As a member of the United Services Automobile Association (USAA), you have access to a range of financial products and services designed to support your unique needs. One of these tools is the USAA Power of Attorney Form, which allows you to appoint someone to manage your financial affairs on your behalf. In this article, we'll explore seven ways to use the USAA Power of Attorney Form and how it can benefit you.

Understanding the USAA Power of Attorney Form

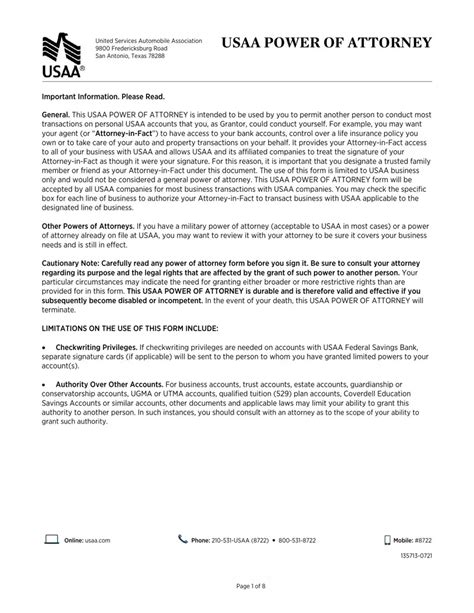

Before we dive into the ways to use the USAA Power of Attorney Form, it's essential to understand what it is and how it works. A power of attorney (POA) is a legal document that grants someone, known as the agent or attorney-in-fact, the authority to manage your financial affairs. This can include tasks such as paying bills, managing investments, and making financial decisions.

The USAA Power of Attorney Form is a specific type of POA designed for USAA members. It allows you to appoint an agent to manage your USAA accounts, including bank accounts, investments, and insurance policies.

1. Planning for Incapacity

One of the primary uses of the USAA Power of Attorney Form is to plan for potential incapacity. If you become unable to manage your financial affairs due to illness, injury, or cognitive decline, your agent can step in and take care of things for you. This ensures that your bills are paid, your investments are managed, and your financial well-being is protected.

For example, if you're serving overseas or deployed in a remote area, you may not have access to your financial accounts. By appointing an agent using the USAA Power of Attorney Form, you can ensure that your financial affairs are managed while you're away.

Benefits of Planning for Incapacity

Planning for incapacity using the USAA Power of Attorney Form provides several benefits, including:

- Peace of mind: Knowing that your financial affairs are in good hands can give you peace of mind, even if you're unable to manage them yourself.

- Protection of assets: Your agent can help protect your assets and ensure that they're used for your benefit.

- Reduced financial stress: By appointing an agent, you can reduce financial stress on your loved ones and avoid costly court proceedings.

2. Managing Multiple Accounts

If you have multiple USAA accounts, managing them can be complex and time-consuming. The USAA Power of Attorney Form allows you to appoint an agent to manage these accounts on your behalf, making it easier to keep track of your finances.

For instance, if you have multiple bank accounts, investments, and insurance policies with USAA, your agent can help you manage them all in one place. This can help you stay organized, reduce paperwork, and avoid missed payments or late fees.

3. Assisting with Financial Decisions

The USAA Power of Attorney Form can also be used to appoint an agent to assist with financial decisions. If you're unsure about a particular financial decision or need help navigating a complex financial situation, your agent can provide guidance and support.

For example, if you're considering investing in a new asset or making a major purchase, your agent can help you weigh the pros and cons and make an informed decision.

Benefits of Assisting with Financial Decisions

Assisting with financial decisions using the USAA Power of Attorney Form provides several benefits, including:

- Expert guidance: Your agent can provide expert guidance and support to help you make informed financial decisions.

- Reduced financial stress: By having someone to turn to for advice, you can reduce financial stress and make more confident decisions.

- Protection of assets: Your agent can help protect your assets and ensure that they're used for your benefit.

4. Facilitating Estate Planning

The USAA Power of Attorney Form can also be used to facilitate estate planning. By appointing an agent, you can ensure that your financial affairs are managed according to your wishes, even after you pass away.

For instance, if you have a will or trust, your agent can help ensure that your assets are distributed according to your wishes. This can help avoid costly court proceedings and ensure that your loved ones are taken care of.

5. Supporting Military Members

The USAA Power of Attorney Form is particularly useful for military members who may be deployed or serving overseas. By appointing an agent, military members can ensure that their financial affairs are managed while they're away.

For example, if you're deployed in a remote area, your agent can help manage your finances, pay bills, and make financial decisions on your behalf.

Benefits of Supporting Military Members

Supporting military members using the USAA Power of Attorney Form provides several benefits, including:

- Peace of mind: Military members can have peace of mind knowing that their financial affairs are in good hands.

- Reduced financial stress: By appointing an agent, military members can reduce financial stress and focus on their military duties.

- Protection of assets: Your agent can help protect your assets and ensure that they're used for your benefit.

6. Managing Business Finances

If you're a business owner, the USAA Power of Attorney Form can be used to manage your business finances. By appointing an agent, you can ensure that your business financial affairs are managed while you're away or unable to manage them yourself.

For instance, if you have a small business or side hustle, your agent can help manage your business finances, pay bills, and make financial decisions on your behalf.

7. Providing Emergency Support

Finally, the USAA Power of Attorney Form can be used to provide emergency support in case of unexpected events or emergencies. By appointing an agent, you can ensure that your financial affairs are managed while you're dealing with an emergency.

For example, if you're involved in an accident or experience a medical emergency, your agent can help manage your finances, pay bills, and make financial decisions on your behalf.

Benefits of Providing Emergency Support

Providing emergency support using the USAA Power of Attorney Form provides several benefits, including:

- Peace of mind: Knowing that your financial affairs are in good hands can give you peace of mind during an emergency.

- Reduced financial stress: By appointing an agent, you can reduce financial stress and focus on your emergency.

- Protection of assets: Your agent can help protect your assets and ensure that they're used for your benefit.

What is the USAA Power of Attorney Form?

+The USAA Power of Attorney Form is a legal document that grants someone the authority to manage your financial affairs on your behalf.

How do I appoint an agent using the USAA Power of Attorney Form?

+To appoint an agent, you'll need to complete the USAA Power of Attorney Form and sign it in the presence of a notary public.

What are the benefits of using the USAA Power of Attorney Form?

+The benefits of using the USAA Power of Attorney Form include peace of mind, reduced financial stress, and protection of assets.

In conclusion, the USAA Power of Attorney Form is a valuable tool that can be used in a variety of situations. By appointing an agent, you can ensure that your financial affairs are managed while you're away, unable to manage them yourself, or dealing with an emergency. Whether you're a military member, business owner, or simply looking to plan for the future, the USAA Power of Attorney Form can provide peace of mind and protection of assets.

We encourage you to share your experiences or ask questions about the USAA Power of Attorney Form in the comments below.