The world of financial documentation can be overwhelming, especially when dealing with complex forms and regulations. One such form that has garnered significant attention in recent years is the FS Form 1455. If you're an individual or business dealing with financial transactions, understanding the intricacies of this form is crucial. In this article, we'll delve into the details and purpose of the FS Form 1455, ensuring you're well-equipped to navigate its requirements.

As we explore the FS Form 1455, it's essential to acknowledge the significance of financial reporting in today's economy. With the increasing complexity of financial transactions, regulatory bodies have implemented various forms to ensure transparency and accountability. The FS Form 1455 is one such document that plays a vital role in facilitating smooth financial operations.

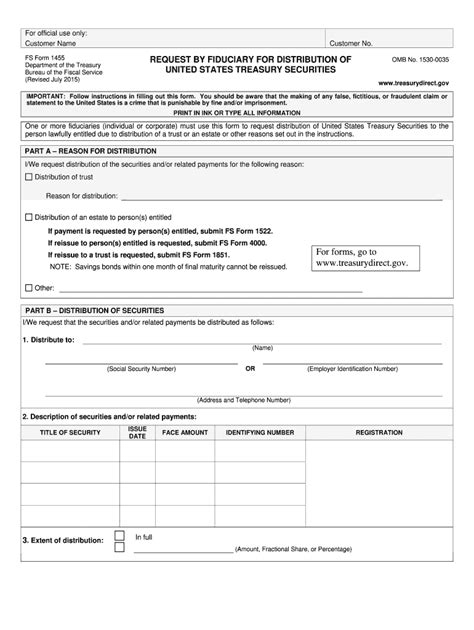

What is the FS Form 1455?

The FS Form 1455 is a standardized document used to report specific financial transactions to the relevant authorities. It's designed to capture critical information about transactions that involve multiple parties, facilitating the tracking and monitoring of financial activities. By providing a standardized format for reporting, the FS Form 1455 helps regulatory bodies to identify potential risks and ensure compliance with existing laws and regulations.

Purpose of the FS Form 1455

Key Objectives

The primary purpose of the FS Form 1455 is to provide a comprehensive framework for reporting financial transactions. The form serves several key objectives:

- Enhanced Transparency: By requiring detailed information about financial transactions, the FS Form 1455 promotes transparency and accountability in the financial sector.

- Risk Assessment: The form helps regulatory bodies to identify potential risks associated with financial transactions, enabling them to take proactive measures to mitigate these risks.

- Compliance Monitoring: The FS Form 1455 facilitates the monitoring of compliance with existing laws and regulations, ensuring that financial institutions and individuals adhere to established standards.

Who Needs to File the FS Form 1455?

Eligible Entities

The FS Form 1455 is typically required for financial institutions, businesses, and individuals engaged in specific types of transactions. The following entities may need to file the FS Form 1455:

- Financial Institutions: Banks, credit unions, and other financial institutions that facilitate transactions on behalf of their clients.

- Businesses: Companies engaged in international trade, e-commerce, or other financial activities that involve multiple parties.

- Individuals: Individuals who engage in significant financial transactions, such as those involving large sums of money or multiple currencies.

How to Complete the FS Form 1455

Step-by-Step Guide

Completing the FS Form 1455 requires careful attention to detail and a thorough understanding of the form's requirements. Here's a step-by-step guide to help you navigate the process:

- Gather Required Information: Collect all necessary documents and information, including transaction details, party information, and relevant dates.

- Fill Out the Form: Complete the FS Form 1455, ensuring that all fields are accurately filled out and that the form is signed and dated.

- Submit the Form: Submit the completed form to the relevant authorities, either electronically or in paper format, depending on the specified requirements.

Common Challenges and Solutions

Overcoming Obstacles

While completing the FS Form 1455 can be a straightforward process, challenges may arise. Here are some common issues and their corresponding solutions:

- Incomplete or Inaccurate Information: Ensure that all required fields are completed accurately and that supporting documentation is available.

- Difficulty with Form Submission: Verify the submission requirements and deadlines to avoid delays or penalties.

Best Practices for FS Form 1455 Compliance

Ensuring Smooth Reporting

To ensure seamless compliance with the FS Form 1455, consider the following best practices:

- Establish a Reporting System: Implement a system for tracking and reporting financial transactions to simplify the process.

- Provide Ongoing Training: Educate staff on the requirements and procedures for completing the FS Form 1455.

- Maintain Accurate Records: Keep detailed records of all financial transactions to facilitate easy reporting.

Frequently Asked Questions

What is the purpose of the FS Form 1455?

+The FS Form 1455 is used to report specific financial transactions to regulatory authorities, promoting transparency and accountability in the financial sector.

Who needs to file the FS Form 1455?

+Financial institutions, businesses, and individuals engaged in specific types of transactions may need to file the FS Form 1455.

How do I complete the FS Form 1455?

+To complete the FS Form 1455, gather required information, fill out the form accurately, and submit it to the relevant authorities.

By understanding the details and purpose of the FS Form 1455, you'll be better equipped to navigate the complexities of financial reporting. Stay up-to-date with the latest regulations and best practices to ensure seamless compliance and avoid potential pitfalls.