The process of managing employee payments and benefits can be a daunting task for any business owner. One crucial aspect of this process is setting up direct deposit for employees, which allows them to receive their paychecks electronically. QuickBooks, a popular accounting software, offers a direct deposit feature that simplifies this process. In this article, we will guide you through the QuickBooks direct deposit form and show you how to make the most out of it.

The Importance of Direct Deposit

Direct deposit is a payment method that allows employers to transfer funds directly into their employees' bank accounts. This method offers numerous benefits, including convenience, speed, and security. With direct deposit, employees can receive their paychecks faster and avoid the hassle of paper checks. Employers also benefit from reduced administrative costs and minimized risk of lost or stolen checks.

What is the QuickBooks Direct Deposit Form?

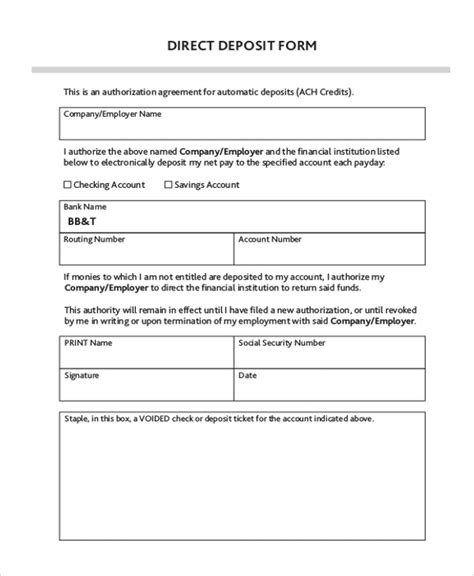

The QuickBooks direct deposit form is a document that employers use to set up direct deposit for their employees. The form requires employees to provide their bank account information, including the account number, routing number, and bank name. This information is used to create a direct deposit profile in QuickBooks, which enables employers to send payments electronically.

Benefits of Using the QuickBooks Direct Deposit Form

The QuickBooks direct deposit form offers several benefits, including:

- Convenience: The form is easy to fill out and can be completed online or in-person.

- Security: The form ensures that employee bank account information is kept secure and confidential.

- Efficiency: The form streamlines the direct deposit process, reducing administrative costs and minimizing errors.

How to Set Up Direct Deposit in QuickBooks

Setting up direct deposit in QuickBooks is a straightforward process that requires several steps. Here's a step-by-step guide:

- Gather Employee Information: Collect the necessary employee information, including their bank account number, routing number, and bank name.

- Create a Direct Deposit Profile: In QuickBooks, go to the "Payroll" menu and select "Direct Deposit." Create a new direct deposit profile for each employee.

- Enter Employee Bank Account Information: Enter the employee's bank account information into the direct deposit profile.

- Verify Bank Account Information: Verify the employee's bank account information to ensure accuracy.

- Set Up Direct Deposit: Set up direct deposit for each employee by selecting the direct deposit profile and specifying the payment amount.

Troubleshooting Common Issues

While setting up direct deposit in QuickBooks is relatively straightforward, issues can arise. Here are some common issues and their solutions:

- Incorrect Bank Account Information: Verify the employee's bank account information to ensure accuracy.

- Direct Deposit Profile Not Found: Check that the direct deposit profile is created and correctly set up.

- Payment Errors: Verify that the payment amount is correct and that the direct deposit profile is properly set up.

Best Practices for Using the QuickBooks Direct Deposit Form

To get the most out of the QuickBooks direct deposit form, follow these best practices:

- Use Secure Online Forms: Use secure online forms to collect employee bank account information.

- Verify Employee Information: Verify employee bank account information to ensure accuracy.

- Use QuickBooks Direct Deposit Features: Use QuickBooks direct deposit features to streamline the payment process.

Conclusion

In conclusion, the QuickBooks direct deposit form is a valuable tool for employers looking to streamline their payment process. By following the steps outlined in this article, employers can set up direct deposit in QuickBooks and enjoy the benefits of convenience, security, and efficiency.

Take Action

We hope this article has provided you with a comprehensive guide to using the QuickBooks direct deposit form. If you have any questions or need further assistance, please don't hesitate to reach out. Take the first step towards streamlining your payment process today!

What is the QuickBooks direct deposit form?

+The QuickBooks direct deposit form is a document that employers use to set up direct deposit for their employees. The form requires employees to provide their bank account information, including the account number, routing number, and bank name.

How do I set up direct deposit in QuickBooks?

+To set up direct deposit in QuickBooks, gather employee information, create a direct deposit profile, enter employee bank account information, verify bank account information, and set up direct deposit for each employee.

What are the benefits of using the QuickBooks direct deposit form?

+The QuickBooks direct deposit form offers several benefits, including convenience, security, and efficiency. The form streamlines the direct deposit process, reducing administrative costs and minimizing errors.