As an employer, it is crucial to understand the importance of Form 941 Schedule B in maintaining accurate records of tax liability. This schedule is a vital component of the Employer's Quarterly Federal Tax Return (Form 941) and plays a significant role in ensuring compliance with the Internal Revenue Service (IRS) regulations.

In this article, we will delve into the world of Form 941 Schedule B, exploring its purpose, benefits, and steps to complete it accurately. We will also provide practical examples and statistical data to enhance your understanding of this critical topic.

What is Form 941 Schedule B?

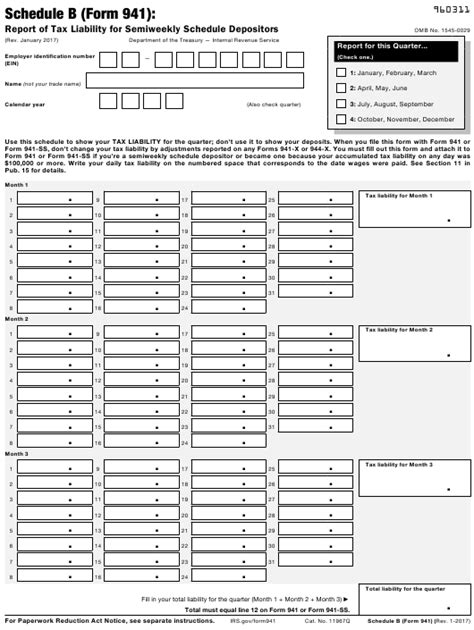

Form 941 Schedule B, also known as the "Employer's Record of Tax Liability," is a supplemental schedule to Form 941. It is used to report an employer's tax liability for each quarter, including the amount of taxes withheld from employees' wages, as well as the employer's share of payroll taxes.

The schedule is divided into three main sections:

- Section 1: Tax Liability for the Quarter

- Section 2: Summary of Quarterly Tax Liability

- Section 3: Totals for the Year

Why is Form 941 Schedule B Important?

Form 941 Schedule B is essential for several reasons:

- Accurate Tax Reporting: The schedule helps employers accurately report their tax liability for each quarter, ensuring compliance with IRS regulations.

- Tax Payment Verification: The schedule verifies the employer's tax payments, reducing the risk of errors or penalties.

- Year-End Reconciliation: The schedule facilitates year-end reconciliation, enabling employers to reconcile their quarterly tax liability with their annual tax return.

Benefits of Using Form 941 Schedule B

Using Form 941 Schedule B offers several benefits, including:

- Improved Accuracy: The schedule ensures accurate reporting of tax liability, reducing errors and penalties.

- Enhanced Compliance: The schedule facilitates compliance with IRS regulations, minimizing the risk of audits or fines.

- Streamlined Record-Keeping: The schedule provides a clear and concise record of tax liability, making it easier to manage and maintain payroll records.

Steps to Complete Form 941 Schedule B

To complete Form 941 Schedule B accurately, follow these steps:

- Gather Required Information: Collect all necessary information, including employee wages, taxes withheld, and employer payroll taxes.

- Complete Section 1: Report the tax liability for the quarter, including the amount of taxes withheld from employees' wages and the employer's share of payroll taxes.

- Complete Section 2: Summarize the quarterly tax liability, including the total tax liability and the total amount of taxes paid.

- Complete Section 3: Report the totals for the year, including the total tax liability and the total amount of taxes paid.

Practical Examples and Statistical Data

To illustrate the importance of Form 941 Schedule B, let's consider a practical example:

- Example: XYZ Corporation has 100 employees, with a total quarterly payroll of $100,000. The company withholds $15,000 in taxes from employees' wages and pays $5,000 in employer payroll taxes. Using Form 941 Schedule B, XYZ Corporation reports a total tax liability of $20,000 for the quarter.

According to the IRS, in 2020, over 6 million employers filed Form 941, with a total tax liability of over $2.5 trillion.

Common Mistakes to Avoid

When completing Form 941 Schedule B, avoid the following common mistakes:

- Inaccurate Reporting: Ensure accurate reporting of tax liability, including the amount of taxes withheld from employees' wages and the employer's share of payroll taxes.

- Late Filing: File Form 941 Schedule B on time to avoid penalties and fines.

- Inadequate Record-Keeping: Maintain accurate and complete records of tax liability, including all supporting documentation.

Best Practices for Managing Form 941 Schedule B

To manage Form 941 Schedule B effectively, follow these best practices:

- Use Payroll Software: Utilize payroll software to streamline the reporting process and reduce errors.

- Maintain Accurate Records: Keep accurate and complete records of tax liability, including all supporting documentation.

- Review and Verify: Review and verify Form 941 Schedule B for accuracy and completeness before filing.

In conclusion, Form 941 Schedule B is a critical component of the Employer's Quarterly Federal Tax Return (Form 941). By understanding its purpose, benefits, and steps to complete it accurately, employers can ensure compliance with IRS regulations, improve accuracy, and streamline record-keeping.

We invite you to share your thoughts and experiences with Form 941 Schedule B in the comments section below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the purpose of Form 941 Schedule B?

+Form 941 Schedule B is used to report an employer's tax liability for each quarter, including the amount of taxes withheld from employees' wages, as well as the employer's share of payroll taxes.

What are the benefits of using Form 941 Schedule B?

+The benefits of using Form 941 Schedule B include improved accuracy, enhanced compliance, and streamlined record-keeping.

What are the common mistakes to avoid when completing Form 941 Schedule B?

+