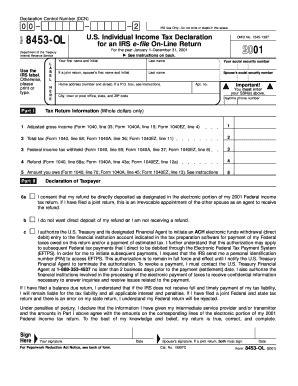

As a taxpayer, you're likely familiar with the process of filing your tax return, but have you considered the benefits of electronically filing Form 8453-OL? This form is used to declare that the original or amended return is being filed electronically, and it's a crucial step in ensuring that your tax return is processed efficiently. In this article, we'll provide you with 5 tips for filing Form 8453-OL electronically, making the process smoother and less prone to errors.

Why File Form 8453-OL Electronically?

Filing Form 8453-OL electronically is a convenient and efficient way to declare that your original or amended return is being filed electronically. By doing so, you can avoid the hassle of mailing paper forms and reduce the risk of errors or lost documents. Electronic filing also enables the IRS to process your return more quickly, which means you'll receive your refund faster.

Tip 1: Understand the Requirements

Before you begin the electronic filing process, it's essential to understand the requirements for Form 8453-OL. This form is used to declare that your original or amended return is being filed electronically, and it must be submitted along with your tax return. Ensure you have all the necessary documentation, including your tax return, W-2 forms, and any other supporting documents.

Tip 2: Choose the Right Filing Status

When filing Form 8453-OL electronically, you'll need to choose the correct filing status. This is crucial, as it affects the processing of your tax return. Ensure you select the correct filing status, whether it's single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Tip 3: Gather Required Information

Before you start the electronic filing process, gather all the required information. This includes your tax return, W-2 forms, and any other supporting documents. Ensure you have the following information readily available:

- Your name and Social Security number

- Your spouse's name and Social Security number (if applicable)

- Your address

- Your filing status

- Your tax return information

Tip 4: Use the Correct Software

To file Form 8453-OL electronically, you'll need to use tax preparation software that supports electronic filing. Ensure the software you choose is IRS-approved and compatible with your device. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

Tip 5: Review and Submit

Once you've completed the electronic filing process, review your return carefully to ensure accuracy. Double-check your personal information, tax return information, and supporting documents. If everything is correct, submit your return electronically. You'll receive an acknowledgement from the IRS confirming receipt of your return.

By following these 5 tips, you can ensure a smooth and efficient electronic filing process for Form 8453-OL. Remember to review your return carefully, use IRS-approved software, and gather all required information before submitting your return.

What to Expect After Filing Form 8453-OL

After filing Form 8453-OL electronically, you can expect the following:

- An acknowledgement from the IRS confirming receipt of your return

- Faster processing of your tax return

- A quicker refund, if applicable

- Reduced risk of errors or lost documents

Common Errors to Avoid

When filing Form 8453-OL electronically, it's essential to avoid common errors that can delay processing or lead to rejection. Some common errors to avoid include:

- Inaccurate personal information

- Incorrect tax return information

- Missing or incomplete supporting documents

- Failure to sign and date the return

By avoiding these common errors, you can ensure a smooth and efficient electronic filing process for Form 8453-OL.

Conclusion

Filing Form 8453-OL electronically is a convenient and efficient way to declare that your original or amended return is being filed electronically. By following the 5 tips outlined in this article, you can ensure a smooth and efficient electronic filing process. Remember to review your return carefully, use IRS-approved software, and gather all required information before submitting your return.

What is Form 8453-OL used for?

+Form 8453-OL is used to declare that the original or amended return is being filed electronically.

What software can I use to file Form 8453-OL electronically?

+You can use IRS-approved tax preparation software, such as TurboTax, H&R Block, or TaxAct, to file Form 8453-OL electronically.

What happens after I file Form 8453-OL electronically?

+After filing Form 8453-OL electronically, you can expect an acknowledgement from the IRS confirming receipt of your return, faster processing of your tax return, and a quicker refund, if applicable.