task, but with the right guidance, it can be a breeze. Wisconsin Form 2 is a critical component of the state's tax filing process, and understanding how to file it correctly is essential to avoid any penalties or delays. Whether you're a seasoned tax filer or a newcomer to the world of taxes, this article will walk you through the simple steps to file your Wisconsin Form 2 accurately and efficiently.

What is Wisconsin Form 2?

Wisconsin Form 2 is the state's individual income tax return form. It's used to report income, deductions, and credits for Wisconsin state income tax purposes. The form is typically filed by April 15th of each year, and it's essential to ensure accuracy and completeness to avoid any delays or penalties.

Who Needs to File Wisconsin Form 2?

You'll need to file Wisconsin Form 2 if you're a Wisconsin resident and you meet certain income requirements. These requirements include:

- You're a Wisconsin resident and have a gross income of $12,000 or more

- You're a non-resident and have a gross income of $2,000 or more from Wisconsin sources

- You're a resident and have a gross income of $12,000 or more, even if you're not required to file a federal income tax return

5 Easy Filing Instructions for Wisconsin Form 2

Filing Wisconsin Form 2 can seem intimidating, but with these easy instructions, you'll be done in no time.

Step 1: Gather Your Documents

Before you start filing, gather all the necessary documents, including:

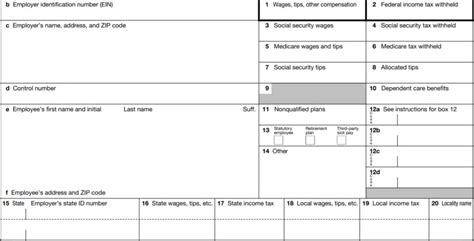

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance or contract work

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Wisconsin driver's license or state ID

- Any relevant tax deductions or credits

Step 2: Choose Your Filing Status

Your filing status will determine which tax rates and deductions you're eligible for. Choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Your Income

Report all your income from W-2 forms, 1099 forms, and any other relevant sources. Make sure to include:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

Step 4: Claim Your Deductions and Credits

Claim all eligible deductions and credits to reduce your tax liability. These may include:

- Standard deduction

- Itemized deductions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Step 5: File Your Return

Once you've completed your return, file it with the Wisconsin Department of Revenue by April 15th. You can file electronically or by mail.

Tips and Reminders

- Make sure to sign and date your return

- Keep a copy of your return for your records

- If you're filing electronically, make sure to use a secure connection

- If you're filing by mail, use a trackable shipping method

Conclusion: Filing Wisconsin Form 2 Made Easy

Filing Wisconsin Form 2 doesn't have to be a daunting task. By following these easy instructions, you'll be able to file your taxes accurately and efficiently. Remember to gather all necessary documents, choose your filing status, report your income, claim your deductions and credits, and file your return on time. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the Wisconsin Department of Revenue.

What is the deadline to file Wisconsin Form 2?

+The deadline to file Wisconsin Form 2 is April 15th of each year.

Do I need to file Wisconsin Form 2 if I don't owe any taxes?

+Yes, you still need to file Wisconsin Form 2 even if you don't owe any taxes. You may be eligible for a refund or credits.

Can I file Wisconsin Form 2 electronically?

+Yes, you can file Wisconsin Form 2 electronically through the Wisconsin Department of Revenue's website.