Filing tax forms can be a daunting task, especially for those who are new to the process. The Wisconsin Form 1, also known as the Wisconsin Individual Income Tax Return, is a crucial document for Wisconsin residents who need to report their income and claim deductions and credits. In this article, we will provide a step-by-step guide on how to fill out the Wi Form 1 instructions, making the filing process less overwhelming.

Whether you're a seasoned taxpayer or a newcomer to the world of tax filing, understanding the Wi Form 1 instructions is essential to ensure accuracy and avoid any potential delays or penalties. With the help of this guide, you'll be able to navigate the form with confidence and complete your tax return with ease.

What is Wi Form 1?

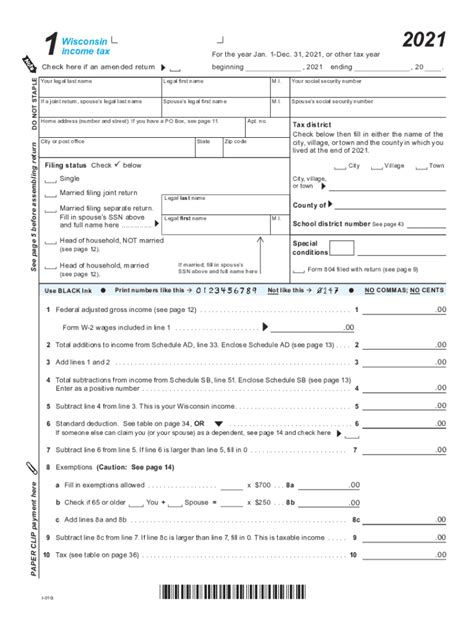

Wi Form 1 is the Wisconsin Individual Income Tax Return form, which is used to report an individual's income, deductions, and credits for the tax year. The form is similar to the federal Form 1040, but it has some unique features and requirements specific to Wisconsin state taxes.

Who Needs to File Wi Form 1?

Not everyone is required to file Wi Form 1. Generally, Wisconsin residents who meet the following conditions need to file the form:

- You are a Wisconsin resident and have a filing requirement (e.g., you have income that exceeds the standard deduction or you have self-employment income).

- You are a non-resident who has income sourced from Wisconsin (e.g., rental income or income from a Wisconsin business).

Step-by-Step Guide to Filing Wi Form 1

Now that we've covered the basics, let's dive into the step-by-step guide to filing Wi Form 1.

Step 1: Gather Required Documents

Before starting the filing process, make sure you have the necessary documents and information:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for self-employment income or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense records

Step 2: Determine Your Filing Status

Your filing status affects your tax rates and deductions. Choose the correct filing status:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Your Income

Report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Unemployment compensation

Step 4: Claim Deductions and Credits

Claim deductions and credits that apply to you, such as:

- Standard deduction or itemized deductions

- Mortgage interest deduction

- Charitable donations

- Education credits

- Child tax credit

Step 5: Calculate Your Tax Liability

Calculate your total tax liability by subtracting your deductions and credits from your total income.

Step 6: Complete Additional Forms and Schedules

Complete any additional forms and schedules that apply to your situation, such as:

- Schedule H for household employment taxes

- Schedule SE for self-employment taxes

- Form 2441 for child and dependent care expenses

Step 7: Sign and Date the Form

Sign and date the form, and make sure to include your Social Security number or Individual Taxpayer Identification Number (ITIN).

Electronic Filing Options

Wisconsin offers electronic filing options for Wi Form 1, which can simplify the filing process and reduce errors. You can e-file through the Wisconsin Department of Revenue's website or use tax preparation software that supports Wisconsin state tax filing.

Tax Preparation Software Options

Some popular tax preparation software options that support Wisconsin state tax filing include:

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

Common Errors to Avoid

When filing Wi Form 1, it's essential to avoid common errors that can delay or even reject your tax return. Some common errors to watch out for include:

- Inaccurate or missing Social Security numbers

- Incorrect filing status

- Missing or incorrect W-2 forms

- Incorrect math calculations

- Failure to sign and date the form

Conclusion

Filing Wi Form 1 requires attention to detail and a basic understanding of tax laws and regulations. By following this step-by-step guide, you can ensure accuracy and avoid common errors that can delay or reject your tax return. Remember to take advantage of electronic filing options and tax preparation software to simplify the filing process.

What is the deadline for filing Wi Form 1?

+The deadline for filing Wi Form 1 is typically April 15th of each year, but it may vary depending on the tax year and any extensions granted by the Wisconsin Department of Revenue.

Can I file Wi Form 1 electronically?

+Yes, Wisconsin offers electronic filing options for Wi Form 1. You can e-file through the Wisconsin Department of Revenue's website or use tax preparation software that supports Wisconsin state tax filing.

What is the penalty for late filing of Wi Form 1?

+The penalty for late filing of Wi Form 1 is typically 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Additionally, you may be subject to interest on the unpaid tax.