Living and working abroad can be a thrilling experience, but it also comes with unique tax implications. As a U.S. citizen or resident alien, you may be eligible to exclude a portion of your foreign-earned income from taxation. This is where Form 2555 comes in – a crucial document for claiming the Foreign Earned Income Exclusion (FEIE). In this article, we'll delve into the world of Form 2555 instructions, explaining the benefits, requirements, and step-by-step process for claiming this valuable tax exclusion.

Understanding the Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion is a tax benefit designed to alleviate the burden of double taxation on individuals who earn income abroad. By excluding a portion of your foreign-earned income from U.S. taxation, you can avoid paying taxes on the same income in both the United States and the foreign country where you earned it. This exclusion can significantly reduce your tax liability, making it an attractive option for expats and digital nomads.

Who Qualifies for the Foreign Earned Income Exclusion?

To qualify for the FEIE, you must meet certain requirements:

- Physical presence test: You must have been physically present in a foreign country for at least 330 full days within a 12-month period.

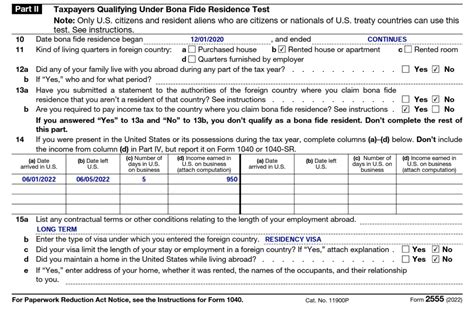

- Bona fide residence test: You must have established a bona fide residence in a foreign country, which means you must have a permanent home and be a resident of that country.

- Tax home test: Your tax home must be in a foreign country, which means you must have a regular place of business or work in that country.

Form 2555 Instructions: A Step-by-Step Guide

Now that you've determined you qualify for the FEIE, let's dive into the Form 2555 instructions:

**Section 1: Information About You**

- Enter your name, address, and Social Security number.

- If you're married, enter your spouse's name and Social Security number.

- Indicate whether you're claiming the FEIE as a self-employed individual or as an employee.

**Section 2: Foreign Earned Income**

- Report your total foreign-earned income from all sources, including wages, salaries, and self-employment income.

- Enter the amount of foreign-earned income you're excluding from taxation.

**Foreign Earned Income Categories**

- Wages and salaries

- Self-employment income

- Foreign housing expenses (see Form 2555-EZ for details)

**Section 3: Foreign Housing Expenses**

- Report your foreign housing expenses, including rent, utilities, and other expenses related to your foreign residence.

- Enter the amount of foreign housing expenses you're excluding from taxation.

**Foreign Housing Expenses Limitations**

- The amount of foreign housing expenses you can exclude is limited to 30% of the maximum foreign earned income exclusion (currently $105,900 for tax year 2022).

- You can only exclude foreign housing expenses if you're a qualified individual under the physical presence test or bona fide residence test.

**Section 4: Calculation of Exclusion**

- Calculate the total amount of foreign-earned income you're excluding from taxation.

- Enter the amount of foreign housing expenses you're excluding from taxation.

**Foreign Earned Income Exclusion Limitations**

- The maximum foreign earned income exclusion is $105,900 for tax year 2022.

- You can only exclude foreign-earned income if you're a qualified individual under the physical presence test or bona fide residence test.

Additional Tips and Reminders

- Make sure to keep accurate records of your foreign-earned income and expenses, as well as proof of your physical presence and bona fide residence in a foreign country.

- If you're self-employed, you may need to complete additional forms, such as Schedule C (Form 1040).

- Consult with a tax professional or the IRS if you're unsure about any aspect of the Form 2555 instructions.

Conclusion

Claiming the Foreign Earned Income Exclusion can be a complex process, but with the right guidance, you can navigate the Form 2555 instructions with ease. By following the steps outlined above and keeping accurate records, you can take advantage of this valuable tax benefit and reduce your tax liability. Don't hesitate to reach out to a tax professional or the IRS if you have any questions or concerns.

FAQ Section:

What is the Foreign Earned Income Exclusion?

+The Foreign Earned Income Exclusion is a tax benefit that allows U.S. citizens and resident aliens to exclude a portion of their foreign-earned income from taxation.

Who qualifies for the Foreign Earned Income Exclusion?

+To qualify for the FEIE, you must meet the physical presence test, bona fide residence test, or tax home test.

What is the maximum foreign earned income exclusion for tax year 2022?

+The maximum foreign earned income exclusion for tax year 2022 is $105,900.