As the tax season approaches, many individuals and businesses are scrambling to gather their financial documents and prepare their tax returns. One crucial form that many taxpayers need to file is Form 8949, also known as the Sales and Other Dispositions of Capital Assets form. In this article, we will guide you through the process of filing Form 8949 with FreeTaxUSA, a popular tax preparation software.

What is Form 8949?

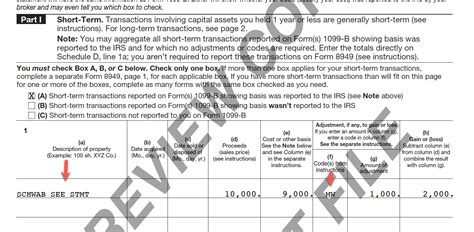

Form 8949 is a tax form used to report the sale or exchange of capital assets, such as stocks, bonds, mutual funds, and real estate. The form is used to calculate the gain or loss from the sale of these assets, which is then reported on Schedule D (Capital Gains and Losses) of the taxpayer's Form 1040.

Why is Form 8949 Important?

Form 8949 is essential because it helps taxpayers accurately report their capital gains and losses, which can impact their tax liability. By filing Form 8949, taxpayers can claim losses to offset gains, reducing their tax bill. Additionally, the form helps the IRS track and verify the sale of capital assets, ensuring that taxpayers are reporting their income accurately.

How to File Form 8949 with FreeTaxUSA

Filing Form 8949 with FreeTaxUSA is a straightforward process. Here's a step-by-step guide:

- Gather Required Documents: Before starting the filing process, gather all the necessary documents, including:

- 1099-B forms from your broker or financial institution

- Proof of purchase and sale dates

- Cost basis information

- Create an Account: If you haven't already, create a FreeTaxUSA account. The software is user-friendly, and the sign-up process is quick and easy.

- Select the Correct Filing Status: Choose the correct filing status, such as single, married filing jointly, or head of household.

- Enter Investment Income: Navigate to the "Investment Income" section and select "Sales of Capital Assets" (Form 8949).

- Add Transactions: Enter each transaction, including the date acquired, date sold, proceeds, and cost basis. You can import transactions from your broker or manually enter the information.

- Calculate Gains and Losses: FreeTaxUSA will automatically calculate the gains and losses from each transaction.

- Review and Edit: Review your entries carefully and edit as needed.

- Submit Your Return: Once you've completed the form, submit your tax return to the IRS through FreeTaxUSA.

Benefits of Filing Form 8949 with FreeTaxUSA

Filing Form 8949 with FreeTaxUSA offers several benefits, including:

- Accurate Calculations: FreeTaxUSA ensures accurate calculations of gains and losses, reducing the risk of errors and audits.

- Easy Import: Import transactions from your broker or financial institution, saving time and reducing manual entry errors.

- Audit Support: FreeTaxUSA provides audit support, giving you peace of mind in case of an audit.

- Free Filing: FreeTaxUSA offers free filing for simple tax returns, including Form 8949.

Common Mistakes to Avoid

When filing Form 8949, avoid the following common mistakes:

- Incorrect Cost Basis: Ensure you have accurate cost basis information to calculate gains and losses correctly.

- Missing Transactions: Double-check that you've reported all transactions, including those with small gains or losses.

- Incorrect Dates: Verify the dates acquired and sold to ensure accurate reporting.

Form 8949 FAQs

Q: Do I need to file Form 8949 if I only have a small gain or loss? A: Yes, you need to file Form 8949 for all sales or exchanges of capital assets, regardless of the gain or loss amount.

Q: Can I file Form 8949 separately from my tax return? A: No, Form 8949 must be filed with your tax return (Form 1040).

Q: How do I report a wash sale on Form 8949? A: Report a wash sale by checking the box in column (f) of Form 8949 and attaching a statement explaining the wash sale.

What is the deadline for filing Form 8949?

+The deadline for filing Form 8949 is typically April 15th, but it may vary depending on your tax filing status and any extensions you've requested.

Can I e-file Form 8949 with FreeTaxUSA?

+Yes, FreeTaxUSA allows you to e-file Form 8949 with your tax return (Form 1040).

What if I need help with Form 8949?

+FreeTaxUSA offers support and guidance throughout the filing process. You can also contact their customer support team for assistance.

Conclusion

Filing Form 8949 with FreeTaxUSA is a straightforward process that can help you accurately report your capital gains and losses. By following the steps outlined above and avoiding common mistakes, you can ensure a smooth filing experience. If you have any questions or need help, don't hesitate to reach out to FreeTaxUSA's support team.