New York State requires businesses to file annual sales tax returns to report their sales tax liability. The NY State Annual Sales Tax Form ST-100 is a crucial document for businesses operating in the state. In this comprehensive guide, we will walk you through the process of filing the ST-100 form, highlighting key requirements, deadlines, and best practices.

Understanding the ST-100 Form

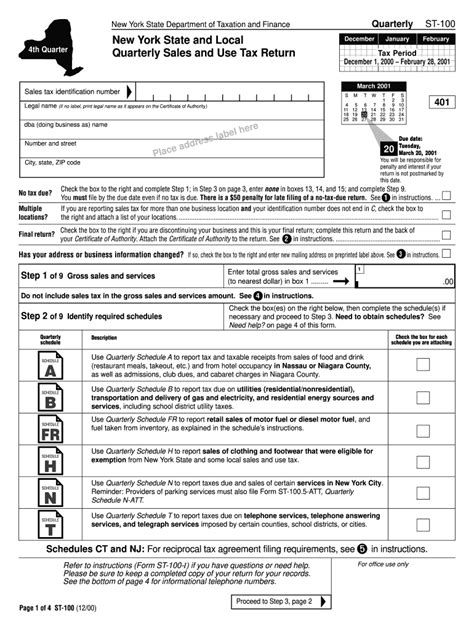

The ST-100 form is used to report the total sales tax collected by a business during the calendar year. The form requires businesses to report their sales tax liability, including the amount of tax collected, exempt sales, and any credits or deductions claimed. The ST-100 form is typically filed annually, but quarterly filings may be required for businesses with a high sales tax liability.

Who Needs to File the ST-100 Form?

Businesses operating in New York State that collect sales tax are required to file the ST-100 form. This includes:

- Retailers

- Wholesalers

- Restaurants

- Hotels

- Online marketplaces

- Other businesses that collect sales tax

Filing Requirements and Deadlines

The ST-100 form is typically filed annually, with a deadline of February 20th of each year. However, businesses with a high sales tax liability may be required to file quarterly. The quarterly filing deadlines are:

- January 20th for the 4th quarter (October 1 - December 31)

- April 20th for the 1st quarter (January 1 - March 31)

- July 20th for the 2nd quarter (April 1 - June 30)

- October 20th for the 3rd quarter (July 1 - September 30)

How to File the ST-100 Form

Businesses can file the ST-100 form electronically or by mail. Electronic filing is recommended, as it is faster and more accurate. To file electronically, businesses can use the New York State Department of Taxation and Finance's online portal, Taxpayer Access Point (TAP).

To file by mail, businesses can download the ST-100 form from the New York State Department of Taxation and Finance's website or request a copy by phone. The completed form should be mailed to:

New York State Department of Taxation and Finance Centralized Filing Unit Albany, NY 12261-0001

Penalties and Interest for Late Filing

Businesses that fail to file the ST-100 form on time may be subject to penalties and interest. The penalty for late filing is 5% of the tax due, plus interest at a rate of 14.3% per annum. Businesses that intentionally fail to file the ST-100 form may be subject to additional penalties and fines.

Amending a Previously Filed ST-100 Form

Businesses that need to amend a previously filed ST-100 form can do so by filing an amended return, Form ST-100A. The amended return should include the corrected information and an explanation of the changes made. Businesses can file the amended return electronically or by mail.

Best Practices for Filing the ST-100 Form

To ensure accurate and timely filing of the ST-100 form, businesses should follow these best practices:

- Keep accurate and detailed records of sales tax collected and remitted

- Verify the accuracy of the ST-100 form before filing

- File the ST-100 form electronically to reduce errors and improve processing time

- Keep a copy of the filed ST-100 form for record-keeping purposes

Common Errors to Avoid

Businesses should avoid the following common errors when filing the ST-100 form:

- Inaccurate or incomplete information

- Failure to report exempt sales

- Failure to claim credits or deductions

- Late filing or payment

By following these best practices and avoiding common errors, businesses can ensure accurate and timely filing of the ST-100 form and avoid penalties and interest.

Conclusion

Filing the NY State Annual Sales Tax Form ST-100 is a critical requirement for businesses operating in New York State. By understanding the filing requirements, deadlines, and best practices, businesses can ensure accurate and timely filing of the ST-100 form and avoid penalties and interest. If you have any questions or concerns about filing the ST-100 form, consult with a tax professional or contact the New York State Department of Taxation and Finance for assistance.

Who needs to file the ST-100 form?

+Businesses operating in New York State that collect sales tax are required to file the ST-100 form.

What is the deadline for filing the ST-100 form?

+The ST-100 form is typically filed annually, with a deadline of February 20th of each year. However, businesses with a high sales tax liability may be required to file quarterly.

How do I file the ST-100 form?

+Businesses can file the ST-100 form electronically or by mail. Electronic filing is recommended, as it is faster and more accurate.