The North Carolina Department of Revenue requires individuals and businesses to file tax returns annually, and one of the most commonly used forms is the NC Tax Form D-400. Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. However, with the right guidance, navigating the D-400 form can be made easy and accurate. In this article, we will break down the key components of the NC Tax Form D-400, provide tips for filing, and explore the benefits of accurate tax filing.

Understanding the NC Tax Form D-400

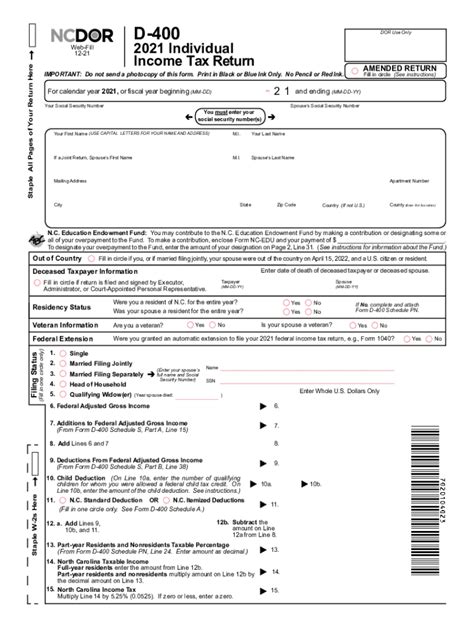

The NC Tax Form D-400 is the standard form used for individual income tax returns in North Carolina. It is used to report income, claim deductions and credits, and calculate the amount of taxes owed or refunded. The form is typically filed annually by April 15th, and it is essential to ensure accuracy to avoid penalties and interest.

Key Components of the NC Tax Form D-400

The NC Tax Form D-400 consists of several sections, including:

- Personal information: This section requires individuals to provide their name, address, and social security number.

- Income: This section requires individuals to report their income from various sources, such as wages, salaries, and investments.

- Deductions and credits: This section allows individuals to claim deductions and credits, such as the standard deduction, mortgage interest, and charitable donations.

- Tax computation: This section calculates the amount of taxes owed or refunded based on the individual's income and deductions.

Benefits of Accurate Tax Filing

Accurate tax filing is essential to avoid penalties and interest. The benefits of accurate tax filing include:

- Avoiding penalties and interest: Inaccurate tax filing can result in penalties and interest, which can add up quickly.

- Maximizing refunds: Accurate tax filing ensures that individuals receive the maximum refund they are eligible for.

- Reducing audit risk: Accurate tax filing reduces the risk of audit, which can be time-consuming and costly.

- Ensuring compliance: Accurate tax filing ensures that individuals are in compliance with tax laws and regulations.

Tips for Filing the NC Tax Form D-400

Here are some tips for filing the NC Tax Form D-400:

- Gather all necessary documents: Before starting the filing process, gather all necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Use tax software: Tax software, such as TurboTax or H&R Block, can make the filing process easier and more accurate.

- Consult a tax professional: If you have complex financial situations or are unsure about the filing process, consider consulting a tax professional.

- File electronically: Filing electronically is faster and more accurate than filing by mail.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing the NC Tax Form D-400:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including names, addresses, and social security numbers.

- Math errors: Double-check math calculations to ensure accuracy.

- Missing signatures: Ensure that all signatures are included, including the taxpayer's signature and the spouse's signature, if applicable.

- Missing schedules: Ensure that all schedules, such as Schedule A for itemized deductions, are included.

Amending the NC Tax Form D-400

If you need to make changes to your tax return after filing, you can amend the NC Tax Form D-400 using Form D-400X. Here are some reasons why you may need to amend your tax return:

- Changes in income or deductions: If you receive additional income or deductions, you may need to amend your tax return.

- Errors in math or information: If you discover errors in math or information, you may need to amend your tax return.

- Changes in filing status: If you change your filing status, such as from single to married, you may need to amend your tax return.

Conclusion: Filing the NC Tax Form D-400 Made Easy

Filing the NC Tax Form D-400 can be made easy and accurate by understanding the key components of the form, following tips for filing, and avoiding common mistakes. By taking the time to ensure accuracy and completeness, individuals can avoid penalties and interest, maximize refunds, and reduce audit risk. If you have complex financial situations or are unsure about the filing process, consider consulting a tax professional.

We invite you to share your thoughts and questions about filing the NC Tax Form D-400 in the comments section below. Additionally, if you found this article helpful, please share it with others who may benefit from the information.

What is the deadline for filing the NC Tax Form D-400?

+The deadline for filing the NC Tax Form D-400 is typically April 15th.

Can I file the NC Tax Form D-400 electronically?

+Yes, you can file the NC Tax Form D-400 electronically using tax software, such as TurboTax or H&R Block.

What happens if I make a mistake on my tax return?

+If you make a mistake on your tax return, you may be subject to penalties and interest. However, you can amend your tax return using Form D-400X.