As a business owner in New Jersey, it's essential to understand the sales tax exemption process to avoid unnecessary taxes on qualified purchases. The NJ St-3 Form is a crucial document that helps you claim sales tax exemptions on specific transactions. In this article, we'll provide a comprehensive guide on completing the NJ St-3 Form, including its benefits, eligibility criteria, and step-by-step instructions.

Benefits of the NJ St-3 Form

The NJ St-3 Form offers numerous benefits to businesses, organizations, and individuals in New Jersey. Some of the advantages of completing this form include:

- Exemption from sales tax on qualified purchases

- Reduced tax liability for businesses and organizations

- Increased cash flow for businesses and organizations

- Simplified tax compliance process

Eligibility Criteria for the NJ St-3 Form

To be eligible for sales tax exemption, the purchaser must meet specific criteria, including:

- The purchaser must be a registered business or organization in New Jersey

- The purchaser must have a valid New Jersey tax identification number

- The purchase must be for a qualified exemption, such as a resale or a purchase for a tax-exempt organization

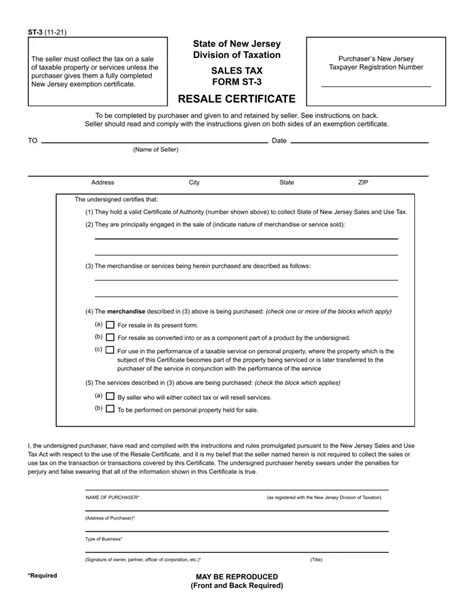

Step-by-Step Guide to Completing the NJ St-3 Form

Completing the NJ St-3 Form requires careful attention to detail and accurate information. Here's a step-by-step guide to help you complete the form:

- Obtain the NJ St-3 Form: You can download the NJ St-3 Form from the New Jersey Division of Taxation website or obtain it from a tax professional.

- Fill in the Purchaser's Information: Enter the purchaser's name, address, and New Jersey tax identification number.

- Specify the Exemption Type: Indicate the type of exemption claimed, such as resale or tax-exempt organization.

- Provide the Seller's Information: Enter the seller's name, address, and New Jersey tax identification number.

- List the Purchased Items: Describe the items purchased, including the quantity and price.

- Sign and Date the Form: Sign and date the form to certify that the information provided is accurate.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the NJ St-3 Form:

What is the NJ St-3 Form used for?

The NJ St-3 Form is used to claim sales tax exemptions on qualified purchases in New Jersey.

Who is eligible for sales tax exemption?

To be eligible for sales tax exemption, the purchaser must be a registered business or organization in New Jersey with a valid New Jersey tax identification number.

How do I obtain the NJ St-3 Form?

You can download the NJ St-3 Form from the New Jersey Division of Taxation website or obtain it from a tax professional.

What information do I need to provide on the NJ St-3 Form?

You need to provide the purchaser's information, exemption type, seller's information, purchased items, and signature.

What is the deadline for submitting the NJ St-3 Form?

+The deadline for submitting the NJ St-3 Form varies depending on the specific exemption claimed. It's best to consult with a tax professional or the New Jersey Division of Taxation for specific guidance.

Can I file the NJ St-3 Form electronically?

+Yes, you can file the NJ St-3 Form electronically through the New Jersey Division of Taxation's online portal.

What are the penalties for not filing the NJ St-3 Form?

+The penalties for not filing the NJ St-3 Form vary depending on the specific circumstances. Failure to file the form may result in fines, interest, and other penalties. It's best to consult with a tax professional or the New Jersey Division of Taxation for specific guidance.

Conclusion

The NJ St-3 Form is an essential document for businesses, organizations, and individuals in New Jersey to claim sales tax exemptions on qualified purchases. By following the step-by-step guide outlined in this article, you can ensure accurate completion of the form and avoid unnecessary taxes. Remember to consult with a tax professional or the New Jersey Division of Taxation for specific guidance on completing the NJ St-3 Form.

Don't forget to share your thoughts on this article in the comments section below!