Every business, regardless of its size or industry, faces the risk of potential lawsuits and financial losses. Business liability coverage is an essential type of insurance that protects companies from the financial consequences of such risks. The Business Liability Coverage Form SS0008 is a standardized insurance form used by many insurance companies to provide liability coverage to businesses. In this article, we will delve into the details of the Business Liability Coverage Form SS0008 and explain what it covers, its key features, and how it can benefit your business.

Understanding Business Liability Coverage

Business liability coverage is designed to protect businesses from the financial consequences of lawsuits and other claims that may arise from their operations. This type of insurance coverage can help pay for damages, settlements, and defense costs in the event of a lawsuit. Without business liability coverage, a company may be forced to pay these costs out of pocket, which can be financially devastating.

Key Features of the Business Liability Coverage Form SS0008

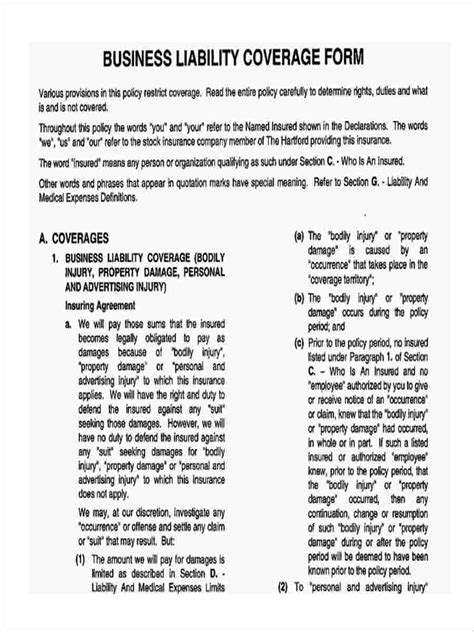

The Business Liability Coverage Form SS0008 is a comprehensive insurance form that provides a wide range of liability coverage options for businesses. Some of the key features of this form include:

- General Liability Coverage: This type of coverage protects businesses from general liability claims, such as slips and falls, product liability, and other accidents that may occur on or off the business premises.

- Professional Liability Coverage: This type of coverage protects businesses from professional liability claims, such as negligence, errors, and omissions.

- Employment Practices Liability Coverage: This type of coverage protects businesses from employment-related claims, such as wrongful termination, discrimination, and harassment.

- Umbrella Liability Coverage: This type of coverage provides additional liability coverage above and beyond the limits of the primary liability coverage.

What Does the Business Liability Coverage Form SS0008 Cover?

The Business Liability Coverage Form SS0008 provides a wide range of liability coverage options for businesses. Some of the specific types of claims that are covered under this form include:

- Bodily Injury Claims: Claims arising from bodily injury or death to a third party.

- Property Damage Claims: Claims arising from damage to a third party's property.

- Personal Injury Claims: Claims arising from personal injury, such as defamation, slander, and libel.

- Advertising Injury Claims: Claims arising from advertising injuries, such as copyright infringement and misappropriation of advertising ideas.

How Does the Business Liability Coverage Form SS0008 Work?

The Business Liability Coverage Form SS0008 works by providing liability coverage to businesses in the event of a lawsuit or other claim. Here's how it works:

- Policy Period: The policy period is the length of time during which the insurance coverage is in effect.

- Coverage Limits: The coverage limits are the maximum amount of liability coverage provided by the insurance policy.

- Deductible: The deductible is the amount of money that the business must pay out of pocket before the insurance coverage kicks in.

- Premium: The premium is the amount of money that the business must pay to purchase the insurance coverage.

Benefits of the Business Liability Coverage Form SS0008

The Business Liability Coverage Form SS0008 provides a wide range of benefits to businesses, including:

- Financial Protection: This type of insurance coverage provides financial protection to businesses in the event of a lawsuit or other claim.

- Risk Management: This type of insurance coverage helps businesses to manage their risk and avoid costly lawsuits.

- Peace of Mind: This type of insurance coverage provides peace of mind to business owners, knowing that they are protected in the event of a lawsuit or other claim.

Who Needs Business Liability Coverage Form SS0008?

Business liability coverage is essential for all businesses, regardless of their size or industry. Some of the businesses that may need business liability coverage include:

- Small Businesses: Small businesses may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

- Medium-Sized Businesses: Medium-sized businesses may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

- Large Businesses: Large businesses may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

- Startups: Startups may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

Frequently Asked Questions

Here are some frequently asked questions about the Business Liability Coverage Form SS0008:

What is the Business Liability Coverage Form SS0008?

The Business Liability Coverage Form SS0008 is a standardized insurance form used by many insurance companies to provide liability coverage to businesses.

What does the Business Liability Coverage Form SS0008 cover?

The Business Liability Coverage Form SS0008 provides a wide range of liability coverage options for businesses, including general liability coverage, professional liability coverage, employment practices liability coverage, and umbrella liability coverage.

Who needs Business Liability Coverage Form SS0008?

All businesses, regardless of their size or industry, may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

What is the purpose of the Business Liability Coverage Form SS0008?

+The purpose of the Business Liability Coverage Form SS0008 is to provide liability coverage to businesses in the event of a lawsuit or other claim.

What types of businesses need Business Liability Coverage Form SS0008?

+All businesses, regardless of their size or industry, may need business liability coverage to protect themselves from the financial consequences of a lawsuit or other claim.

How does the Business Liability Coverage Form SS0008 work?

+The Business Liability Coverage Form SS0008 works by providing liability coverage to businesses in the event of a lawsuit or other claim. The policy period, coverage limits, deductible, and premium all play a role in how the insurance coverage works.

Conclusion

In conclusion, the Business Liability Coverage Form SS0008 is an essential type of insurance coverage for businesses. It provides financial protection, risk management, and peace of mind to business owners. By understanding the key features and benefits of this insurance form, businesses can make informed decisions about their liability coverage needs.