Completing Form SF-425 is a crucial task for individuals and organizations that receive federal funding, as it serves as a standard form for reporting on the financial status of grants, cooperative agreements, and other federal assistance awards. The Form SF-425, also known as the Federal Financial Report (FFR), is used to report on the financial status of a project, including expenditures, obligations, and unobligated balances. In this article, we will walk you through the 7 essential steps to complete Form SF-425 accurately and efficiently.

Understanding the Purpose and Scope of Form SF-425

Before diving into the steps to complete Form SF-425, it's essential to understand its purpose and scope. The Form SF-425 is used to report on the financial status of federal funding awards, including grants, cooperative agreements, and other types of assistance. The form is typically submitted quarterly or annually, depending on the terms of the award. The information reported on the form is used by federal agencies to monitor the financial status of awards, identify potential issues, and ensure compliance with federal regulations.

Step 1: Gather Required Information and Documents

The first step in completing Form SF-425 is to gather all the required information and documents. This includes:

- The award document, including the award number, project period, and budget

- Financial records, including expenditures, obligations, and unobligated balances

- Budget reports and financial statements

- Any other relevant documents, such as invoices, receipts, and bank statements

Step 2: Review and Understand the Form SF-425 Instructions

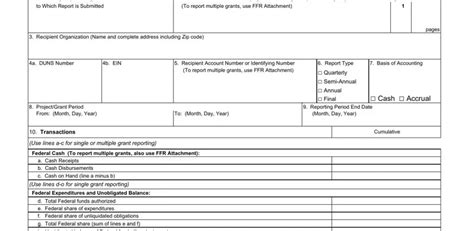

The next step is to review and understand the instructions for completing Form SF-425. The form is divided into several sections, each with its own specific instructions. It's essential to read and understand the instructions carefully to ensure accurate completion of the form.

Step 3: Complete the Award Information Section

The Award Information section is the first section of the form and requires the following information:

- Award number

- Project period

- Budget period

- Award type (grant, cooperative agreement, etc.)

- Federal agency and program name

Step 4: Report on Expenditures and Obligations

The next section of the form requires reporting on expenditures and obligations. This includes:

- Total expenditures during the reporting period

- Total obligations during the reporting period

- Total unobligated balance at the end of the reporting period

Step 5: Report on Unobligated Balances

The Unobligated Balances section requires reporting on the unobligated balance at the end of the reporting period. This includes:

- Total unobligated balance

- Breakdown of unobligated balance by budget category

Step 6: Certify the Report

The next step is to certify the report by signing and dating the form. The certification statement acknowledges that the information reported is accurate and complete.

Step 7: Submit the Report

The final step is to submit the report to the federal agency. The report can be submitted electronically or by mail, depending on the agency's requirements.

Common Mistakes to Avoid

When completing Form SF-425, there are several common mistakes to avoid, including:

- Inaccurate or incomplete information

- Failure to certify the report

- Late submission of the report

- Failure to include required documentation

Best Practices for Completing Form SF-425

To ensure accurate and efficient completion of Form SF-425, follow these best practices:

- Review and understand the instructions carefully

- Gather all required information and documents

- Use a checklist to ensure all sections are complete

- Review the report carefully before submission

- Submit the report on time

By following these 7 essential steps and best practices, individuals and organizations can ensure accurate and efficient completion of Form SF-425.

Benefits of Accurate Completion of Form SF-425

Accurate completion of Form SF-425 provides several benefits, including:

- Ensures compliance with federal regulations

- Helps to identify potential financial issues

- Enables federal agencies to monitor the financial status of awards

- Facilitates timely and accurate reporting

Common Challenges and Solutions

Completing Form SF-425 can be challenging, especially for those who are new to federal funding. Some common challenges and solutions include:

- Challenge: Inaccurate or incomplete information

- Solution: Review and understand the instructions carefully, and gather all required information and documents.

- Challenge: Late submission of the report

- Solution: Use a calendar or reminder system to ensure timely submission.

- Challenge: Failure to certify the report

- Solution: Review the certification statement carefully and ensure it is signed and dated.

By understanding the common challenges and solutions, individuals and organizations can overcome obstacles and ensure accurate completion of Form SF-425.

Conclusion

Completing Form SF-425 is a critical task for individuals and organizations that receive federal funding. By following the 7 essential steps and best practices outlined in this article, individuals and organizations can ensure accurate and efficient completion of the form. Remember to review and understand the instructions carefully, gather all required information and documents, and use a checklist to ensure all sections are complete. By doing so, individuals and organizations can ensure compliance with federal regulations, identify potential financial issues, and facilitate timely and accurate reporting.

Call to Action

If you have any questions or concerns about completing Form SF-425, please don't hesitate to reach out to us. We're here to help you navigate the process and ensure accurate completion of the form.

Share your experiences and tips for completing Form SF-425 in the comments section below.

What is Form SF-425 used for?

+Form SF-425 is used to report on the financial status of federal funding awards, including grants, cooperative agreements, and other types of assistance.

How often is Form SF-425 submitted?

+Form SF-425 is typically submitted quarterly or annually, depending on the terms of the award.

What are the consequences of late submission of Form SF-425?

+Late submission of Form SF-425 can result in delayed payment, reduced funding, or even termination of the award.