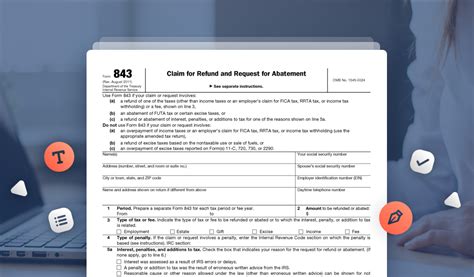

When dealing with the complexities of the US tax system, it's not uncommon for individuals and businesses to encounter errors or discrepancies in their tax filings. One of the most effective ways to address these issues is by filing IRS Form 843, also known as the "Claim for Refund and Request for Abatement." This form allows taxpayers to request a refund or abatement of certain taxes, penalties, and interest. However, the process can be daunting, especially for those who are unfamiliar with tax laws and procedures. In this article, we will break down the 7 essential steps to filing IRS Form 843, providing you with the necessary guidance to navigate this complex process.

Step 1: Determine Eligibility and Purpose

Before starting the process, it's crucial to understand the purpose and eligibility criteria for filing IRS Form 843. This form is typically used to request a refund or abatement of:

- Overpaid taxes

- Penalties and interest related to overpaid taxes

- Taxes withheld in error

- Taxes paid on behalf of another party

Taxpayers must also meet specific requirements, such as:

- Filing the form within the statute of limitations (generally 3 years from the original filing date)

- Providing supporting documentation and evidence

- Ensuring the claim is not frivolous or without merit

Common Scenarios for Filing Form 843

Some common scenarios that may require filing Form 843 include:

- Overpayment of taxes due to incorrect withholding or estimated tax payments

- Errors in tax calculation or reporting

- Changes in tax laws or regulations that affect prior year returns

- Refund claims for taxes paid on behalf of another party

Step 2: Gather Required Documents and Information

To support your claim, you'll need to gather relevant documents and information, including:

- Original tax return and supporting schedules

- Proof of overpayment or error (e.g., canceled checks, receipts, or statements)

- Documentation of changes in tax laws or regulations

- Identification and contact information for the taxpayer and representative (if applicable)

Step 3: Complete Form 843

Once you have gathered the necessary documents and information, you can begin completing Form 843. The form consists of several sections, including:

- Identification and contact information

- Claim details (including type of tax, tax year, and amount claimed)

- Supporting documentation and evidence

- Certification and signature

It's essential to carefully review the instructions and ensure accuracy when completing the form.

Form 843 Sections and Requirements

Here's a brief overview of the main sections and requirements:

- Section 1: Provide taxpayer identification and contact information

- Section 2: Describe the claim, including type of tax, tax year, and amount claimed

- Section 3: Attach supporting documentation and evidence

- Section 4: Certify the claim and provide signature

Step 4: Attach Supporting Documentation

As mentioned earlier, supporting documentation is crucial to a successful claim. Ensure you attach all relevant documents, including:

- Original tax return and supporting schedules

- Proof of overpayment or error

- Documentation of changes in tax laws or regulations

- Identification and contact information for the taxpayer and representative (if applicable)

Step 5: Submit the Form and Supporting Documentation

Once you've completed the form and gathered supporting documentation, you can submit the claim to the IRS. You can either:

- Mail the form and supporting documentation to the IRS address listed in the instructions

- Fax the form and supporting documentation to the IRS fax number listed in the instructions

- Electronically file the form and supporting documentation through the IRS e-file system (if eligible)

IRS Mailing and Fax Information

Here's the IRS mailing and fax information:

- Mail: Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224

- Fax: (855) 214-2223

Step 6: Follow Up and Respond to IRS Inquiries

After submitting the claim, it's essential to follow up with the IRS to ensure the claim is being processed. You may also receive inquiries or requests for additional information from the IRS.

- Respond promptly to any IRS inquiries or requests

- Verify the status of your claim through the IRS website or by contacting the IRS directly

- Be prepared to provide additional documentation or evidence to support your claim

Step 7: Receive and Review the IRS Decision

Once the IRS has processed your claim, you'll receive a decision letter or notice. Carefully review the decision to ensure it's accurate and complete.

- Verify the amount of the refund or abatement (if applicable)

- Review any penalties or interest assessed (if applicable)

- Understand any next steps or requirements (if applicable)

IRS Decision Letter or Notice

Here's what to expect in the IRS decision letter or notice:

- A clear explanation of the decision

- The amount of the refund or abatement (if applicable)

- Any penalties or interest assessed (if applicable)

- Next steps or requirements (if applicable)

By following these 7 essential steps, you'll be well on your way to successfully filing IRS Form 843 and resolving your tax issues. Remember to stay organized, provide accurate and complete information, and be prepared to respond to any IRS inquiries or requests.

What is IRS Form 843 used for?

+IRS Form 843 is used to request a refund or abatement of certain taxes, penalties, and interest.

How long do I have to file Form 843?

+Generally, you have 3 years from the original filing date to file Form 843.

What documentation do I need to support my claim?

+You'll need to provide supporting documentation, such as original tax returns, proof of overpayment or error, and documentation of changes in tax laws or regulations.