Muskegon City Tax Form: A Guide to Download and Filing Instructions

Paying taxes is a civic duty, and for residents of Muskegon, Michigan, understanding the city tax form is essential. The Muskegon city tax form is a crucial document that helps the city government collect taxes from its residents, which are then used to fund public services and infrastructure. In this article, we will provide a comprehensive guide on how to download and file the Muskegon city tax form.

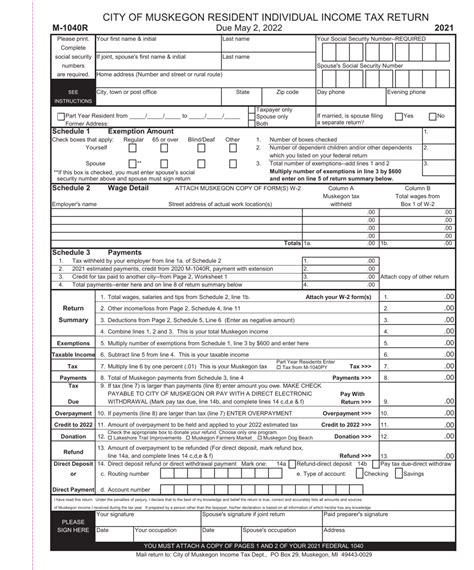

Understanding the Muskegon City Tax Form

The Muskegon city tax form is a document that requires residents to report their income and pay taxes on it. The form is typically due on April 30th of each year, and it's essential to file it on time to avoid penalties and fines. The city tax form is used to calculate the taxes owed by residents, and it's based on the income earned during the previous tax year.

Who Needs to File the Muskegon City Tax Form?

Not everyone is required to file the Muskegon city tax form. However, if you're a resident of Muskegon and have income from any of the following sources, you're likely required to file:

- Employment income

- Self-employment income

- Rental income

- Interest income

- Dividend income

If you're unsure whether you need to file the Muskegon city tax form, it's best to consult with a tax professional or contact the city's tax department.

What Information Do I Need to File the Muskegon City Tax Form?

To file the Muskegon city tax form, you'll need to provide the following information:

- Your name and address

- Your social security number or individual taxpayer identification number (ITIN)

- Your income from all sources

- Your deductions and exemptions

- Your tax credits

You may also need to provide additional information, such as your employer's name and address, if you're employed.

How to Download the Muskegon City Tax Form

The Muskegon city tax form can be downloaded from the city's official website. Here's how:

- Visit the city's website at .

- Click on the "Taxes" tab at the top of the page.

- Select "City Tax Form" from the drop-down menu.

- Choose the correct tax year and form type (individual or business).

- Click on the "Download" button to save the form to your computer.

Filing Instructions for the Muskegon City Tax Form

Once you've downloaded the Muskegon city tax form, follow these steps to file it:

- Complete the form accurately and thoroughly.

- Sign and date the form.

- Attach any required documentation, such as W-2 forms or 1099 forms.

- Mail the form to the city's tax department at the address listed on the form.

It's essential to file the Muskegon city tax form on time to avoid penalties and fines. If you're unsure about any aspect of the filing process, consider consulting with a tax professional.

What Happens if I Don't File the Muskegon City Tax Form?

If you don't file the Muskegon city tax form, you may be subject to penalties and fines. The city may also assess additional taxes and interest on any unpaid tax liability.

To avoid these consequences, make sure to file the Muskegon city tax form on time and accurately.

Additional Resources for Filing the Muskegon City Tax Form

If you need help with filing the Muskegon city tax form, consider the following resources:

- The city's tax department:

- A tax professional: Consider hiring a tax professional to help you with the filing process.

- Tax preparation software: Utilize tax preparation software, such as TurboTax or H&R Block, to help you complete and file the Muskegon city tax form.

Filing the Muskegon city tax form is a crucial step in fulfilling your civic duty. By understanding the form and following the filing instructions, you can avoid penalties and fines and ensure that you're in compliance with the city's tax laws.

FAQ Section

What is the deadline for filing the Muskegon city tax form?

+The deadline for filing the Muskegon city tax form is April 30th of each year.

Can I file the Muskegon city tax form electronically?

+Yes, you can file the Muskegon city tax form electronically through the city's website.

What happens if I don't file the Muskegon city tax form on time?

+If you don't file the Muskegon city tax form on time, you may be subject to penalties and fines.