California is known for its intricate tax laws and regulations, which can be overwhelming for businesses and individuals alike. One of the essential forms that taxpayers in California need to familiarize themselves with is the CA Form 571-L, also known as the Business Property Statement. This form is a crucial part of the state's tax assessment process, and understanding its requirements and implications is vital for compliance and accurate tax reporting.

In this article, we will delve into the world of CA Form 571-L, exploring its purpose, benefits, and key aspects that taxpayers need to be aware of. Whether you are a business owner, accountant, or simply a taxpayer looking to stay informed, this comprehensive guide will provide you with the essential facts you need to know about CA Form 571-L.

What is CA Form 571-L?

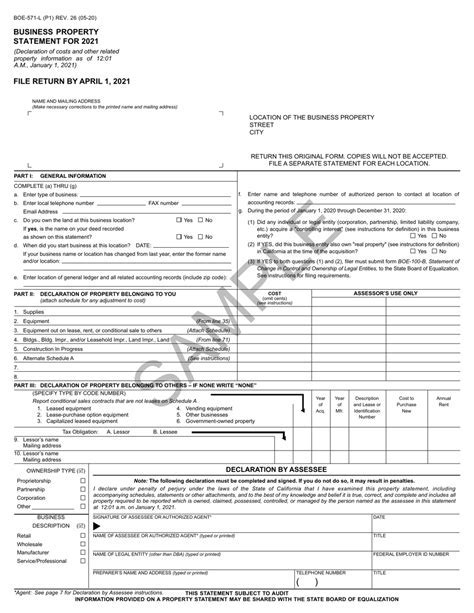

CA Form 571-L is a Business Property Statement that the California State Board of Equalization (BOE) requires businesses to file annually. The form is used to report the acquisition and disposal of business personal property, including equipment, furniture, fixtures, and other tangible assets. The information provided on the form helps the BOE to assess the value of business property for taxation purposes.

Why is CA Form 571-L Important?

Filing CA Form 571-L is a mandatory requirement for businesses in California, and it serves several purposes:

- It helps the BOE to determine the correct taxable value of business property.

- It enables businesses to report changes in their property holdings, including acquisitions and disposals.

- It provides a record of business property ownership and value, which can be useful for auditing and compliance purposes.

Who Needs to File CA Form 571-L?

All businesses in California that own or lease tangible personal property are required to file CA Form 571-L. This includes:

- Sole proprietorships

- Partnerships

- Corporations

- Limited liability companies (LLCs)

- Trusts and estates

What is the Filing Deadline for CA Form 571-L?

The filing deadline for CA Form 571-L is April 1st of each year. However, if April 1st falls on a weekend or holiday, the deadline is extended to the next business day.

How to File CA Form 571-L

Filing CA Form 571-L involves the following steps:

- Obtain the form: You can download CA Form 571-L from the California State Board of Equalization website or obtain it from your local county assessor's office.

- Complete the form: Fill out the form accurately and thoroughly, providing all required information, including business property descriptions, acquisition dates, and values.

- Attach supporting documentation: You may need to attach supporting documentation, such as invoices, receipts, or appraisals, to substantiate your property values.

- File the form: Submit the completed form and supporting documentation to your local county assessor's office by the filing deadline.

Penalties for Late Filing or Non-Filing

Failure to file CA Form 571-L or filing late can result in penalties and interest. The BOE may impose a penalty of up to 10% of the assessed value of the business property, plus interest on the unpaid tax.

Benefits of Filing CA Form 571-L

Filing CA Form 571-L provides several benefits, including:

- Compliance with state tax laws and regulations

- Accurate assessment of business property values

- Avoidance of penalties and interest

- Opportunity to report changes in business property holdings

Common Mistakes to Avoid

When filing CA Form 571-L, it is essential to avoid common mistakes, such as:

- Inaccurate or incomplete reporting of business property

- Failure to attach supporting documentation

- Late filing or non-filing

- Underreporting or overreporting of business property values

Conclusion

In conclusion, CA Form 571-L is a critical component of California's tax assessment process. Understanding its requirements and implications is essential for businesses to ensure compliance and accurate tax reporting. By familiarizing yourself with the form's purpose, benefits, and key aspects, you can avoid common mistakes and penalties, and ensure that your business is in good standing with the state.

If you have any questions or concerns about CA Form 571-L, please don't hesitate to reach out to us. We are here to help you navigate the complexities of California's tax laws and regulations.

What is the purpose of CA Form 571-L?

+CA Form 571-L is used to report the acquisition and disposal of business personal property, including equipment, furniture, fixtures, and other tangible assets.

Who needs to file CA Form 571-L?

+All businesses in California that own or lease tangible personal property are required to file CA Form 571-L.

What is the filing deadline for CA Form 571-L?

+The filing deadline for CA Form 571-L is April 1st of each year.