As a US taxpayer, it's essential to report certain foreign financial transactions to the IRS, including those related to foreign trusts and gifts. One form used for this purpose is the Turbotax Form 3520, also known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Here are five tips for filing this form accurately and efficiently.

Understanding the Purpose of Form 3520

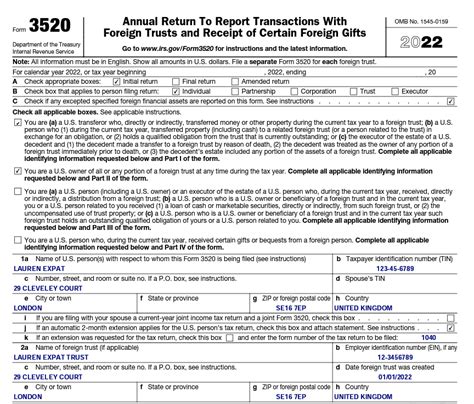

Before diving into the tips, it's crucial to understand the purpose of Form 3520. This form is used to report transactions with foreign trusts, including the creation or transfer of a foreign trust, as well as the receipt of certain foreign gifts. The IRS uses this information to track and enforce compliance with US tax laws related to foreign financial transactions.

Tip 1: Determine if You Need to File Form 3520

Not everyone needs to file Form 3520. To determine if you need to file this form, consider the following scenarios:

- You are a US person who created or transferred assets to a foreign trust.

- You are a US person who received a distribution from a foreign trust.

- You are a US person who received a gift or bequest from a foreign person.

If any of these scenarios apply to you, you may need to file Form 3520. Consult the IRS instructions or consult with a tax professional to ensure you meet the filing requirements.

Tip 2: Gather Required Information and Documents

To file Form 3520, you'll need to gather various information and documents, including:

- The name and address of the foreign trust.

- The date of creation or transfer of assets to the foreign trust.

- The value of the assets transferred to the foreign trust.

- The name and address of the foreign person who made the gift or bequest.

- The value of the gift or bequest.

Make sure to keep accurate records and documentation, as the IRS may request this information during an audit.

Tip 3: Understand the Filing Deadline and Penalties

The filing deadline for Form 3520 is the same as the deadline for your individual tax return (Form 1040). This is typically April 15th for calendar-year taxpayers. However, if you need more time, you can file for an automatic six-month extension.

Failure to file Form 3520 or filing late may result in penalties, including:

- A penalty of up to $10,000 for failing to file Form 3520.

- A penalty of up to $10,000 for failing to report a foreign trust on Form 3520.

- Additional penalties for willful failure to file or report.

Tip 4: Use the Correct Filing Status and Report Transactions Accurately

When filing Form 3520, it's essential to use the correct filing status and report transactions accurately. The form requires you to report the type of transaction, the value of the transaction, and the name and address of the foreign trust or person involved.

Use the following filing statuses:

- Part I: Creation or transfer of assets to a foreign trust.

- Part II: Receipt of a distribution from a foreign trust.

- Part III: Receipt of a gift or bequest from a foreign person.

Tip 5: Seek Professional Help if Needed

Filing Form 3520 can be complex, especially if you have multiple transactions or are unsure about the reporting requirements. If you need help, consider consulting a tax professional or using tax software like Turbotax.

Turbotax offers a range of tools and resources to help you file Form 3520 accurately and efficiently. Their software guides you through the filing process, ensuring you report transactions correctly and avoid potential penalties.

Benefits of Using Turbotax for Form 3520

Using Turbotax for Form 3520 offers several benefits, including:

- Easy-to-use interface: Turbotax guides you through the filing process, making it easy to report transactions accurately.

- Accuracy guarantee: Turbotax ensures your return is accurate, reducing the risk of errors and penalties.

- Support: Turbotax offers live support and resources to help you with any questions or issues.

Common Mistakes to Avoid When Filing Form 3520

When filing Form 3520, avoid the following common mistakes:

- Failing to report all transactions: Ensure you report all transactions, including those related to foreign trusts and gifts.

- Inaccurate reporting: Double-check your reporting to ensure accuracy and avoid potential penalties.

- Missing deadlines: File Form 3520 by the deadline to avoid penalties and interest.

Conclusion

Filing Form 3520 requires attention to detail and accuracy. By following these five tips, you can ensure you file this form correctly and efficiently. Remember to determine if you need to file, gather required information, understand the filing deadline and penalties, use the correct filing status, and seek professional help if needed. If you're unsure about any aspect of the filing process, consider consulting a tax professional or using tax software like Turbotax.

We hope this article has provided valuable insights and tips for filing Form 3520. If you have any questions or comments, please feel free to share them below.

FAQ Section:

What is the purpose of Form 3520?

+Form 3520 is used to report transactions with foreign trusts and receipt of certain foreign gifts.

Who needs to file Form 3520?

+US persons who created or transferred assets to a foreign trust, received a distribution from a foreign trust, or received a gift or bequest from a foreign person.

What is the filing deadline for Form 3520?

+The filing deadline for Form 3520 is the same as the deadline for your individual tax return (Form 1040).