Understanding the Importance of Accurate Form 8949 Submission on Robinhood

As a trader on Robinhood, it's essential to understand the significance of accurate Form 8949 submission. Form 8949 is used to report sales and other dispositions of capital assets, which includes stocks, bonds, and other securities. The form is crucial for calculating capital gains and losses, which in turn affects your tax liability. In this article, we will guide you through the process of filling out Robinhood Form 8949 correctly, highlighting the importance of accuracy and providing tips to ensure a smooth submission process.

The consequences of incorrect Form 8949 submission can be severe, including delayed refunds, penalties, and even audits. Therefore, it's vital to take the time to understand the form and its requirements. Robinhood provides a simplified way to generate Form 8949, but it's still crucial to review and verify the information to ensure accuracy.

What is Form 8949, and Why is it Important?

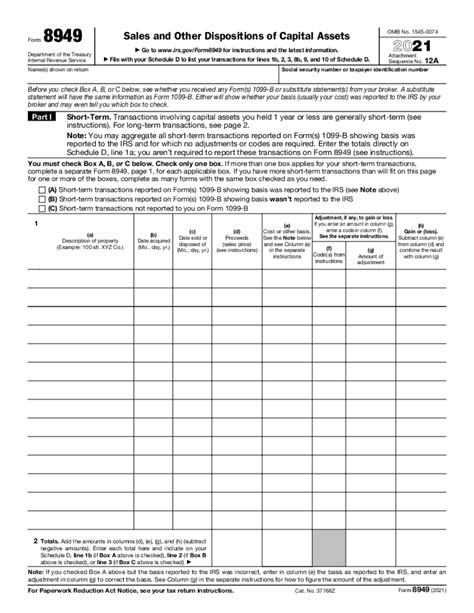

Form 8949 is a tax form used to report sales and other dispositions of capital assets. The form is used to calculate capital gains and losses, which are then reported on Schedule D (Form 1040). The form is essential for accurate tax reporting, as it helps the IRS track and verify the sale of capital assets.

The importance of Form 8949 cannot be overstated. Accurate submission of the form ensures that you report the correct capital gains and losses, which in turn affects your tax liability. Inaccurate or incomplete submission can lead to delayed refunds, penalties, and even audits.

Benefits of Accurate Form 8949 Submission

- Accurate tax reporting

- Correct capital gains and losses calculation

- Reduced risk of delayed refunds, penalties, and audits

- Simplified tax preparation process

5 Ways to Fill Out Robinhood Form 8949 Correctly

Filling out Robinhood Form 8949 correctly requires attention to detail and a thorough understanding of the form's requirements. Here are five ways to ensure accurate submission:

1. Review and Verify Your Trade History

Before generating Form 8949, review your trade history to ensure that all transactions are accurate and up-to-date. Verify the dates, quantities, and prices of each trade to ensure that the information is correct.

2. Understand the Different Parts of Form 8949

Form 8949 consists of two parts: Part I and Part II. Part I reports short-term transactions, while Part II reports long-term transactions. Understand the differences between the two parts and ensure that you report transactions correctly.

3. Use the Correct Codes and Symbols

Form 8949 requires the use of specific codes and symbols to report transactions. Use the correct codes and symbols to avoid errors and ensure accurate reporting.

4. Report Wash Sales Correctly

Wash sales occur when you sell a security at a loss and purchase a substantially identical security within 30 days. Report wash sales correctly to avoid disallowing losses.

5. Double-Check Your Math

Finally, double-check your math to ensure that your calculations are accurate. Verify that your capital gains and losses are correctly calculated and reported.

Tips for a Smooth Form 8949 Submission Process

To ensure a smooth Form 8949 submission process, follow these tips:

- Review and verify your trade history before generating the form

- Use the correct codes and symbols

- Report wash sales correctly

- Double-check your math

- Keep accurate records of your transactions

By following these tips and understanding the importance of accurate Form 8949 submission, you can ensure a smooth tax preparation process and avoid potential errors and penalties.

Conclusion

Filling out Robinhood Form 8949 correctly requires attention to detail and a thorough understanding of the form's requirements. By following the tips outlined in this article, you can ensure accurate submission and avoid potential errors and penalties. Remember to review and verify your trade history, understand the different parts of the form, use the correct codes and symbols, report wash sales correctly, and double-check your math.

If you have any questions or concerns about filling out Robinhood Form 8949, please don't hesitate to ask. We encourage you to share your experiences and tips in the comments section below.

What is Form 8949, and why is it important?

+Form 8949 is a tax form used to report sales and other dispositions of capital assets. It's essential for accurate tax reporting, as it helps the IRS track and verify the sale of capital assets.

How do I fill out Robinhood Form 8949 correctly?

+To fill out Robinhood Form 8949 correctly, review and verify your trade history, understand the different parts of the form, use the correct codes and symbols, report wash sales correctly, and double-check your math.

What are the consequences of incorrect Form 8949 submission?

+The consequences of incorrect Form 8949 submission can be severe, including delayed refunds, penalties, and even audits.