Wisconsin employers, are you looking for a straightforward guide to help you complete the WI Form 3, also known as the Wisconsin Withholding Exemption Certificate? Look no further! This article will walk you through the easy steps to complete this essential form, ensuring you comply with state regulations and avoid any potential penalties.

Understanding the Importance of WI Form 3

Before we dive into the steps, let's briefly discuss the significance of the WI Form 3. This form is used to certify the number of exemptions an employee claims for Wisconsin state income tax withholding purposes. It's essential to complete this form accurately, as it affects the amount of taxes withheld from an employee's wages.

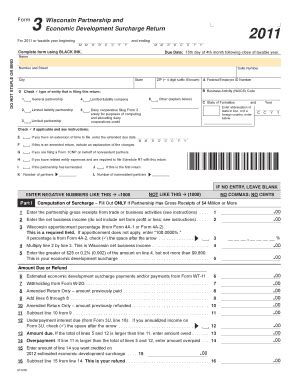

Step 1: Download and Print the WI Form 3

To begin, download and print the WI Form 3 from the Wisconsin Department of Revenue website or obtain it from your employer. Make sure to use the latest version of the form to avoid any errors.

Step 2: Complete Employee Information (Section 1)

Employee Information

In this section, you'll need to provide your employee's personal details:

- Employee's name

- Address

- Social Security number

- Date of birth

Ensure all information is accurate and matches the employee's identification documents.

Step 3: Claim Exemptions (Section 2)

Claiming Exemptions

In this section, you'll need to claim the number of exemptions your employee is eligible for. The exemptions include:

- Single exemption

- Married exemption

- Head of household exemption

- Dependent exemptions

- Other exemptions (e.g., blindness, disability)

Your employee should carefully review the exemption options and claim only the ones they're eligible for.

Step 4: Sign and Date the Form (Section 3)

Signing and Dating the Form

Once your employee has completed sections 1 and 2, they must sign and date the form in section 3. This confirms that the information provided is accurate and true.

Step 5: Submit the Form to Your Employer

Submitting the Form

After completing the WI Form 3, your employee should submit it to you, their employer. You'll need to review the form for accuracy and completeness before accepting it.

Additional Tips and Reminders

- Ensure you use the latest version of the WI Form 3 to avoid any errors or penalties.

- Verify your employee's information to ensure accuracy.

- Keep a copy of the completed form on file for at least four years.

- If your employee's exemption status changes, they must submit a new WI Form 3.

Conclusion: Take the Next Step

By following these easy steps, you'll be able to complete the WI Form 3 with confidence. Remember to review the form carefully and submit it to your employer promptly. If you have any questions or concerns, don't hesitate to reach out to the Wisconsin Department of Revenue or consult with a tax professional.

What's Next?

- Share this article with your colleagues or employees to help them understand the importance of completing the WI Form 3 accurately.

- Leave a comment below if you have any questions or need further clarification on any of the steps.

- Explore other resources on our website to stay up-to-date on the latest tax regulations and compliance requirements.

What is the purpose of the WI Form 3?

+The WI Form 3 is used to certify the number of exemptions an employee claims for Wisconsin state income tax withholding purposes.

How often do I need to update the WI Form 3?

+If your employee's exemption status changes, they must submit a new WI Form 3. Otherwise, the form remains in effect until the employee notifies you of a change.

What happens if I don't complete the WI Form 3 accurately?

+If the WI Form 3 is not completed accurately, it may result in incorrect tax withholding, penalties, or fines. Ensure you follow the steps outlined in this article to avoid any errors.