Filing tax returns can be a daunting task, and sometimes, individuals and businesses need more time to complete the process. This is where tax extensions come into play. If you're a Missouri resident or business owner, you're likely aware of the importance of meeting tax deadlines. However, if you're facing challenges in filing your taxes on time, you can file a Missouri tax extension to avoid penalties and late fees. In this article, we'll walk you through the process of filing a Missouri tax extension form with ease.

The Importance of Filing Tax Extensions

Filing tax extensions is a common practice, and it's essential to understand the benefits of doing so. By filing a tax extension, you can avoid late-filing penalties, which can add up quickly. In Missouri, the penalty for late filing is 5% of the unpaid tax liability per month, up to 25%. By filing an extension, you can also avoid late-payment penalties, which can be up to 17% of the unpaid tax liability. Furthermore, filing an extension gives you more time to gather all the necessary documents and information, reducing the likelihood of errors and audits.

Who Can File a Missouri Tax Extension?

Any individual or business required to file a Missouri tax return can file a tax extension. This includes:

- Individual taxpayers (Form MO-1040)

- Business taxpayers (Form MO-1120)

- Partnership taxpayers (Form MO-1065)

- Fiduciary taxpayers (Form MO-1041)

How to File a Missouri Tax Extension Form

Filing a Missouri tax extension form is a relatively straightforward process. You can file an extension online or by mail.

Online Filing

You can file a Missouri tax extension online through the Missouri Department of Revenue's website. To do so, follow these steps:

- Visit the Missouri Department of Revenue's website at .

- Click on the "File" tab and select "Individual" or "Business" depending on your tax type.

- Choose the correct tax year and form type (MO-1040, MO-1120, etc.).

- Click on the "File an Extension" button.

- Follow the prompts to complete the extension application.

Mail Filing

You can also file a Missouri tax extension by mail. To do so, follow these steps:

- Complete Form MO-60, Application for Extension of Time to File (Individual) or Form MO-1120EXT, Application for Extension of Time to File (Business).

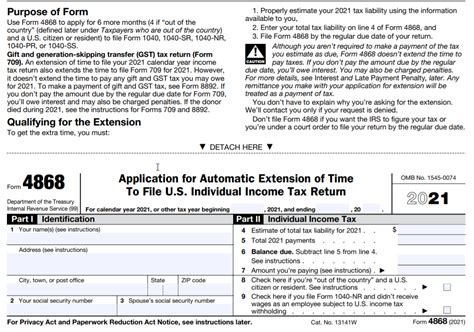

- Attach a copy of your federal extension (Form 4868 or Form 7004) if you've already filed one.

- Mail the completed form to the Missouri Department of Revenue at the address listed on the form.

What You Need to File a Missouri Tax Extension

To file a Missouri tax extension, you'll need to provide some basic information, including:

- Your name and address

- Your Social Security number or Employer Identification Number (EIN)

- Your tax year and form type

- An estimate of your tax liability (if applicable)

You may also need to provide additional documentation, such as:

- A copy of your federal extension (if applicable)

- A statement explaining why you need an extension

Missouri Tax Extension Deadlines

The deadline to file a Missouri tax extension is the same as the federal tax filing deadline. For individual taxpayers, this is typically April 15th. For business taxpayers, this is typically March 15th or April 15th, depending on the type of business.

Common Mistakes to Avoid When Filing a Missouri Tax Extension

When filing a Missouri tax extension, it's essential to avoid common mistakes that can delay or reject your application. Some common mistakes to avoid include:

- Failing to provide required documentation

- Entering incorrect information

- Failing to sign the application

- Failing to pay estimated tax liability (if applicable)

Conclusion

Filing a Missouri tax extension can provide you with the extra time you need to complete your tax return. By understanding the process and requirements, you can avoid penalties and late fees. Remember to file your extension on time and provide all required documentation to ensure a smooth process.

If you have any questions or concerns about filing a Missouri tax extension, leave a comment below. Share this article with others who may benefit from this information.

What is the deadline to file a Missouri tax extension?

+The deadline to file a Missouri tax extension is the same as the federal tax filing deadline. For individual taxpayers, this is typically April 15th. For business taxpayers, this is typically March 15th or April 15th, depending on the type of business.

Can I file a Missouri tax extension online?

+Yes, you can file a Missouri tax extension online through the Missouri Department of Revenue's website.

What information do I need to provide when filing a Missouri tax extension?

+You'll need to provide your name and address, Social Security number or Employer Identification Number (EIN), tax year and form type, and an estimate of your tax liability (if applicable).