The Payoneer tax form, also known as the 1099-MISC or 1099-K form, is an essential document for freelancers, contractors, and businesses that receive payments through Payoneer. As a Payoneer user, it's crucial to understand the tax form process to ensure compliance with tax regulations and avoid any potential penalties. In this comprehensive guide, we'll walk you through the Payoneer tax form process, providing a step-by-step explanation of what to expect and how to navigate the process with ease.

The Importance of Payoneer Tax Forms

As a Payoneer user, you're required to report your earnings on your tax return. The Payoneer tax form serves as proof of income, and it's essential to ensure that the information is accurate and complete. Failure to report income or incorrect reporting can lead to penalties, fines, and even audits. By understanding the Payoneer tax form process, you'll be able to manage your taxes efficiently and avoid any potential issues.

Who Receives a Payoneer Tax Form?

Payoneer issues tax forms to users who meet specific requirements. These requirements vary depending on the type of account and the amount of money earned. Typically, Payoneer sends tax forms to users who have earned more than $600 in a calendar year. However, it's essential to note that even if you don't receive a tax form, you're still required to report your earnings on your tax return.

Types of Payoneer Tax Forms

Payoneer issues two types of tax forms: the 1099-MISC and 1099-K.

- 1099-MISC: This form is used to report miscellaneous income, such as freelance work, consulting, and other non-employee compensation.

- 1099-K: This form is used to report payment card and third-party network transactions, such as credit card payments and online transactions.

Step-by-Step Guide to the Payoneer Tax Form Process

Here's a step-by-step guide to help you navigate the Payoneer tax form process:

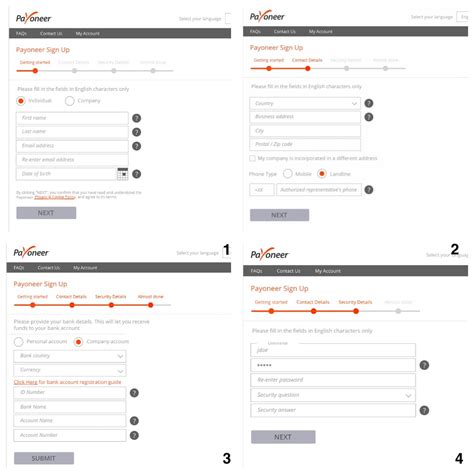

Step 1: Verify Your Account Information

Before you receive your tax form, ensure that your Payoneer account information is up-to-date and accurate. Log in to your Payoneer account and verify your name, address, and tax identification number (TIN).

Step 2: Receive Your Tax Form

Payoneer typically sends tax forms by January 31st of each year. You'll receive an email notification once your tax form is available. Log in to your Payoneer account to access your tax form.

Step 3: Review Your Tax Form

Carefully review your tax form to ensure that the information is accurate and complete. Check for errors or discrepancies in your name, address, TIN, and income amount.

Step 4: Report Your Income

Report your Payoneer income on your tax return. You'll need to complete the relevant tax forms, such as Schedule C (Form 1040) for freelancers and businesses.

Step 5: Keep Records

Keep a copy of your tax form and supporting documentation, such as invoices and receipts, for at least three years in case of an audit.

Common Payoneer Tax Form Issues

Despite the straightforward process, some users may encounter issues with their Payoneer tax form. Here are some common issues and their solutions:

Issue 1: Incorrect Account Information

If your account information is incorrect, contact Payoneer support to update your details.

Issue 2: Missing Tax Form

If you haven't received your tax form, check your email spam folder or contact Payoneer support.

Issue 3: Errors on Tax Form

If you find errors on your tax form, contact Payoneer support to correct the issues.

Payoneer Tax Form FAQs

Here are some frequently asked questions about the Payoneer tax form process:

Q: What is the deadline for receiving my Payoneer tax form?

A: Payoneer typically sends tax forms by January 31st of each year.

Q: How do I access my Payoneer tax form?

A: Log in to your Payoneer account to access your tax form.

Q: What if I find errors on my tax form?

A: Contact Payoneer support to correct the issues.

Conclusion

The Payoneer tax form process is a crucial aspect of managing your taxes as a freelancer, contractor, or business. By understanding the process and following the steps outlined in this guide, you'll be able to navigate the Payoneer tax form process with ease. Remember to verify your account information, review your tax form carefully, and report your income accurately to avoid any potential issues.

We encourage you to share your experiences or ask questions about the Payoneer tax form process in the comments section below.

What is the purpose of the Payoneer tax form?

+The Payoneer tax form serves as proof of income and is used to report miscellaneous income, such as freelance work and consulting.

Who receives a Payoneer tax form?

+Payoneer issues tax forms to users who have earned more than $600 in a calendar year.

What if I find errors on my tax form?

+Contact Payoneer support to correct the issues.