Understanding and navigating tax forms can be a daunting task for many individuals. The complexity of tax laws and regulations can lead to confusion and frustration, especially during tax season. However, with the right guidance and resources, anyone can master the art of tax form completion. In this article, we will delve into the world of tax form expert crossword solutions and provide valuable tips for those seeking to improve their tax form skills.

Benefits of Mastering Tax Form Expertise

Mastering tax form expertise can bring numerous benefits, including:

- Reduced stress and anxiety during tax season

- Increased accuracy and efficiency in tax form completion

- Enhanced understanding of tax laws and regulations

- Improved financial management and planning

- Potential cost savings through optimized tax deductions and credits

Common Tax Forms and Their Purpose

To become a tax form expert, it's essential to familiarize yourself with the most common tax forms, including:

- Form 1040: Individual Income Tax Return

- Form W-2: Wage and Tax Statement

- Form 1099: Miscellaneous Income

- Form 1098: Mortgage Interest Statement

- Form 5498: IRA Contribution Information

Each form serves a specific purpose, and understanding their requirements and deadlines is crucial for accurate and timely tax form completion.

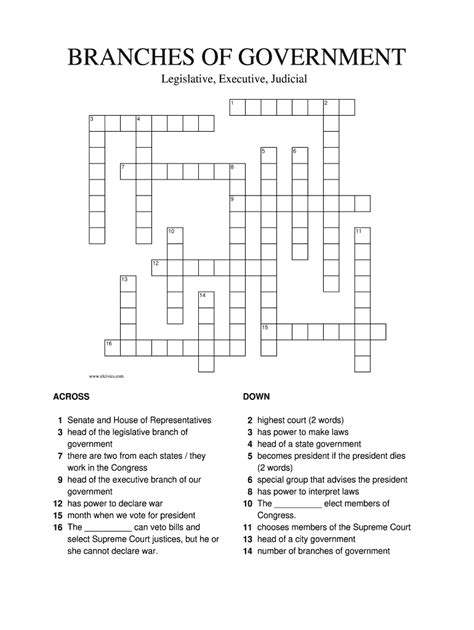

Tax Form Expert Crossword Solutions

To help you master tax form expertise, we've created a series of crossword puzzles and solutions. These puzzles cover various tax-related topics, including tax forms, deductions, credits, and laws.

- Puzzle 1: Tax Forms and Deadlines

- Across: Form 1040 deadline (April 15)

- Down: Form W-2 issuer (Employer)

- Puzzle 2: Tax Deductions and Credits

- Across: Mortgage interest deduction (Itemized)

- Down: Earned Income Tax Credit (EITC)

- Puzzle 3: Tax Laws and Regulations

- Across: Tax Cuts and Jobs Act (TCJA)

- Down: Alternative Minimum Tax (AMT)

Tips for Mastering Tax Form Expertise

To become a tax form expert, follow these valuable tips:

- Stay up-to-date with tax laws and regulations: Regularly review tax updates and changes to ensure you're aware of the latest requirements and deadlines.

- Familiarize yourself with common tax forms: Understand the purpose and requirements of each form to ensure accurate and timely completion.

- Organize your tax documents: Keep all tax-related documents, including receipts and records, organized and easily accessible.

- Seek guidance when needed: Don't hesitate to consult with a tax professional or seek online resources when faced with complex tax questions or issues.

- Practice, practice, practice: Complete sample tax forms and puzzles to improve your skills and build confidence.

Tax Form Expert Resources

To further enhance your tax form expertise, take advantage of the following resources:

- IRS Website: irs.gov

- Tax Form Instructions: irs.gov/forms-instructions

- Tax Professional Associations: AICPA.org, NATP.org

- Online Tax Communities: Reddit.com/r/tax, TaxForum.org

By following these tips and utilizing these resources, you'll be well on your way to becoming a tax form expert and mastering the art of tax form completion.

We hope you found this article informative and helpful. If you have any questions or topics you'd like to discuss, please feel free to comment below. Don't forget to share this article with friends and family who may benefit from tax form expertise.

What is the deadline for filing Form 1040?

+The deadline for filing Form 1040 is typically April 15th of each year.

What is the purpose of Form W-2?

+Form W-2 is used to report an employee's income and taxes withheld to the IRS.

What is the Alternative Minimum Tax (AMT)?

+The Alternative Minimum Tax (AMT) is a tax calculation that ensures individuals and corporations pay a minimum amount of tax.