Faxing Form 2553 to the IRS can be a convenient way to submit your application for S corporation tax status. Here's an overview of the importance of submitting Form 2553 and the process of faxing it to the IRS.

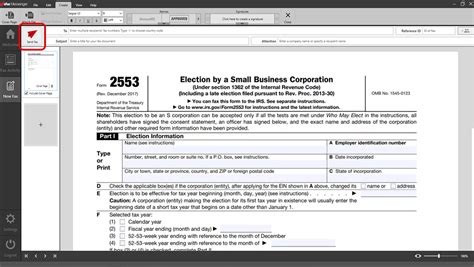

Form 2553 is a crucial document for businesses that want to elect S corporation tax status. By filing this form, a corporation can pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes. This can provide tax benefits and simplify the tax filing process for the business and its owners.

In this article, we will explore the three ways to fax Form 2553 to the IRS, along with some important details to keep in mind. We will also cover the requirements for faxing, the necessary documentation, and tips for ensuring a successful transmission.

Why Faxing Form 2553 is Important

Faxing Form 2553 is an efficient way to submit your application for S corporation tax status. The IRS requires that this form be filed within a certain timeframe, typically within 2 months and 15 days of the beginning of the tax year in which the election is to take effect. By faxing the form, you can ensure timely submission and avoid potential delays or penalties.

Method 1: Faxing Form 2553 Directly to the IRS

The IRS provides a dedicated fax number for submitting Form 2553. You can fax the completed form to the IRS at (855) 214-2223. Before faxing, ensure that you have completed the form accurately and included all required documentation, such as a copy of your business's articles of incorporation or a letter explaining any delays in filing.

Method 2: Using an IRS-Approved Fax Service

The IRS has approved several private fax services that can transmit your Form 2553 to the IRS on your behalf. These services often provide a confirmation of receipt and may offer additional features, such as secure online storage of your faxed documents. Some popular IRS-approved fax services include FedTax and Fax-It-Right.

When using an IRS-approved fax service, be sure to follow their specific instructions for preparing and submitting your Form 2553. These services may have additional requirements or fees associated with their services.

Method 3: Faxing Form 2553 through a Tax Professional

If you are working with a tax professional or accountant, they may be able to fax your Form 2553 to the IRS on your behalf. This can be a convenient option, especially if you are unsure about the faxing process or need assistance with completing the form.

Before faxing your Form 2553 through a tax professional, ensure that you have provided them with all necessary documentation and information. Your tax professional can guide you through the process and ensure that your application is submitted correctly.

What to Include When Faxing Form 2553

When faxing Form 2553, it's essential to include all required documentation and information. Here are some key items to include:

- A completed and signed Form 2553

- A copy of your business's articles of incorporation or other organizational documents

- A letter explaining any delays in filing, if applicable

- A copy of your business's federal tax ID number (EIN)

Tips for Ensuring a Successful Fax Transmission

To ensure a successful fax transmission, follow these tips:

- Use a clear and legible font on your fax cover sheet

- Include a confirmation page with your fax transmission

- Verify the IRS fax number or the fax number of your IRS-approved fax service

- Keep a record of your fax transmission, including the date and time of transmission

Common Errors to Avoid When Faxing Form 2553

When faxing Form 2553, it's essential to avoid common errors that can delay or prevent processing. Here are some common errors to avoid:

- Incomplete or inaccurate information on the form

- Missing or incomplete documentation

- Using an incorrect fax number or IRS-approved fax service

- Failing to include a confirmation page with your fax transmission

Conclusion

Faxing Form 2553 to the IRS is a straightforward process that can be completed in a few easy steps. By following the methods outlined above and including all required documentation, you can ensure a successful transmission and avoid potential delays or penalties. Remember to verify the IRS fax number or the fax number of your IRS-approved fax service, and keep a record of your fax transmission.

If you have any questions or concerns about faxing Form 2553, don't hesitate to ask. Share your experiences or tips for faxing Form 2553 in the comments below.

What is the deadline for faxing Form 2553 to the IRS?

+The deadline for faxing Form 2553 is typically within 2 months and 15 days of the beginning of the tax year in which the election is to take effect.

Can I fax Form 2553 to the IRS using a non-IRS-approved fax service?

+No, the IRS only accepts faxed Form 2553 submissions through their dedicated fax number or IRS-approved fax services.

What documentation do I need to include when faxing Form 2553?

+You should include a completed and signed Form 2553, a copy of your business's articles of incorporation or other organizational documents, and a letter explaining any delays in filing, if applicable.