Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. Illinois residents, in particular, must navigate the state's tax laws and regulations to ensure they are in compliance. To help make the process easier, we will provide a comprehensive guide to Illinois tax form instructions. In this article, we will walk you through the step-by-step process of completing and filing your Illinois tax return.

Illinois tax laws and regulations can be complex, and even small mistakes can result in delays or penalties. According to the Illinois Department of Revenue, the state collected over $33 billion in taxes in 2020, with the majority coming from individual income taxes. With so much at stake, it's essential to understand the tax laws and follow the correct procedures to avoid any issues.

Illinois tax forms can be overwhelming, especially for those who are new to the process. However, with the right guidance, you can ensure you are taking advantage of all the deductions and credits available to you. In this article, we will break down the Illinois tax form instructions into easy-to-follow steps, covering topics such as filing status, income, deductions, and credits.

Understanding Your Filing Status

Before you begin filling out your Illinois tax return, it's essential to determine your filing status. Your filing status will determine which tax forms you need to complete and which deductions and credits you are eligible for.

Types of Filing Statuses

- Single: You are unmarried or separated and have no dependents.

- Married Filing Jointly: You and your spouse are filing your tax return together.

- Married Filing Separately: You and your spouse are filing your tax return separately.

- Head of Household: You are unmarried or separated and have dependents.

- Qualifying Widow(er): You are a widow or widower with dependents.

Gathering Necessary Documents

Before you start filling out your Illinois tax return, make sure you have all the necessary documents. These may include:

- W-2 forms from your employer

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Filing Your Illinois Tax Return

Now that you have determined your filing status and gathered all the necessary documents, it's time to start filling out your Illinois tax return.

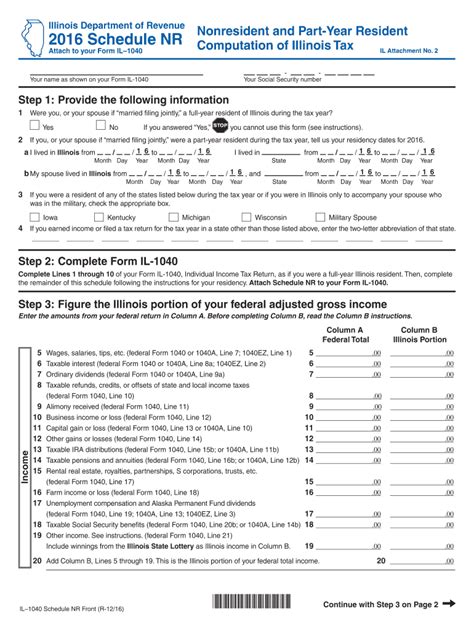

Step 1: Complete Form IL-1040

Form IL-1040 is the main form for Illinois tax returns. You will need to complete this form, even if you are filing a joint return with your spouse.

- Enter your name, address, and Social Security number.

- Choose your filing status.

- List your dependents.

- Report your income from all sources.

Step 2: Complete Schedule 1

Schedule 1 is used to report additional income, such as freelance work or other income not reported on Form IL-1040.

- List your additional income sources.

- Calculate your total additional income.

Step 3: Complete Schedule 2

Schedule 2 is used to report deductions and credits.

- List your deductions, such as charitable donations and medical expenses.

- Calculate your total deductions.

- List your credits, such as the Earned Income Tax Credit (EITC).

Illinois Tax Deductions and Credits

Illinois offers several deductions and credits to help reduce your tax liability. Some of the most common deductions and credits include:

- Standard Deduction: A fixed amount that can be deducted from your income, regardless of your actual expenses.

- Itemized Deductions: Expenses such as charitable donations, medical expenses, and mortgage interest.

- Earned Income Tax Credit (EITC): A credit for low-income working individuals and families.

- Education Expenses: A credit for education expenses, such as tuition and fees.

Step 4: Review and Submit Your Return

Once you have completed all the necessary forms and schedules, review your return to ensure everything is accurate and complete.

- Check for math errors.

- Make sure you have signed and dated your return.

- Submit your return by the deadline, which is typically April 15th.

Additional Resources

If you need help with your Illinois tax return, there are several resources available.

- Illinois Department of Revenue: The official website for the Illinois Department of Revenue, which provides information on tax laws, forms, and instructions.

- Tax Professionals: Certified public accountants (CPAs) and enrolled agents (EAs) who can provide guidance and assistance with your tax return.

- Tax Software: Software programs, such as TurboTax and H&R Block, that can help guide you through the tax preparation process.

What is the deadline for filing my Illinois tax return?

+The deadline for filing your Illinois tax return is typically April 15th.

Do I need to file a state tax return if I only have income from a W-2?

+Yes, you may still need to file a state tax return, even if you only have income from a W-2. Check the Illinois Department of Revenue website for more information.

Can I e-file my Illinois tax return?

+Yes, you can e-file your Illinois tax return using tax software or the Illinois Department of Revenue website.

We hope this guide has provided you with a comprehensive understanding of Illinois tax form instructions. Remember to take your time, gather all necessary documents, and seek help if you need it. By following these steps and staying informed, you can ensure a smooth and stress-free tax filing experience.