Filing taxes as a non-resident in California can be a daunting task, especially when it comes to navigating the complex world of tax forms. The California Form 540NR is a crucial document for non-residents who need to report their income earned in the state. To help you through this process, we've compiled seven essential tips for understanding and completing the CA Form 540NR instructions.

Understanding the CA Form 540NR

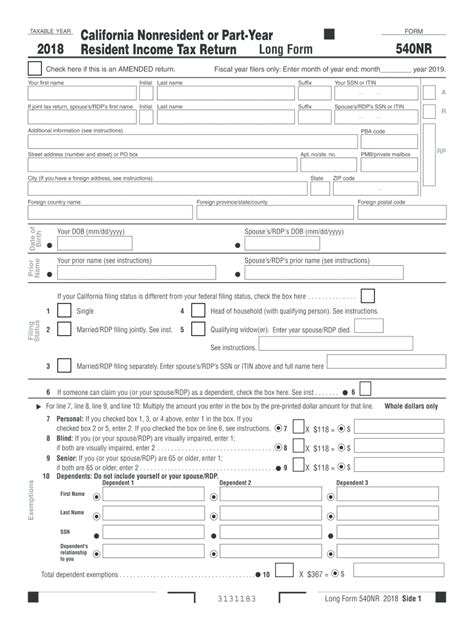

Before diving into the instructions, it's essential to understand the purpose of the CA Form 540NR. This form is used by non-residents who have earned income in California, such as wages, salaries, tips, and other forms of compensation. The form is used to report this income and calculate the tax owed to the state.

Tip 1: Determine Your Residency Status

To file the CA Form 540NR, you must first determine your residency status. If you're a non-resident, you'll need to file this form. However, if you're a part-year resident or a resident, you'll need to file a different form, such as the CA Form 540.

To determine your residency status, ask yourself:

- Did you live in California for more than six months during the tax year?

- Did you have a permanent home in California?

- Did you have a California driver's license or vehicle registration?

- Did you have a California voter registration?

If you answered "yes" to any of these questions, you may be considered a resident or part-year resident, and you should file a different form.

Gathering Required Documents

Before starting the CA Form 540NR instructions, gather all the necessary documents to ensure a smooth filing process. These documents may include:

- W-2 forms from employers

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements

- Rental income statements

Make sure you have all the necessary documents before starting the form, as this will help you accurately report your income and calculate your tax owed.

Tip 2: Complete the Form 540NR in Its Entirety

When completing the CA Form 540NR, it's essential to fill out the form in its entirety. This includes:

- Your name, address, and Social Security number

- Your spouse's name, address, and Social Security number (if filing jointly)

- Your income earned in California

- Your deductions and credits

- Your tax owed or refund due

Make sure to complete every section of the form, even if you think it doesn't apply to you. Leaving sections blank may delay the processing of your return or result in errors.

Understanding California Tax Credits

California offers several tax credits that can reduce your tax liability. These credits include:

- The California Earned Income Tax Credit (CalEITC)

- The Child and Dependent Care Credit

- The Education Credits

- The Homebuyer's Downpayment Assistance Program

To claim these credits, you'll need to complete the corresponding sections on the CA Form 540NR. Make sure to read the instructions carefully and follow the guidelines for each credit.

Tip 3: Claim the Correct Credits

When claiming credits on the CA Form 540NR, make sure to claim the correct credits for your situation. For example:

- If you're a low-income earner, you may be eligible for the CalEITC.

- If you have dependent children, you may be eligible for the Child and Dependent Care Credit.

- If you're a student or have a dependent student, you may be eligible for the Education Credits.

Claiming the correct credits can significantly reduce your tax liability, so make sure to read the instructions carefully and claim the credits you're eligible for.

Calculating Your Tax Owed

Once you've completed the CA Form 540NR, you'll need to calculate your tax owed. This involves:

- Adding up your income earned in California

- Subtracting your deductions and credits

- Multiplying the result by the applicable tax rate

Make sure to use the correct tax rates and follow the instructions carefully to avoid errors.

Tip 4: Pay Your Tax Owed on Time

If you owe tax, make sure to pay it on time to avoid penalties and interest. You can pay your tax owed online, by phone, or by mail. Make sure to include your name, Social Security number, and the tax year on your payment.

Amending Your Return

If you need to amend your return, you'll need to complete the CA Form 540X. This form is used to correct errors or omissions on your original return.

When amending your return, make sure to:

- Complete the CA Form 540X in its entirety

- Attach a copy of your original return

- Explain the reason for the amendment

Make sure to follow the instructions carefully and attach all required documentation to avoid delays or errors.

Tip 5: Keep Accurate Records

When filing the CA Form 540NR, it's essential to keep accurate records of your income, deductions, and credits. This includes:

- Keeping copies of your W-2 and 1099 forms

- Keeping records of your business expenses

- Keeping records of your charitable donations

Keeping accurate records can help you avoid errors and ensure you're taking advantage of all the credits and deductions you're eligible for.

Seeking Professional Help

If you're unsure about any part of the CA Form 540NR instructions, consider seeking professional help. This can include:

- Hiring a tax professional or accountant

- Consulting with a tax attorney

- Using tax preparation software

Seeking professional help can ensure you're taking advantage of all the credits and deductions you're eligible for and avoid errors or penalties.

Tip 6: Check for Updates and Changes

Tax laws and regulations are constantly changing, so it's essential to check for updates and changes before filing your return. This can include:

- Checking the California Franchise Tax Board (FTB) website for updates

- Signing up for FTB newsletters and alerts

- Following tax professionals and accountants on social media

Staying up-to-date on changes and updates can help you avoid errors and ensure you're taking advantage of all the credits and deductions you're eligible for.

Conclusion

Filing the CA Form 540NR can be a complex and daunting task, but by following these seven essential tips, you can ensure a smooth and accurate filing process. Remember to determine your residency status, gather required documents, complete the form in its entirety, understand California tax credits, calculate your tax owed, amend your return if necessary, keep accurate records, and seek professional help if needed.

By following these tips, you can ensure you're taking advantage of all the credits and deductions you're eligible for and avoid errors or penalties.

Engage with us!

Have you filed the CA Form 540NR before? What challenges did you face, and how did you overcome them? Share your experiences and tips in the comments below!

FAQ Section

What is the CA Form 540NR?

+The CA Form 540NR is a tax form used by non-residents who have earned income in California. It's used to report this income and calculate the tax owed to the state.

Who needs to file the CA Form 540NR?

+Non-residents who have earned income in California need to file the CA Form 540NR. This includes individuals who have worked in California, earned rental income, or have other sources of income in the state.

What are the benefits of filing the CA Form 540NR?

+Filing the CA Form 540NR allows non-residents to report their income earned in California and claim credits and deductions they're eligible for. This can help reduce their tax liability and avoid penalties or errors.