As a foreign individual, navigating the complexities of the US tax system can be overwhelming, especially when it comes to filing the necessary forms. Form 8840, also known as the Closer Connection Exception Statement, is a crucial document for non-resident aliens who spend a significant amount of time in the United States. In this article, we will break down the 5 easy steps to fill Form 8840, making it easier for you to comply with the IRS requirements.

What is Form 8840 and Why is it Important?

Form 8840 is a statement used by non-resident aliens to claim a closer connection to a foreign country, which can exempt them from being considered a US resident for tax purposes. The form is typically filed by individuals who spend 183 days or more in the United States but do not intend to establish residency. Failing to file Form 8840 can lead to the IRS considering you a US resident, resulting in tax implications and potential penalties.

Who Needs to File Form 8840?

Not everyone needs to file Form 8840. You are required to file this form if:

- You are a non-resident alien

- You were present in the United States for 183 days or more in the current year

- You do not intend to establish residency in the United States

- You have a closer connection to a foreign country

Step 1: Determine Your Eligibility

Before filling out Form 8840, you need to determine if you are eligible to file it. Review the criteria mentioned earlier and ensure you meet the requirements. If you are unsure, consult with a tax professional or the IRS directly.

Required Documents

To determine your eligibility, gather the necessary documents, including:

- Your passport

- Visa documents (if applicable)

- Proof of foreign residence

- Proof of income and employment (if applicable)

Step 2: Gather Required Information

Once you have determined your eligibility, gather the required information to complete Form 8840. This includes:

- Your name and address

- Date of birth and place of birth

- Passport number and country of issuance

- Visa type and number (if applicable)

- Dates of entry and departure from the United States

- Information about your foreign residence, including address and type of residence

Tips for Gathering Information

- Make sure to have all necessary documents and information readily available

- Double-check your passport and visa documents for accuracy

- Use a calendar to track your dates of entry and departure from the United States

Step 3: Complete Form 8840

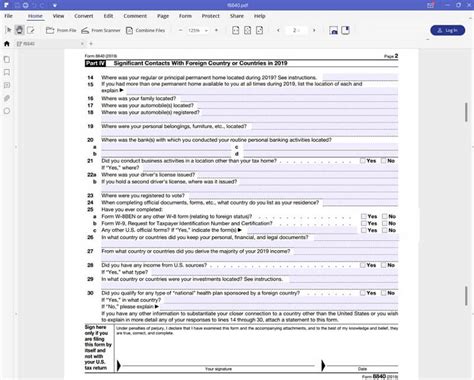

With all the required information gathered, complete Form 8840. The form consists of four parts:

- Part I: Information About You

- Part II: Information About Your Visits to the United States

- Part III: Information About Your Foreign Residence

- Part IV: Certification

Tips for Completing Form 8840

- Read the instructions carefully before filling out the form

- Use black ink and print clearly

- Do not leave any fields blank; if a question does not apply, write "N/A"

Step 4: Sign and Date the Form

Once you have completed Form 8840, sign and date it. Make sure to sign your name as it appears on your passport.

Importance of Signature and Date

- Your signature certifies that the information provided is accurate and true

- The date ensures that the form is filed in a timely manner

Step 5: File Form 8840

The final step is to file Form 8840 with the IRS. You can file the form electronically or by mail.

Filing Options

- Electronic filing: You can file Form 8840 electronically through the IRS website

- Mail filing: You can mail the form to the IRS address listed in the instructions

By following these 5 easy steps, you can ensure that you correctly fill out and file Form 8840. Remember to seek professional help if you are unsure about any part of the process.

Now that you have completed Form 8840, take a moment to review your work and ensure everything is accurate and complete. If you have any questions or concerns, do not hesitate to reach out to a tax professional or the IRS directly.

What is the deadline for filing Form 8840?

+The deadline for filing Form 8840 is typically the same as the deadline for filing your tax return. However, if you are not required to file a tax return, you can file Form 8840 by the end of the calendar year.

Can I file Form 8840 electronically?

+Yes, you can file Form 8840 electronically through the IRS website. However, you will need to create an account and obtain a username and password.

What happens if I do not file Form 8840?

+If you do not file Form 8840, the IRS may consider you a US resident for tax purposes, resulting in tax implications and potential penalties.