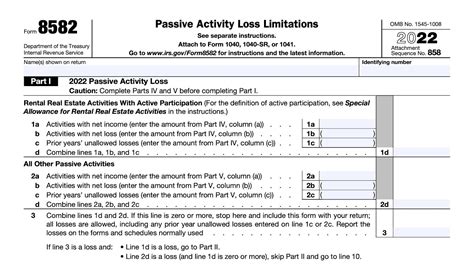

The Form 8582, also known as the Passive Activity Loss Limitations, is a crucial document for taxpayers who have rental real estate or other passive activities. However, handling unallowed losses on this form can be a daunting task, especially for those who are new to the world of taxation. In this article, we will delve into the world of Form 8582 and explore five ways to handle unallowed losses, making it easier for you to navigate the complexities of tax filing.

Understanding Form 8582 and Unallowed Losses

Before we dive into the ways to handle unallowed losses, it's essential to understand what Form 8582 is and what unallowed losses mean. Form 8582 is used to calculate the amount of passive activity loss (PAL) that can be deducted on a taxpayer's tax return. Passive activities include rental real estate, limited partnerships, and other investments where the taxpayer is not actively involved. Unallowed losses refer to the portion of the PAL that cannot be deducted in a given year due to the passive activity loss limitations.

Ways to Handle Unallowed Losses

Now that we have a basic understanding of Form 8582 and unallowed losses, let's explore the five ways to handle these losses.

1. Carryover Unallowed Losses

One way to handle unallowed losses is to carry them over to future years. This means that the unallowed loss is not deducted in the current year but is instead carried over to future years where it can be deducted against passive income. This is a common strategy for taxpayers who have a steady stream of passive income.

2. Utilize the $25,000 Allowance

Taxpayers who actively participate in rental real estate activities may be eligible for the $25,000 allowance. This allowance allows taxpayers to deduct up to $25,000 of passive losses against non-passive income, such as wages or interest income. However, this allowance is subject to phase-out limits, which reduce the allowance as the taxpayer's modified adjusted gross income (MAGI) increases.

3. Take Advantage of the Real Estate Professional Exception

Real estate professionals who meet certain requirements may be exempt from the passive activity loss limitations. To qualify, the taxpayer must spend more than 750 hours per year in real estate activities and meet other requirements. If the taxpayer qualifies, they can deduct all of their rental real estate losses against non-passive income.

4. Utilize the Passive Activity Credit

Taxpayers who have unallowed losses may be eligible for the passive activity credit. This credit allows taxpayers to claim a credit against their tax liability for unallowed losses. However, the credit is subject to certain limitations and phase-out limits.

5. Consider a Grouping Election

In some cases, taxpayers may be able to group their passive activities together to deduct unallowed losses. This is known as a grouping election. By grouping activities together, taxpayers can net their gains and losses, which may result in a larger deduction.

Strategies for Minimizing Unallowed Losses

While the above strategies can help taxpayers handle unallowed losses, it's essential to minimize these losses in the first place. Here are some strategies for minimizing unallowed losses:

- Keep accurate records: Keeping accurate records of income and expenses is crucial for calculating PAL. Make sure to keep receipts, invoices, and bank statements to support your calculations.

- Maximize deductions: Take advantage of all deductions available to you, such as mortgage interest, property taxes, and operating expenses.

- Consider a cost segregation study: A cost segregation study can help you identify and separate the costs of your rental property, which can result in larger deductions.

- Plan for passive income: Plan your passive income to ensure that you have enough income to offset your PAL.

Conclusion

Handling unallowed losses on Form 8582 can be a complex task, but with the right strategies, you can minimize these losses and maximize your deductions. By understanding the passive activity loss limitations and utilizing the strategies outlined above, you can ensure that you are taking advantage of all the deductions available to you. Remember to keep accurate records, maximize deductions, consider a cost segregation study, and plan for passive income to minimize unallowed losses.

What is Form 8582?

+Form 8582 is used to calculate the amount of passive activity loss (PAL) that can be deducted on a taxpayer's tax return.

What are unallowed losses?

+Unallowed losses refer to the portion of the PAL that cannot be deducted in a given year due to the passive activity loss limitations.

How can I minimize unallowed losses?

+To minimize unallowed losses, keep accurate records, maximize deductions, consider a cost segregation study, and plan for passive income.