California's tax regulations can be complex, and one crucial document for employees and employers alike is the California DE 4 Form, also known as the Employees Withholding Allowance Certificate. This form is essential for accurately calculating state income tax withholdings from an employee's wages. In this article, we will delve into the world of the California DE 4 Form, explaining its importance, benefits, and providing a step-by-step guide on how to fill it out.

Understanding the California DE 4 Form

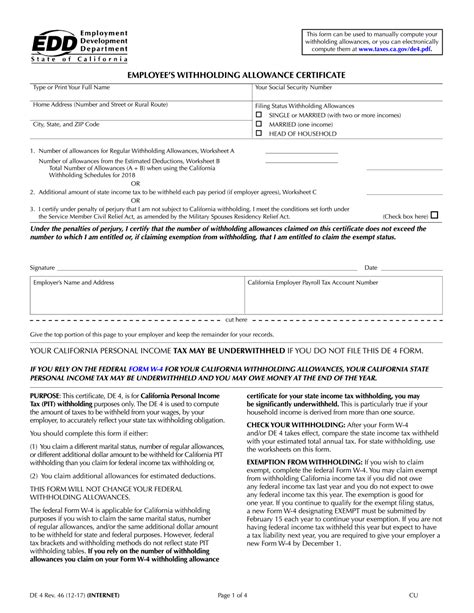

The California DE 4 Form is a document that new employees must complete and submit to their employer. The primary purpose of this form is to determine the correct amount of state income tax to withhold from an employee's wages. The form is used to calculate the employee's withholding allowance, which affects the amount of taxes withheld.

Why is the California DE 4 Form Important?

The California DE 4 Form is crucial for both employees and employers. For employees, it ensures that the correct amount of state income tax is withheld from their wages, avoiding any potential tax liabilities or penalties. For employers, it helps them comply with California's tax regulations and avoid any fines or penalties associated with incorrect tax withholdings.

Benefits of the California DE 4 Form

The California DE 4 Form offers several benefits to both employees and employers. Some of the key benefits include:

- Accurate tax withholdings: The form ensures that the correct amount of state income tax is withheld from an employee's wages, reducing the risk of tax liabilities or penalties.

- Compliance with tax regulations: The form helps employers comply with California's tax regulations, avoiding any fines or penalties associated with incorrect tax withholdings.

- Reduced administrative burden: The form simplifies the process of calculating state income tax withholdings, reducing the administrative burden on employers.

How to Fill Out the California DE 4 Form

Filling out the California DE 4 Form is a relatively straightforward process. Here's a step-by-step guide to help you complete the form:

- Employee Information: The first section of the form requires employees to provide their personal information, including their name, address, and Social Security number.

- Withholding Allowance: The next section requires employees to claim their withholding allowance. The allowance is based on the number of allowances the employee is eligible for, which includes themselves, their spouse, and any dependents.

- Additional Withholding: Employees can also request additional withholding, which can be useful if they have other sources of income or want to minimize their tax liability.

- Certification: The final section requires employees to certify that the information provided is accurate and complete.

Common Mistakes to Avoid

When filling out the California DE 4 Form, there are several common mistakes to avoid. Some of the most common mistakes include:

- Inaccurate information: Providing inaccurate information can lead to incorrect tax withholdings, which can result in tax liabilities or penalties.

- Incorrect withholding allowance: Claiming too many or too few allowances can affect the amount of taxes withheld, leading to tax liabilities or penalties.

- Failure to certify: Failing to certify the information provided can render the form invalid, requiring the employee to complete a new form.

Tips for Employers

As an employer, it's essential to ensure that your employees complete the California DE 4 Form accurately and submit it to you in a timely manner. Here are some tips to help you manage the process:

- Provide clear instructions: Provide your employees with clear instructions on how to complete the form and what information is required.

- Verify information: Verify the information provided by your employees to ensure accuracy and completeness.

- Maintain records: Maintain accurate records of the forms completed by your employees, including the date submitted and any changes made.

FAQs

Here are some frequently asked questions about the California DE 4 Form:

- What is the purpose of the California DE 4 Form?: The primary purpose of the form is to determine the correct amount of state income tax to withhold from an employee's wages.

- Who needs to complete the California DE 4 Form?: All new employees in California must complete the form and submit it to their employer.

- How often do I need to update the California DE 4 Form?: Employees should update the form whenever their withholding allowance changes, such as when they get married, have children, or change their address.

What happens if I don't complete the California DE 4 Form?

+If you don't complete the California DE 4 Form, your employer may be required to withhold state income tax at the highest rate, which could result in a larger tax liability for you.

Can I claim more than 10 allowances on the California DE 4 Form?

+No, you cannot claim more than 10 allowances on the California DE 4 Form. If you need to claim more allowances, you may need to complete a separate form or provide additional documentation.

How do I submit the California DE 4 Form to my employer?

+You should submit the completed California DE 4 Form to your employer's payroll or HR department. Your employer may also provide an online portal or email address for submitting the form.

In conclusion, the California DE 4 Form is an essential document for employees and employers in California. By understanding the form's purpose, benefits, and how to fill it out, you can ensure accurate tax withholdings and compliance with California's tax regulations. If you have any questions or concerns, don't hesitate to reach out to your employer or a tax professional for guidance.