Completing a Uniform Disposition of Unclaimed Property Act (UD-105) form can seem like a daunting task, especially for those who are new to the process of reporting unclaimed property. However, with a clear understanding of the requirements and the necessary steps, it can be done efficiently and accurately. In this article, we will break down the process into five key steps to help you fill out a UD-105 form correctly.

Understanding the UD-105 Form

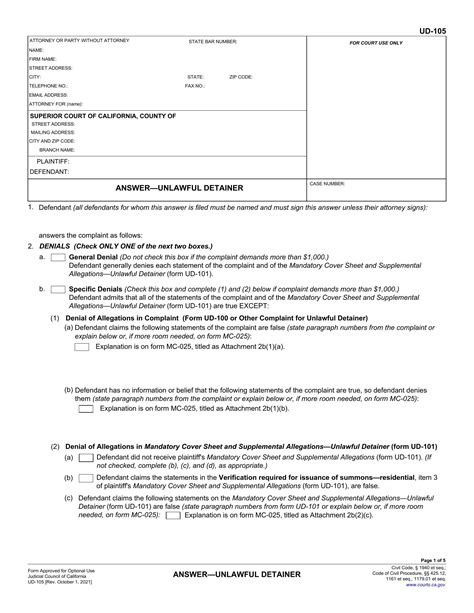

Before we dive into the steps, it's essential to understand what the UD-105 form is and its purpose. The UD-105 form is a standard document used by the National Association of Unclaimed Property Administrators (NAUPA) to report unclaimed property. It's used by businesses, organizations, and government agencies to report and remit unclaimed property to the state.

Step 1: Gather Required Information

To complete the UD-105 form correctly, you'll need to gather the required information. This includes:

- Property owner's name and address

- Property type (e.g., bank account, stock, etc.)

- Property amount

- Reporting company's name and address

- Reporting company's federal tax ID number

- State ID number (if applicable)

Make sure to have all the necessary documents and information readily available before starting the form.

Step 2: Complete the Header Section

The header section of the UD-105 form requires basic information about the reporting company. This includes:

- Reporting company's name and address

- Reporting company's federal tax ID number

- State ID number (if applicable)

- Reporting period ( calendar year or fiscal year)

Make sure to fill out this section accurately, as it will be used to identify the reporting company.

Step 3: Report Unclaimed Property

The next step is to report the unclaimed property. This section requires detailed information about the property owner and the property itself. You'll need to provide:

- Property owner's name and address

- Property type (e.g., bank account, stock, etc.)

- Property amount

- Date the property became unclaimed

You may need to report multiple properties, so make sure to use a separate line for each property.

Step 4: Calculate and Report the Aggregate Amount

The aggregate amount is the total amount of unclaimed property being reported. You'll need to calculate this amount by adding up the individual property amounts.

Make sure to report the correct aggregate amount, as it will be used to determine the total amount of unclaimed property being remitted to the state.

Step 5: Verify and Sign the Form

The final step is to verify and sign the form. Make sure to review the form carefully to ensure that all the information is accurate and complete.

Once you're satisfied that the form is complete, sign and date it. This will confirm that the information is accurate and that you're authorized to report the unclaimed property.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind:

- Make sure to use the correct form version, as it may change over time.

- Use black ink and avoid using whiteout or correction tape.

- Keep a copy of the completed form for your records.

- Submit the form and supporting documentation to the state by the deadline.

By following these steps and tips, you'll be able to fill out a UD-105 form correctly and ensure that unclaimed property is reported and remitted to the state accurately.

Conclusion and Next Steps

In conclusion, completing a UD-105 form requires attention to detail and a clear understanding of the reporting requirements. By following the steps outlined in this article, you'll be able to fill out the form correctly and ensure that unclaimed property is reported and remitted to the state accurately.

If you have any questions or concerns about the process, don't hesitate to reach out to your state's unclaimed property administrator or a qualified professional.

Share your thoughts and experiences with reporting unclaimed property in the comments below.

What is the purpose of the UD-105 form?

+The UD-105 form is used to report unclaimed property to the state.

Who needs to complete the UD-105 form?

+Businesses, organizations, and government agencies that have unclaimed property to report need to complete the UD-105 form.

What information is required to complete the UD-105 form?

+The form requires information about the property owner, property type, property amount, and the reporting company.